Introduction:

“Car insurance is a cornerstone of financial protection for drivers

in the United States, providing coverage for vehicle damage, bodily

injury, and liability in the event of accidents or other unforeseen incidents.”

As an essential aspect of vehicle ownership and operation, understanding the intricacies of car insurance is vital for drivers to make informed decisions and ensure adequate protection. This essay offers an in-depth examination of car insurance in the USA, exploring its importance, types, coverage options, pricing factors, regulations, challenges, and future trends.

Importance of Car Insurance:

Car insurance serves multiple essential functions that contribute to the safety, financial security, and legal compliance of drivers and vehicle owners:

- Financial Protection: Car insurance provides financial protection against the costs associated with vehicle damage, repairs, medical expenses, and legal liabilities resulting from accidents or collisions. Without insurance coverage, drivers may face significant financial burdens and legal consequences, including out-of-pocket expenses, lawsuit judgments, and driver’s license suspension.

- Legal Compliance: Car insurance is mandatory in most states in the USA, with minimum coverage requirements established by law. Compliance with state insurance regulations is essential for maintaining legal driving privileges and avoiding penalties, fines, and potential vehicle impoundment. Proof of insurance is typically required when registering a vehicle, renewing vehicle registration, or obtaining a driver’s license.

- Peace of Mind: Car insurance offers peace of mind to drivers by providing a safety net against unexpected events and potential liabilities on the road. Knowing that they are covered by insurance in the event of accidents, theft, vandalism, or natural disasters allows drivers to navigate the roads with confidence and focus on safe driving practices.

Types of Car Insurance Coverage:

Car insurance coverage in the USA consists of various types of protection, each addressing different risks and liabilities associated with vehicle ownership and operation. Common types of car insurance coverage include:

- Liability Insurance: Liability insurance covers bodily injury and property damage liabilities resulting from at-fault accidents for which the insured driver is legally responsible. It includes two main components:

- Bodily Injury Liability (BIL): Pays for medical expenses, lost wages, and legal expenses for injuries sustained by other parties in an accident caused by the insured driver.

- Property Damage Liability (PDL): Covers repair or replacement costs for damage to other vehicles, buildings, or property caused by the insured driver’s negligence.

- Collision Coverage: Collision coverage provides reimbursement for damage to the insured vehicle resulting from collisions with other vehicles, objects, or stationary obstacles, regardless of fault. It typically covers repair or replacement costs up to the actual cash value of the vehicle, minus the deductible chosen by the policyholder.

- Comprehensive Coverage: Comprehensive coverage offers protection against non-collision-related perils and damages to the insured vehicle, including theft, vandalism, fire, hail, floods, falling objects, and animal collisions. It provides reimbursement for repair or replacement costs up to the vehicle’s actual cash value, minus the deductible.

- Personal Injury Protection (PIP): Personal Injury Protection (PIP) or “no-fault” insurance covers medical expenses, lost wages, and essential services expenses for the insured driver and passengers regardless of fault in an accident. PIP benefits may also include coverage for funeral expenses, rehabilitation costs, and survivor benefits.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): Uninsured/Underinsured Motorist Coverage (UM/UIM) protects the insured driver and passengers against bodily injury and property damage caused by uninsured or underinsured drivers. It covers medical expenses, lost wages, and other damages that exceed the limits of the at-fault driver’s liability coverage or in hit-and-run accidents where the other driver cannot be identified.

- Rental Reimbursement Coverage: Rental Reimbursement Coverage reimburses the insured driver for rental car expenses incurred while their vehicle is undergoing repairs or replacement following a covered accident or loss.

- Roadside Assistance/Towing Coverage: Roadside Assistance/Towing Coverage provides emergency assistance services, such as towing, fuel delivery, lockout assistance, and tire changes, in the event of vehicle breakdowns or roadside emergencies.

Coverage Options and Considerations:

When selecting car insurance coverage, drivers should consider several factors to ensure adequate protection and alignment with their needs, preferences, and budget:

- Coverage Limits: Evaluate the coverage limits and policy provisions for each type of coverage to ensure sufficient protection against potential liabilities and financial losses. Higher coverage limits may offer greater protection but can result in higher premiums.

- Deductible Amount: Choose a deductible amount that balances affordability with out-of-pocket expenses in the event of a claim. Higher deductibles typically result in lower premiums but require the insured driver to pay more upfront before insurance benefits apply.

- Additional Features and Riders: Explore optional features, riders, or endorsements offered by insurers to enhance coverage and tailor protection to specific needs. Examples include accident forgiveness, new car replacement, gap insurance, and custom equipment coverage.

- Discounts and Savings: Inquire about available discounts and savings opportunities to reduce insurance premiums. Common discounts may include multi-policy discounts, safe driver discounts, vehicle safety features discounts, and good student discounts.

- Insurer Reputation and Customer Service: Research insurers’ reputations, financial stability ratings, and customer service reviews to assess their reliability, responsiveness, and claims handling efficiency. Choose an insurer with a strong track record of customer satisfaction and timely claims processing.

Key Markets and Trends in Car Insurance:

The car insurance market in the USA is dynamic and competitive, characterized by a diverse range of insurers, distribution channels, and market trends:

- Insurance Providers: The car insurance market is dominated by a mix of national insurers, regional carriers, and niche providers offering a variety of coverage options and pricing strategies. Major insurers, such as State Farm, GEICO, Progressive, Allstate, and USAA, command significant market share and compete for customers through advertising, branding, and product innovation.

- Distribution Channels: Car insurance is distributed through multiple channels, including direct sales, independent agents, captive agents, and online platforms. Direct-to-consumer sales and digital distribution channels have gained popularity in recent years, allowing consumers to compare quotes, purchase policies, and manage their insurance online or through mobile apps.

- Usage-Based Insurance (UBI): Usage-Based Insurance (UBI) or telematics-based insurance programs use vehicle telematics technology to monitor drivers’ behavior, driving patterns, and mileage in real-time. Insurers offer discounts and personalized premiums based on data collected from connected devices, such as telematics devices, smartphone apps, or onboard diagnostic (OBD-II) devices. UBI programs reward safe driving habits, such as obeying speed limits, avoiding sudden stops, and driving during off-peak hours, with potential premium discounts and incentives.

- Autonomous Vehicles and Emerging Technologies: Advancements in autonomous vehicle technology, vehicle connectivity, and artificial intelligence (AI) are reshaping the automotive industry and influencing car insurance trends. Insurers are adapting to the evolving risk landscape posed by self-driving cars, electric vehicles (EVs), and shared mobility platforms by developing new underwriting models, risk assessment tools, and insurance products tailored to emerging technologies and transportation trends.

- Regulatory Landscape: Car insurance regulations vary by state, with each state establishing minimum coverage requirements, insurance laws, and regulatory oversight mechanisms. State insurance departments regulate insurers’ licensing, rate filings, claims handling practices, and consumer protection standards to ensure fair and transparent insurance markets. Regulatory initiatives, such as auto insurance reform efforts, consumer advocacy campaigns, and legislative mandates, shape the competitive dynamics and affordability of car insurance nationwide.

Challenges and Considerations:

Despite its importance, car insurance in the USA faces several challenges and considerations that impact affordability, accessibility, and consumer satisfaction:

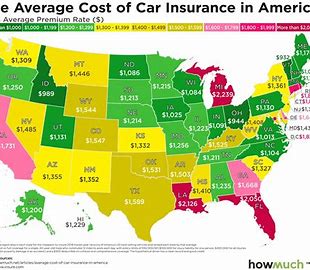

- Rising Premiums and Affordability: Car insurance premiums have been steadily increasing in recent years, outpacing inflation and wage growth, due to various factors, including rising claims costs, vehicle repair expenses, medical inflation, and catastrophic losses. Affordability concerns, particularly among low-income drivers and underserved communities, hinder access to essential insurance coverage and exacerbate financial disparities.

- Coverage Gaps and Underinsurance: Many drivers are underinsured or lack adequate car insurance coverage, leaving them vulnerable to financial risks and liabilities in the event of accidents or losses. Coverage gaps may arise from insufficient liability limits, excluded perils, or non-standard policy provisions that fail to address specific risks or circumstances. High-risk drivers, such as young drivers, seniors, and drivers with poor credit or driving histories, may face challenges in obtaining affordable coverage or meeting state insurance requirements.

- Fraud and Claims Abuse: Car insurance fraud, including staged accidents, exaggerated injuries, and false claims, poses significant challenges for insurers, policyholders, and law enforcement agencies. Fraudulent activities inflate claims costs, drive up insurance premiums, and undermine trust in the insurance system, ultimately affecting consumers’ affordability and access to coverage. Insurers employ anti-fraud measures, such as claims investigations, data analytics, and fraud detection technologies, to identify and combat fraudulent activities effectively.

- Regulatory Compliance and Reform: Car insurance regulations and reform efforts vary by state and jurisdiction, creating regulatory complexities and compliance challenges for insurers and consumers. State lawmakers, regulators, and industry stakeholders continually review insurance laws, rate structures, and consumer protection measures to address evolving market dynamics, legislative priorities, and public policy objectives. Regulatory initiatives, such as no-fault insurance reforms, tort reform proposals, and uninsured motorist enforcement strategies, shape the regulatory environment and insurance market conditions in each state.

Future Trends and Innovations:

The future of car insurance in the USA is influenced by evolving consumer preferences, technological advancements, regulatory changes, and market dynamics. Several trends and innovations are shaping the future landscape of car insurance:

- Digital Transformation: The adoption of digital technologies, automation, and data analytics is transforming the insurance industry’s operations, distribution channels, and customer experiences. Insurers are investing in digital platforms, mobile apps, and virtual assistant tools to streamline policy management, claims processing, and customer service interactions. Digital transformation initiatives enhance insurers’ agility, responsiveness, and competitiveness in a digital-first marketplace.

- Usage-Based Insurance (UBI) Evolution: Usage-Based Insurance (UBI) programs are evolving beyond traditional telematics-based models to incorporate advanced data analytics, artificial intelligence (AI), and predictive modeling techniques. Insurers leverage telematics data, IoT sensors, and connected vehicle technologies to offer personalized risk assessments, dynamic pricing models, and tailored coverage options based on individual driving behaviors, preferences, and risk profiles. UBI evolution promotes safer driving habits, risk prevention, and affordability for policyholders while enabling insurers to better manage underwriting risk and claims exposure.

- Autonomous Vehicle Insurance: The proliferation of autonomous vehicle technology and self-driving cars presents new challenges and opportunities for car insurance. Insurers are developing insurance products, risk models, and liability frameworks tailored to autonomous vehicles’ unique characteristics, including semi-autonomous features, driver-assist systems, and fully autonomous capabilities. Autonomous vehicle insurance considers factors such as vehicle autonomy levels, technology reliability, human-machine interaction, and liability attribution in accidents involving autonomous vehicles. Collaboration among insurers, automakers, regulators, and technology providers is essential to address legal, ethical, and insurance implications of autonomous vehicle adoption.

- Personalization and Customization: Consumer demand for personalized insurance solutions and customized coverage options is driving insurers to offer more flexible, tailored products and pricing structures. Insurers leverage data analytics, machine learning algorithms, and predictive analytics to assess individual risk factors, lifestyle choices, and behavioral patterns, enabling personalized underwriting, risk assessment, and premium pricing. Personalization and customization empower consumers to choose coverage options, deductibles, and policy features that align with their needs, preferences, and budgetary constraints, enhancing customer satisfaction and loyalty.

- Insurtech Disruption: The rise of insurtech startups, digital platforms, and innovation ecosystems is disrupting traditional insurance business models, processes, and value chains. Insurtech companies leverage emerging technologies, such as blockchain, AI, IoT, and big data analytics, to address industry pain points, streamline operations, and enhance customer experiences. Insurtech innovation encompasses various areas, including digital distribution, claims automation, risk management, peer-to-peer insurance, and on-demand insurance solutions. Insurtech disruption fosters innovation, competition, and market dynamism, driving industry transformation and consumer empowerment.

Conclusion:

Car insurance plays a vital role in protecting drivers, vehicles, and communities against the financial risks and liabilities associated with vehicle ownership and operation in the USA. As an essential component of financial planning and risk management, car insurance offers financial protection, legal compliance, and peace of mind to drivers, ensuring that they can navigate the roads safely and responsibly. Understanding the types of coverage, coverage options, pricing factors, regulations, and emerging trends in car insurance is essential for drivers to make informed decisions, obtain adequate protection, and mitigate potential risks and uncertainties on the road. Through innovation, collaboration, and consumer education, the car insurance industry can evolve to meet the evolving needs, preferences, and expectations of drivers in a rapidly changing automotive and insurance landscape.