Introduction:

Earthquakes represent one of the most significant natural hazards, capable of causing widespread destruction, loss of life, and economic disruption. While seismic events occur with varying frequencies and intensities across the United States, certain regions are particularly vulnerable to earthquakes due to their proximity to active fault lines and tectonic plate boundaries. Given the potential for catastrophic losses associated with earthquakes, earthquake insurance plays a crucial role in mitigating financial risks and promoting resilience in communities exposed to seismic hazards. This essay provides an in-depth analysis of earthquake insurance in the USA, exploring its significance, types, coverage options, pricing factors, regulatory framework, challenges, and future prospects.

Understanding Earthquake Risk:

Earthquakes result from the sudden release of energy along fault lines or fractures in the Earth’s crust, leading to ground shaking, surface rupture, and displacement of rock layers. The intensity and impact of earthquakes depend on various factors, including the magnitude of the seismic event, the depth of the earthquake’s focus, the distance from the epicenter, local geology, and building construction practices. In the USA, seismic activity occurs primarily along the Pacific Ring of Fire, encompassing the West Coast states of California, Oregon, and Washington, as well as regions in Alaska, Hawaii, and the Intermountain West.

Significance of Earthquake Insurance:

Earthquake insurance serves as a vital risk management tool for homeowners, businesses, and communities in earthquake-prone regions, providing financial protection against property damage, structural collapse, and loss of life resulting from seismic events. Several key reasons underscore the significance of earthquake insurance:

- Financial Protection: Earthquake insurance provides policyholders with financial protection against the potentially devastating costs of repairing or rebuilding damaged structures, replacing personal belongings, and covering additional living expenses following an earthquake. By purchasing earthquake insurance, property owners transfer the risk of seismic losses to insurance companies, thereby reducing their exposure to catastrophic financial liabilities. Insurance coverage enables policyholders to recover quickly from earthquake-related losses, restore their homes or businesses, and resume normal activities without facing significant financial burdens.

- Risk Transfer and Resilience: Earthquake insurance facilitates risk transfer from individual property owners to the insurance market, spreading the financial risk of seismic events across a broader pool of policyholders and insurers. By pooling resources and sharing risks, earthquake insurance promotes resilience in communities exposed to earthquake hazards, ensuring that the costs of recovery and reconstruction are distributed more equitably. Insurance coverage encourages property owners to invest in earthquake-resistant building measures, retrofitting, and structural upgrades to minimize damage and enhance seismic resilience.

- Mortgage Lender Requirements: In earthquake-prone regions, mortgage lenders may require property owners to obtain earthquake insurance as a condition of obtaining a mortgage loan or financing for real estate transactions. Lenders seek to protect their financial interests and minimize their exposure to potential losses resulting from earthquake damage to mortgaged properties. Earthquake insurance requirements for properties located in high-risk seismic zones ensure that homeowners maintain adequate insurance coverage to protect the lender’s investment and comply with regulatory mandates.

- Community Preparedness and Recovery: Earthquake insurance contributes to community preparedness, mitigation, and recovery efforts by providing financial resources to support disaster response, infrastructure repair, and public assistance programs following seismic events. Insurance proceeds enable communities to rebuild damaged infrastructure, restore essential services, and assist residents affected by earthquakes. By facilitating rapid recovery and reconstruction, earthquake insurance plays a vital role in restoring community stability, economic vitality, and social cohesion in the aftermath of seismic disasters.

Types of Earthquake Insurance Coverage:

Earthquake insurance coverage in the USA is available through various insurance providers, including private insurers, surplus lines insurers, and state-run insurance programs. Common types of earthquake insurance coverage include:

- Residential Earthquake Insurance: Residential earthquake insurance provides coverage for homeowners, condominium owners, and renters against earthquake-related losses to residential properties, including single-family homes, townhouses, and multi-unit dwellings. Residential earthquake insurance policies typically cover structural damage to the dwelling, personal property damage, additional living expenses, and loss of use resulting from seismic events. Coverage options may include building coverage, contents coverage, loss of rental income coverage, and debris removal coverage, with deductible options and coverage limits tailored to the insured property’s value and risk exposure.

- Commercial Earthquake Insurance: Commercial earthquake insurance provides coverage for businesses, landlords, and property owners against earthquake-related losses to commercial properties, including office buildings, retail stores, industrial facilities, and mixed-use developments. Commercial earthquake insurance policies protect commercial properties from structural damage, business interruption, inventory loss, equipment damage, and liability claims resulting from seismic events. Coverage options may include building coverage, business interruption coverage, equipment breakdown coverage, and extra expense coverage, with coverage limits and deductible amounts customized to the insured property’s value and business operations.

- Earthquake Endorsements: Some homeowners insurance policies offer earthquake endorsements or riders that provide limited coverage for earthquake-related losses as an optional add-on to standard homeowners insurance coverage. Earthquake endorsements may offer coverage for structural damage, personal property damage, additional living expenses, and loss of use resulting from seismic events, subject to specified coverage limits, deductibles, and exclusions. Policyholders can purchase earthquake endorsements to supplement their existing homeowners insurance coverage and enhance their protection against earthquake hazards.

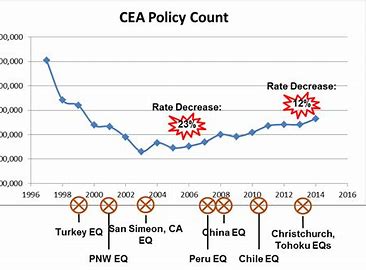

- Government-Sponsored Earthquake Insurance Programs: Several states offer government-sponsored earthquake insurance programs to provide affordable earthquake insurance coverage to homeowners, businesses, and property owners in high-risk seismic zones. These programs may be administered by state insurance departments, quasi-governmental entities, or private insurers underwriting policies on behalf of the state. Government-sponsored earthquake insurance programs offer standardized coverage options, premium rates, and deductible amounts to eligible policyholders, with subsidies, discounts, or incentives available to promote participation and affordability.

Coverage Options and Considerations:

When selecting earthquake insurance coverage, property owners, renters, and businesses should consider several factors to ensure adequate protection, affordability, and compliance with regulatory requirements:

- Property Location and Seismic Risk: Assess the property’s location, seismic risk zone designation, and proximity to active fault lines or seismic hazard areas to determine the level of earthquake risk and insurance coverage needed. Properties located in high-risk seismic zones, such as earthquake faults or liquefaction zones, may require higher levels of earthquake insurance coverage to mitigate potential losses. Consider the property’s construction type, building materials, soil conditions, and retrofitting status when evaluating seismic vulnerability and coverage options.

- Coverage Limits and Deductibles: Evaluate coverage limits, deductible options, and premium rates offered by different earthquake insurance policies to select coverage that aligns with the property’s value, replacement cost, and seismic risk exposure. Earthquake insurance policies typically have separate coverage limits and deductible amounts for building coverage and contents coverage. Choose coverage limits and deductible levels that provide adequate protection against earthquake-related losses while remaining affordable and financially sustainable for the insured party.

- Retrofitting and Seismic Upgrades: Consider retrofitting, structural upgrades, and seismic mitigation measures to reduce the property’s vulnerability to earthquake damage and lower insurance premiums. Retrofitting measures, such as foundation bolting, bracing, anchoring, and reinforcement, strengthen existing structures and improve their resistance to seismic forces. Seismic upgrades, such as installing shear walls, reinforcing concrete walls, or adding seismic restraints to building systems, enhance structural integrity and seismic resilience. Implementing retrofitting and seismic upgrades may qualify property owners for discounts, credits, or incentives from insurers or government agencies, thereby reducing insurance costs and increasing property value.

- Loss Prevention and Risk Management: Implement loss prevention measures, emergency preparedness plans, and risk management strategies to mitigate earthquake risks and minimize potential losses. Secure heavy objects, furniture, and appliances to prevent them from falling or causing injuries during an earthquake. Conduct seismic evaluations, building inspections, and vulnerability assessments to identify structural weaknesses, hazards, and mitigation opportunities. Develop evacuation plans, emergency kits, and communication protocols to ensure readiness for seismic events and enhance personal safety and property protection. Collaborate with local emergency agencies, community organizations, and disaster response teams to coordinate preparedness efforts and improve resilience to earthquakes.

Regulatory Framework and Compliance:

Earthquake insurance in the USA is subject to regulatory oversight by state insurance departments, regulatory agencies, and federal laws governing insurance practices, market conduct, and consumer protection. Insurance companies offering earthquake insurance coverage must comply with state insurance laws, regulations, and licensing requirements to operate legally and ethically in the marketplace. State insurance departments regulate earthquake insurance rates, forms, underwriting practices, claims handling procedures, and market conduct to protect consumers, ensure fair competition, and promote market stability. Insurance companies are required to file earthquake insurance rates, policy forms, and underwriting guidelines with state regulators for approval and adhere to statutory requirements, solvency standards, and consumer protection laws.

Conclusion:

Earthquake insurance serves as a critical tool for protecting homeowners, businesses, and communities from the financial consequences of seismic events and promoting resilience in earthquake-prone regions of the USA. By providing financial protection against property damage, structural collapse, and loss of life resulting from earthquakes, insurance coverage enables policyholders to recover quickly, rebuild their lives, and restore their communities following seismic disasters. As the threat of earthquakes continues to pose challenges to individuals, businesses, and governments, earthquake insurance remains essential for mitigating risks, enhancing preparedness, and fostering resilience in the face of seismic hazards. Through effective risk management practices, comprehensive insurance coverage, and regulatory compliance, earthquake insurance plays a vital role in safeguarding lives, property, and prosperity in earthquake-prone regions across the nation.

Many thanks for this enlightening article. It’s been extremely informative and provided a lot of useful information. For those who are keen on viral real estate SEO, make sure to explore https://www.elevenviral.com for additional insights.