Introduction

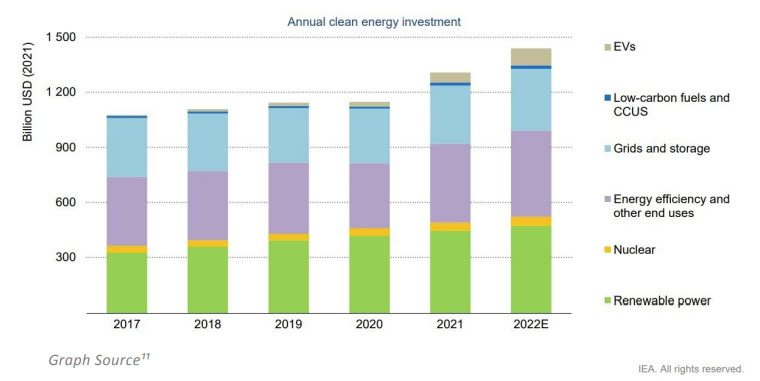

Clean energy investments are crucial for advancing environmental sustainability and reducing dependence on fossil fuels in the United States. With the increasing adoption of renewable energy sources like solar, wind, hydroelectric, and geothermal power, there’s a growing need to address the risks associated with these projects. Insurance for clean energy investments plays a vital role in mitigating various project-specific risks and financial losses encountered by developers, investors, and other stakeholders involved in renewable energy initiatives across the country.

Coverage Areas

A. Construction Risks:

- Delayed Completion Coverage: In the United States, insurance policies cover financial losses stemming from construction delays due to factors like adverse weather conditions, labor disputes, material shortages, or contractor defaults. These policies ensure that projects remain financially viable despite unexpected delays, helping developers meet contractual obligations and timelines.

- Equipment Failure Coverage: American insurance policies extend coverage for losses arising from equipment breakdowns or defects during the construction phase. This coverage encompasses repair or replacement costs and additional expenses incurred due to project delays, ensuring that clean energy projects can resume operations swiftly.

B. Operational Risks:

- Property Damage Coverage: Insurance policies in the USA protect renewable energy infrastructure from damage caused by natural disasters, fires, vandalism, or other perils. This coverage is crucial for ensuring the resilience and longevity of clean energy assets, safeguarding investments against unforeseen property damage events.

- Business Interruption Coverage: In the event of operational disruptions, such as equipment failures or grid outages, American insurance policies provide coverage for financial losses incurred due to interrupted clean energy production. This coverage helps compensate for lost revenue and mitigates the financial impact of downtime on project profitability.

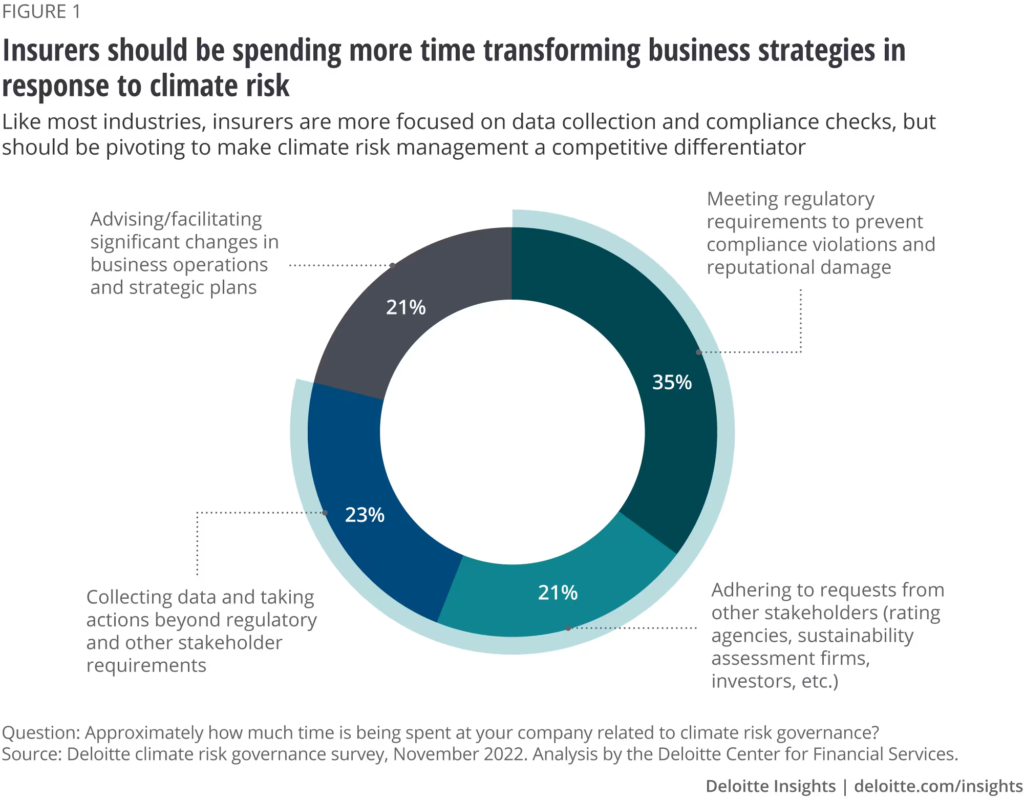

Regulatory Compliance

A. Compliance with Renewable Energy Standards:

- Renewable Portfolio Standards (RPS): Insurance coverage in the USA assists clean energy projects in meeting state or federal RPS mandates by covering costs associated with compliance, including penalties for non-compliance and investments in renewable energy credits (RECs) or carbon offsets.

- Permitting and Regulatory Approvals: American insurance policies extend coverage for expenses related to obtaining permits, licenses, or regulatory approvals for clean energy projects. This coverage encompasses costs associated with environmental impact assessments, land use permits, and other regulatory requirements.

Financial Risks

A. Investment Risks:

- Coverage for Capital Investment: Insurance policies in the USA provide coverage for financial losses resulting from clean energy projects’ failure to meet expected returns on investment. This coverage includes protection for debt service coverage, equity returns, or project financing obligations, ensuring investors’ financial security.

- Sovereign Risk Coverage: American insurance policies safeguard investors against political or regulatory risks associated with renewable energy investments. This coverage protects against adverse government policies, taxation changes, or subsidy fluctuations that could impact project profitability.

B. Currency and Exchange Rate Risks:

- Currency Fluctuation Coverage: In the USA, insurance mitigates losses caused by fluctuations in foreign exchange rates, particularly for international clean energy investments denominated in foreign currencies. Insurers offer risk management solutions such as currency hedging contracts or derivatives to stabilize investment returns and protect against currency exchange risks.

Risk Management Strategies

A. Due Diligence and Project Assessment:

- Comprehensive Risk Analysis: Developers and investors conduct thorough due diligence and risk assessments for clean energy projects, identifying and evaluating potential risks to implement effective risk mitigation strategies.

- Project Structuring: Proper project structuring involves robust contracts, warranties, and insurance provisions to allocate risks effectively among project participants and minimize exposure to financial losses in the USA.

B. Portfolio Diversification:

- Spread of Risks: Diversifying clean energy investments across multiple projects, technologies, and geographic regions reduces concentration risk and mitigates the impact of adverse events on investment portfolios.

- Insurance Coverage Optimization: Tailoring insurance coverage to the specific risk profile of clean energy projects optimizes risk transfer and cost-effectively protects investment portfolios in the USA.

Conclusion

Insurance for clean energy investments is integral to managing project risks and financial losses in the USA’s renewable energy sector. By providing coverage for construction, operational, regulatory, and financial risks, insurance solutions enable developers, investors, and stakeholders to navigate the complexities of clean energy projects confidently. With robust risk management strategies and tailored insurance coverage, the USA can accelerate the transition to a sustainable and low-carbon energy future, driving economic growth and environmental stewardship nationwide.