INTRODUCTION:

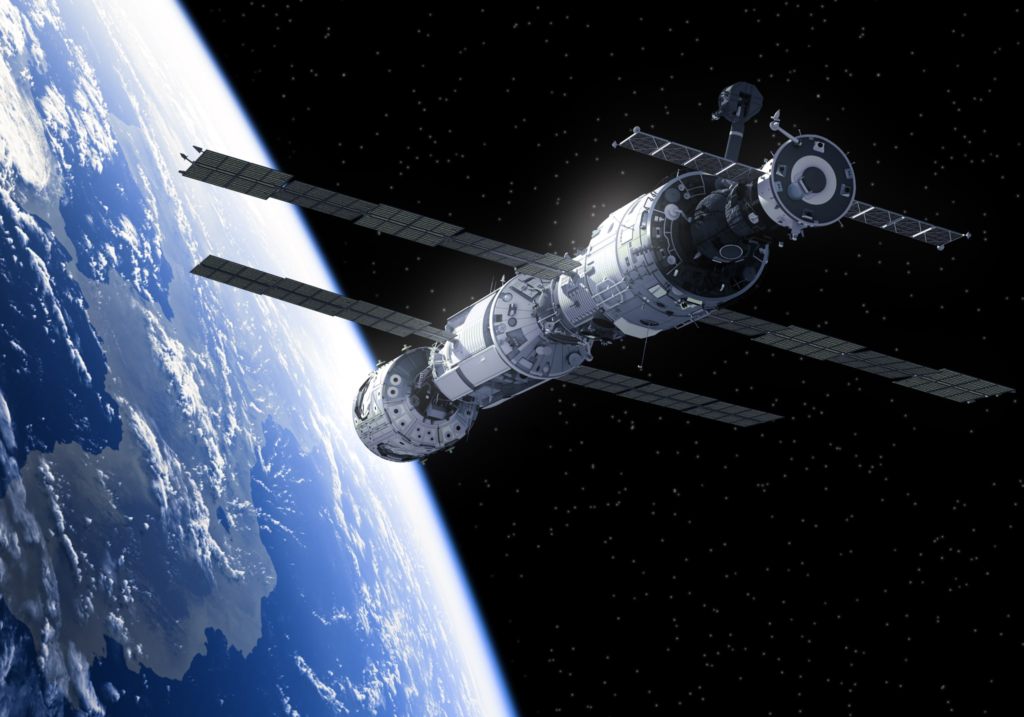

Space tourism, the commercial provision of space travel experiences for private individuals, is a rapidly evolving industry that presents both unique opportunities and challenges for insurers. As space tourism ventures become increasingly feasible, insurers are tasked with providing coverage for various risks associated with these endeavors, while also navigating the complex regulatory landscape governing space activities.

Here’s a detailed explanation of the considerations and challenges involved in insuring space tourism activities, particularly within the context of the United States:

I. Federal Aviation Administration (FAA) Oversight:

- Regulatory Authority:

- The FAA, specifically the Office of Commercial Space Transportation (AST), regulates space tourism activities in the US.

- Licensing Requirements:

- Insurers must comply with stringent licensing requirements outlined in the Commercial Space Launch Act.

- Safety Standards:

- FAA regulations mandate adherence to rigorous safety standards and operational procedures to ensure the safety of space tourism operations.

- Operational Compliance:

- Insurers need to ensure compliance with FAA regulations throughout all phases of space tourism operations, including launch, flight, and re-entry.

II. International Treaty Obligations:

- Outer Space Treaty:

- Insurers must align with the principles established in the Outer Space Treaty, which governs the peaceful use of outer space and prohibits the appropriation of celestial bodies.

- Liability Convention:

- Compliance with the Liability Convention is essential, as it establishes liability principles for space activities, impacting insurance coverage and liability provisions.

- Alignment with US Policy:

- Insurers must ensure alignment with US policy on international space law to maintain coherence and adherence to global standards in space tourism insurance.

III. Risk Assessment and Underwriting:

- Data Limitations:

- Insurers face challenges due to limited historical data on space tourism risks, necessitating innovative risk assessment methodologies.

- Unique Nature of Risks:

- The inherently unique nature of space tourism ventures poses challenges in accurately assessing and underwriting risks associated with these endeavors.

- FAA Guidance:

- Insurers rely on the FAA’s safety oversight and risk management requirements to guide thorough risk assessments and ensure accurate pricing of coverage.

- Financial Stability:

- Despite the complexities involved, insurers prioritize financial stability by conducting robust risk assessments and employing sound underwriting practices.

In navigating these regulatory challenges, insurers play a pivotal role in facilitating the growth and sustainability of the space tourism industry. Through adherence to FAA regulations, compliance with international treaties, and rigorous risk assessment and underwriting practices, insurers uphold their commitment to providing comprehensive coverage solutions while ensuring the safety and integrity of space tourism operations in the United States.

Coverage Considerations

A. Passenger Liability Coverage:

- Insurers must provide comprehensive coverage for bodily injury, death, and medical expenses incurred by space tourists during their journey. Compliance with Federal Aviation Administration (FAA) regulations ensures alignment with safety standards for passengers.

B. Third-Party Liability Coverage:

- Policies should encompass property damage and environmental contamination arising from space tourism operations. Adhering to FAA requirements for environmental protection and public safety is imperative in crafting effective coverage.

C. Vehicle and Payload Insurance:

- Coverage is essential for mitigating risks associated with spacecraft damage or payload malfunction during launch, flight, and re-entry. Compliance with FAA regulations on vehicle safety and reliability is paramount for insurers.

III. Regulatory Challenges

A. Federal Aviation Administration (FAA) Oversight:

- The FAA, particularly through the Office of Commercial Space Transportation (AST), regulates space tourism activities in the US. Insurers must navigate licensing requirements under the Commercial Space Launch Act to ensure adherence to safety standards and operational protocols.

B. International Treaty Obligations:

- Insurers must comply with international treaties like the Outer Space Treaty and Liability Convention, which delineate liability principles for space activities. Alignment with US policy on international space law is essential to ensure consistency in insurance coverage and liability provisions.

C. Risk Assessment and Underwriting:

- Insurers face the challenge of assessing and underwriting space tourism risks due to limited historical data and the unique nature of these ventures. Rigorous risk assessments guided by FAA safety oversight and risk management requirements are crucial for accurate pricing and financial stability.

IV. Future Outlook

A. Market Expansion:

- As the space tourism industry grows, insurers may develop specialized coverage solutions tailored to the needs of space tourism operators and travelers. Increased competition in the US insurance market may foster innovation and collaboration among insurers, resulting in more comprehensive and affordable insurance products.

B. Regulatory Evolution:

- Regulatory frameworks governing space tourism in the US may evolve to address emerging risks and technological advancements. Updates to safety regulations and licensing requirements by the FAA, in collaboration with industry stakeholders, will ensure continued safety and sustainability of space tourism activities, thereby fostering growth and innovation in the sector.

Conclusion

Insurance for space tourism in the US necessitates adept navigation of complex regulatory requirements and the mitigation of unique risks to ensure the safety and financial protection of all stakeholders involved. By aligning with US policy and regulatory standards, insurers can play a pivotal role in supporting the growth and sustainability of the space tourism industry while effectively managing risks and providing essential coverage solutions.