Introduction

Insurance fraud is a significant concern in the United States, with insurers facing substantial financial losses and policyholders experiencing increased premiums as a result. Detecting and preventing insurance fraud is crucial for maintaining the integrity of the insurance industry and ensuring fair treatment for all stakeholders.

This topic explores various aspects of insurance fraud detection and prevention in the USA, including:

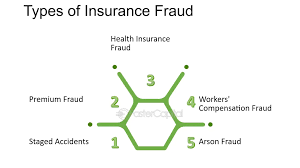

Types of Insurance Fraud in the USA

Insurance fraud in the USA encompasses a wide range of fraudulent activities, including:

1. Property Insurance Fraud

Property insurance fraud involves individuals or groups making false claims to their insurance provider for property damage, theft, arson, or vandalism. This type of fraud can take various forms:

- Exaggerated Claims: Claimants may inflate the extent of damage to their property to receive a larger insurance payout than what is justified.

- False Theft Claims: Individuals may falsely report items as stolen or exaggerate the value of stolen items to receive compensation from their insurance company.

- Arson: Deliberately setting fire to one’s property to collect insurance money is a serious form of property insurance fraud.

- Vandalism Claims: Individuals may cause damage to their property themselves or hire someone to do so in order to file a claim with their insurance company.

2. Auto Insurance Fraud

Auto insurance fraud involves individuals or groups making fraudulent claims related to automobile accidents or vehicle damage. Common forms of auto insurance fraud include:

- Staged Accidents: Fraudsters may intentionally cause accidents or collaborate with others to stage accidents in order to file false claims for vehicle damage and bodily injuries.

- Exaggerated Injuries: Claimants may exaggerate the extent of their injuries or falsely claim injuries that did not occur in the accident to receive higher compensation.

- Fraudulent Medical Treatment: Individuals may submit fraudulent medical bills or receive unnecessary medical treatment and then file claims with their insurance company to cover the costs.

- False Vehicle Damage Claims: Claimants may falsely report vehicle damage or exaggerate the extent of damage to their vehicle to receive compensation for repairs or replacement.

3. Healthcare Insurance Fraud

Healthcare insurance fraud involves fraudulent activities related to medical services, billing, and identity theft for medical treatment. This type of fraud can include:

- Billing for Unnecessary Medical Services: Healthcare providers may bill insurance companies for medical services or procedures that were not performed or were medically unnecessary.

- Prescription Fraud: Individuals may fraudulently obtain prescription medications, forge prescriptions, or sell prescription medications for profit.

- Identity Theft for Medical Treatment: Fraudsters may steal or use someone else’s identity to receive medical treatment, prescriptions, or healthcare services covered by insurance.

4. Workers’ Compensation Fraud

Workers’ compensation fraud involves individuals falsely claiming workplace injuries or disabilities to receive compensation benefits. This type of fraud can include:

- Falsifying Workplace Injuries: Employees may exaggerate the extent of their injuries or falsely claim injuries that did not occur at work in order to receive workers’ compensation benefits.

- Malingering: Claimants may prolong their recovery or falsely claim ongoing disabilities to continue receiving compensation benefits.

- Fraudulent Claims for Occupational Diseases: Employees may falsely claim to have contracted an occupational disease or illness as a result of their work in order to receive compensation benefits.

5. Life Insurance Fraud

Life insurance fraud involves individuals making fraudulent claims related to death benefits, such as faking death or providing false beneficiary information. This type of fraud can include:

- Faking Death: Individuals may stage their death or falsely report someone else’s death to collect life insurance benefits.

- False Beneficiary Information: Claimants may provide false or inaccurate information about beneficiaries in order to collect life insurance benefits to which they are not entitled.

In summary, insurance fraud is a serious and pervasive issue that can take various forms across different types of insurance. Detecting and preventing insurance fraud requires vigilance, advanced technology, and collaboration between insurers, law enforcement agencies, and regulatory bodies.

Detection Methods Used in the USA

Detecting insurance fraud in the USA involves a combination of traditional investigative techniques and advanced technologies:

- Traditional Methods: Manual reviews, interviews, and surveillance are conducted to identify suspicious claims and claimants.

- Advanced Analytics: Data analytics, machine learning, and predictive modeling are used to analyze claims data for patterns indicative of fraudulent behavior.

- Predictive Modeling: Historical claims data and fraud indicators are used to predict the likelihood of fraud for new claims.

- Social Network Analysis: Relationships between policyholders, claimants, medical providers, and other entities are analyzed to detect organized fraud rings or collusion networks.

Fraud Indicators Specific to the USA

Identifying common red flags and fraud indicators is essential for effective fraud detection in the USA:

- Claim Data Analysis: Inconsistencies in claim details, such as mismatched dates, conflicting information, or unusually high claim amounts.

- Claimant Behavior Analysis: Suspicious behavior by claimants, such as reluctance to provide documentation, evasiveness during interviews, or frequent changes to the claim narrative.

- Documentation Review: Anomalies in supporting documentation, such as forged signatures, altered invoices, or falsified medical records.

Prevention Strategies in the USA

Preventing insurance fraud in the USA requires a proactive approach and the implementation of various strategies:

- Fraud Awareness Training: Educating employees, agents, and policyholders about the consequences of insurance fraud and their role in detecting and preventing it.

- Authentication and Verification Systems: Implementing robust authentication and verification processes to verify the identity of policyholders and claimants.

- Regulatory Compliance: Ensuring compliance with anti-money laundering (AML) regulations, know your customer (KYC) requirements, and data privacy laws to prevent fraudulent activities.

- Collaboration and Information Sharing: Collaborating with law enforcement agencies, industry associations, and other insurers to share intelligence and best practices for fraud prevention.

Conclusion

In conclusion, insurance fraud detection and prevention are critical components of maintaining the integrity of the insurance industry in the USA. By leveraging advanced technologies, adopting proactive strategies, and collaborating with stakeholders, insurers can effectively combat insurance fraud and protect the interests of policyholders and shareholders.