Introduction

Insurance regulation and international trade agreements intersect in complex ways, as governments seek to balance regulatory objectives with promoting market competition and facilitating cross-border trade. In the United States, this intersection involves navigating domestic regulatory frameworks while complying with international trade obligations, influencing market dynamics and policy outcomes.

let’s elaborate on how insurance regulation and international trade agreements intersect within the context of United States policy.

Insurance Regulation in the USA:

In the United States, insurance regulation primarily occurs at the state level. Each state has its own insurance department responsible for overseeing insurance activities within its jurisdiction. This decentralized approach means that insurance companies must comply with the regulations of each state in which they operate. However, there is also a federal regulatory presence, particularly in areas where federal law supersedes state law, such as in the regulation of health insurance through the Affordable Care Act (ACA).

Key Aspects of Insurance Regulation in the USA:

- Role of State vs. Federal Regulation:

- State governments are primarily responsible for regulating insurance within their borders, including licensing insurers, setting premium rates, and overseeing market conduct.

- Federal regulation is typically limited to specific areas, such as health insurance, where federal laws like the ACA establish minimum standards and requirements.

- State Insurance Departments and Regulatory Oversight:

- Each state has its own insurance department tasked with regulating insurance activities. These departments oversee insurers, monitor financial solvency, and enforce compliance with state laws and regulations.

- State insurance commissioners play a crucial role in setting regulations, issuing licenses, and adjudicating disputes between insurers and policyholders.

- Key Regulatory Objectives:

- Consumer Protection: State regulations aim to protect consumers by ensuring fair treatment, transparency, and access to essential insurance products and services.

- Solvency Regulation: Regulators monitor the financial health of insurers to prevent insolvency and protect policyholders from financial losses.

- Market Stability: Regulatory oversight helps maintain a stable insurance market by preventing anti-competitive practices, ensuring fair competition, and promoting market integrity.

International Trade Agreements and Insurance:

The United States participates in various international trade agreements that impact insurance markets. These agreements seek to liberalize trade in insurance services, facilitate cross-border investment, and establish common rules and standards for market access.

Key Aspects of International Trade Agreements:

- Bilateral and Multilateral Agreements:

- The United States engages in bilateral and multilateral trade agreements with other countries and regions, such as NAFTA, USMCA, TPP, and WTO agreements.

- These agreements often include provisions related to trade in services, including insurance, aimed at reducing barriers to market access, promoting fair competition, and ensuring non-discriminatory treatment of foreign insurers.

- Market Access Provisions:

- International trade agreements typically include provisions that grant foreign insurers access to domestic markets on terms equivalent to domestic insurers. This may involve commitments to national treatment or most-favored-nation treatment, ensuring that foreign insurers are not disadvantaged compared to domestic competitors.

- Provisions on licensing, establishment, and operation of insurance firms aim to streamline regulatory processes, reduce administrative burdens, and promote transparency and fairness in licensing procedures.

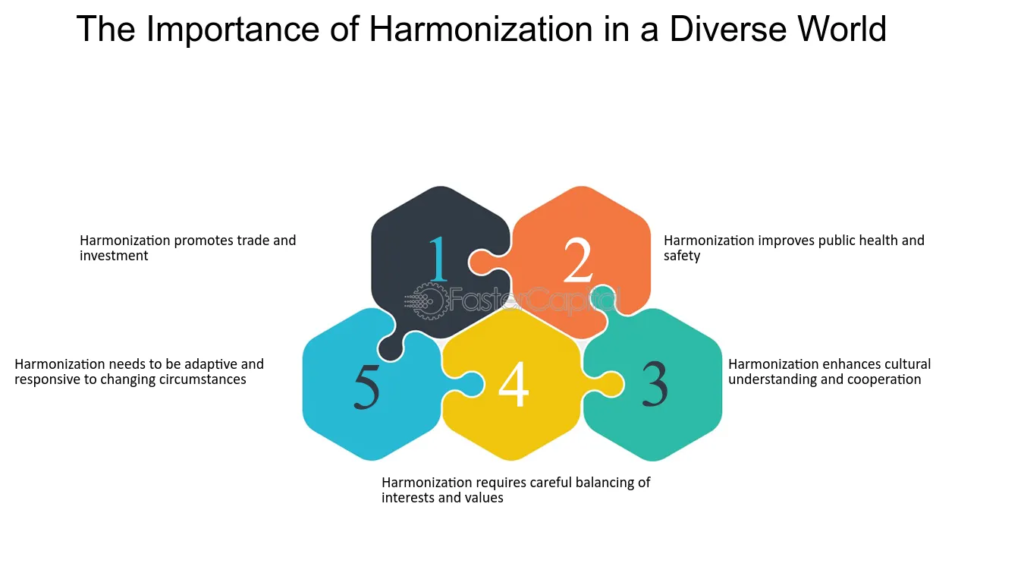

Harmonization Efforts and Policy Implications:

Harmonization of regulatory standards and practices is essential for promoting consumer protection, market confidence, and cross-border trade in insurance services. By aligning regulations and fostering cooperation among regulators, harmonization efforts aim to create a level playing field for insurers while ensuring adequate protection for policyholders.

Policy Implications for the USA:

- Compliance with International Trade Obligations:

- The United States must ensure that its domestic insurance regulations comply with its international trade obligations, as established in trade agreements.

- This may require periodic review and adjustment of domestic laws to align with international standards and commitments, while also preserving regulatory autonomy and addressing any conflicts between domestic and international obligations.

- Market Access and Competitiveness:

- International trade agreements provide opportunities for U.S. insurers to expand into foreign markets and compete on a global scale.

- By liberalizing trade and promoting regulatory cooperation, these agreements can enhance market access for U.S. insurers abroad, attract foreign investment into the U.S. insurance market, and foster innovation and competitiveness in the industry.

- Safeguarding Regulatory Autonomy:

- While promoting market access and competitiveness, the United States must also safeguard its regulatory autonomy and the ability to tailor regulations to its domestic market conditions.

- This involves striking a balance between trade liberalization objectives and prudential regulation goals, ensuring that regulatory reforms do not undermine consumer protection, financial stability, or regulatory effectiveness.

In summary, insurance regulation and international trade agreements intersect in the United States, shaping the regulatory landscape, market dynamics, and policy outcomes in the insurance industry. Through regulatory harmonization efforts and adherence to international trade obligations, the United States aims to promote consumer protection, market confidence, and competitiveness while preserving regulatory autonomy and addressing the challenges of a globalized insurance market.