Introduction

In the realm of financial planning, few topics are as delicate as child life insurance policies. These policies serve as a safeguard against the unthinkable – providing coverage for children’s expenses in the event of their untimely demise. While contemplating such scenarios may seem distressing, child life insurance offers crucial financial protection and peace of mind to families facing unimaginable tragedies. In this blog post, we will embark on a comprehensive exploration of child life insurance policies, shedding light on their coverage, benefits, drawbacks, ethical considerations, and alternatives. Moreover, we will examine these policies through various lenses, considering cultural, legal, and global perspectives.

Understanding Child Life Insurance Policies

Child life insurance policies constitute a subset of the broader life insurance industry, typically falling into three main categories: whole life insurance, term life insurance, and universal life insurance. Each type offers unique features and benefits tailored to meet the diverse needs of policyholders. Whole life insurance, for instance, provides coverage for the entire lifespan of the insured individual, accumulating cash value over time. Conversely, term life insurance offers coverage for a specified term, without the cash value component. Universal life insurance combines elements of both, providing flexibility in premium payments and death benefits.

Coverage Offered by Child Life Insurance Policies

Child life insurance policies extend coverage for various expenses associated with a child’s death. This includes funeral expenses, encompassing costs related to burial or cremation services, such as casket or urn expenses, funeral home fees, and cemetery costs. Additionally, these policies may cover medical expenses incurred before the child’s passing, end-of-life expenses such as legal fees and administrative costs, and even grief counseling services for the family. Some policies also accumulate cash value over time, offering a financial cushion that can be accessed for various purposes.

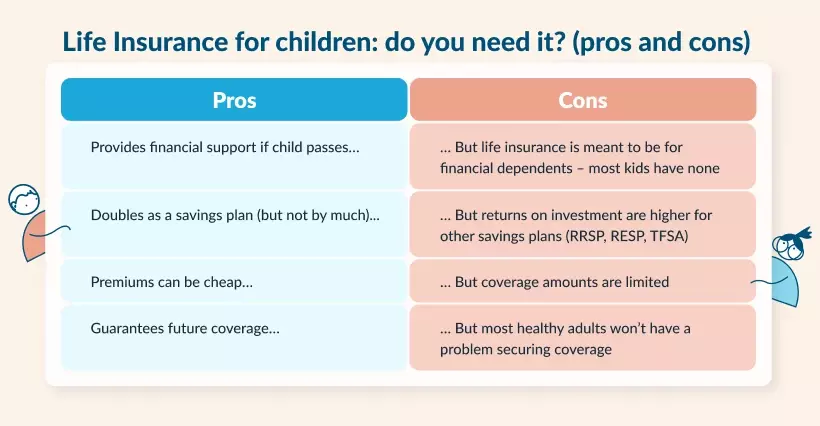

Benefits of Child Life Insurance Policies

- Financial Protection for Families: Child life insurance policies offer a crucial safety net by providing coverage for funeral expenses and other end-of-life costs. This helps families avoid financial strain during an emotionally challenging time.

- Peace of Mind: Parents can have peace of mind knowing that their child’s future is financially secure, regardless of unforeseen circumstances. This assurance allows families to focus on grieving and healing without worrying about financial burdens.

- Accumulation of Cash Value: Certain child life insurance policies accumulate cash value over time. This cash value can serve as an additional financial resource for the family, providing flexibility and stability in managing financial needs.

- Tax Advantages: Child life insurance policies may offer tax advantages, such as tax-free death benefits paid out to beneficiaries. This can provide families with a significant financial benefit and enhance the overall value of the policy.

Drawbacks of Child Life Insurance Policies

- Limited Coverage Scope: Child life insurance policies may not cover all potential expenses arising from a child’s death. While they typically include funeral expenses and some end-of-life costs, they may not provide comprehensive coverage for all financial needs that arise in such circumstances.

- Prohibitive Cost of Premiums: The cost of premiums for child life insurance policies can be prohibitive for some families. Factors such as the child’s age, health status, coverage amount, and type of policy can influence the cost, making it challenging for families to afford coverage.

- Affordability Concerns: Affordability concerns arise when families struggle to allocate financial resources towards paying premiums for child life insurance policies. This can lead to difficult decisions about prioritizing insurance coverage over other essential expenses.

- Opportunity Costs: Investing in a child life insurance policy means allocating financial resources that could potentially be used for other purposes, such as saving for the child’s education or funding retirement savings. Families must consider the opportunity cost of purchasing a child life insurance policy and weigh it against other financial priorities.

- Ethical Considerations: The idea of insuring children can be controversial, raising ethical questions about the commodification of life and the appropriateness of profiting from policies that cover minors. Some individuals argue that child life insurance policies exploit parents’ fears and emotions, while others believe they provide essential financial protection for families.

Ethical Considerations

The ethical implications of insuring children’s lives provoke thoughtful reflection. Critics argue that assigning monetary value to a child’s life commodifies human existence, while others contend that such policies offer essential financial protection. Parents face the moral dilemma of balancing risk and protection, while insurance providers must ensure fair treatment and transparent practices.

Practical Considerations for Purchasing Child Life Insurance

Before purchasing a child life insurance policy, families must carefully assess their needs and priorities. Understanding policy terms and conditions is paramount to making informed decisions, as is researching and evaluating insurance providers to find the best coverage options.

Alternatives to Child Life Insurance

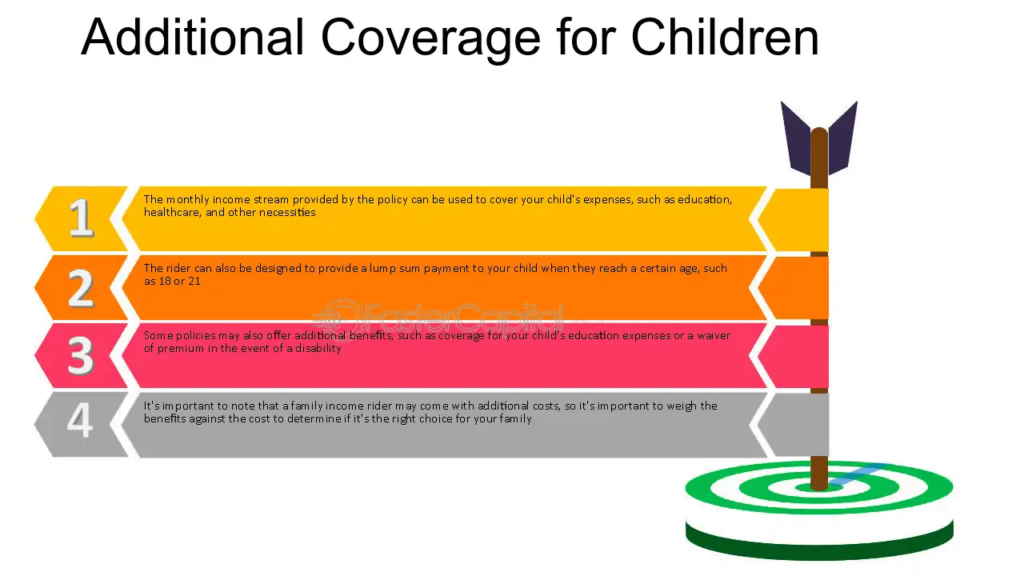

Child life insurance is just one option among many for families seeking financial protection for their children. Additional coverage on a parent’s policy, savings and investment plans, college savings plans, and estate planning measures offer viable alternatives that warrant exploration.

Case Studies and Real-Life Examples

Scenario 1: The Smith Family’s Tragic Loss

The Smith family experienced the unexpected loss of their youngest child, Emily, in a car accident. Fortunately, they had purchased a child life insurance policy for Emily several years earlier. The policy covered funeral expenses, medical bills, and provided additional financial support during their time of need. Without the policy, the Smith family would have struggled to cover the substantial costs associated with Emily’s passing. The policy not only eased their financial burden but also provided emotional reassurance knowing they could focus on grieving without worrying about finances.

Scenario 2: The Garcia Family’s Financial Strain

The Garcia family considered purchasing a child life insurance policy for their two children but ultimately decided against it due to affordability concerns. Several years later, tragedy struck when their youngest child, Miguel, was diagnosed with a rare illness and passed away unexpectedly. The Garcia family found themselves facing overwhelming medical bills and funeral expenses without the financial support of a child life insurance policy. They regretted not prioritizing financial protection for their children and struggled to cope with the financial strain during an already challenging time.

Cultural and Global Perspectives

Cultural attitudes towards child life insurance vary across different regions, shaping societal norms and perceptions. Understanding these cultural variances is crucial in assessing the broader implications of such policies.

Legal Framework and Regulations

Child life insurance policies are subject to legal and regulatory oversight, ensuring consumer protection and fair treatment. Familiarizing oneself with the legal framework governing these policies is essential for both policyholders and insurance providers.

Future Trends and Outlook

As the insurance industry evolves, so too do child life insurance policies. Technological advancements, changes in regulations, shifting societal attitudes, and economic factors all influence the trajectory of these policies, shaping their future landscape.

Conclusion

In conclusion, child life insurance policies offer families a safety net in times of unthinkable tragedy. While they come with benefits and drawbacks, their ethical and practical considerations underscore the need for careful deliberation. By exploring these policies comprehensively and considering various perspectives, families can make informed decisions that align with their values and priorities, ensuring the financial security of their loved ones. Ultimately, child life insurance policies serve as a testament to the profound responsibility and unwavering love that parents hold for their children, offering a beacon of hope in the face of life’s uncertainties.