Introduction:

Disability insurance is a crucial component of financial planning that often gets overlooked. Many individuals prioritize life insurance or health insurance, yet fail to recognize the significance of protecting their income in the event of a disability. In today’s uncertain world, where accidents and illnesses can strike unexpectedly, safeguarding your income through disability insurance is essential for maintaining financial stability. This comprehensive guide aims to elaborate on the importance of disability insurance, its types, benefits, and factors to consider when choosing a policy.

Understanding Disability Insurance:

Disability insurance, also known as income protection insurance or disability income insurance, is a type of insurance policy designed to provide financial support to individuals who are unable to work due to a disability. Unlike health insurance, which covers medical expenses, disability insurance replaces a portion of your income if you become disabled and are unable to earn an income through employment.

Types of Disability Insurance:

- Short-Term Disability Insurance:

- Short-term disability insurance provides coverage for a limited duration, typically ranging from a few weeks to several months.

- This type of insurance is ideal for covering temporary disabilities resulting from accidents, injuries, or short-term illnesses.

- Benefits usually start shortly after the onset of disability and continue for the specified benefit period or until the individual can return to work.

- Long-Term Disability Insurance:

- Long-term disability insurance provides coverage for an extended period, often until retirement age, if the insured individual becomes permanently disabled.

- This type of insurance offers more comprehensive coverage for disabilities that last beyond the short-term period.

- Benefits may replace a percentage of the insured individual’s income, helping to maintain their standard of living despite the inability to work.

Benefits of Disability Insurance:

- Income Replacement:

- One of the primary benefits of disability insurance is its ability to replace lost income when a disability prevents an individual from working.

- This ensures that essential living expenses such as mortgage or rent, utilities, and groceries can still be covered, maintaining financial stability for the individual and their family.

- Protecting Financial Goals:

- Disability insurance helps protect long-term financial goals such as retirement savings, education funds, and investment portfolios.

- Without disability insurance, a sudden disability could derail these goals, potentially leading to financial hardship and insecurity.

- Peace of Mind:

- Knowing that you have disability insurance coverage provides peace of mind, knowing that you and your family are financially protected in the event of a disability.

- This peace of mind allows individuals to focus on their recovery without the added stress of financial uncertainty.

- Customizable Coverage:

- Disability insurance policies are often customizable to suit individual needs and preferences.

- Policyholders can choose the benefit amount, benefit period, waiting period, and other features to tailor the coverage to their specific circumstances.

Factors to Consider When Choosing a Policy:

- Benefit Amount:

- The benefit amount determines how much income will be replaced in the event of a disability.

- Consider factors such as current income, living expenses, and financial obligations when determining the appropriate benefit amount.

- Benefit Period:

- The benefit period specifies how long benefits will be paid out during a disability.

- Choose a benefit period that aligns with your expected recovery time and long-term financial goals.

- Waiting Period:

- The waiting period, also known as the elimination period, is the amount of time you must wait after becoming disabled before benefits are paid.

- Consider your savings, emergency funds, and other sources of income when selecting a waiting period.

- Definition of Disability:

- Different disability insurance policies have varying definitions of disability, which can impact eligibility for benefits.

- Review the definition of disability carefully to ensure it aligns with your circumstances and occupation.

- Cost of Coverage:

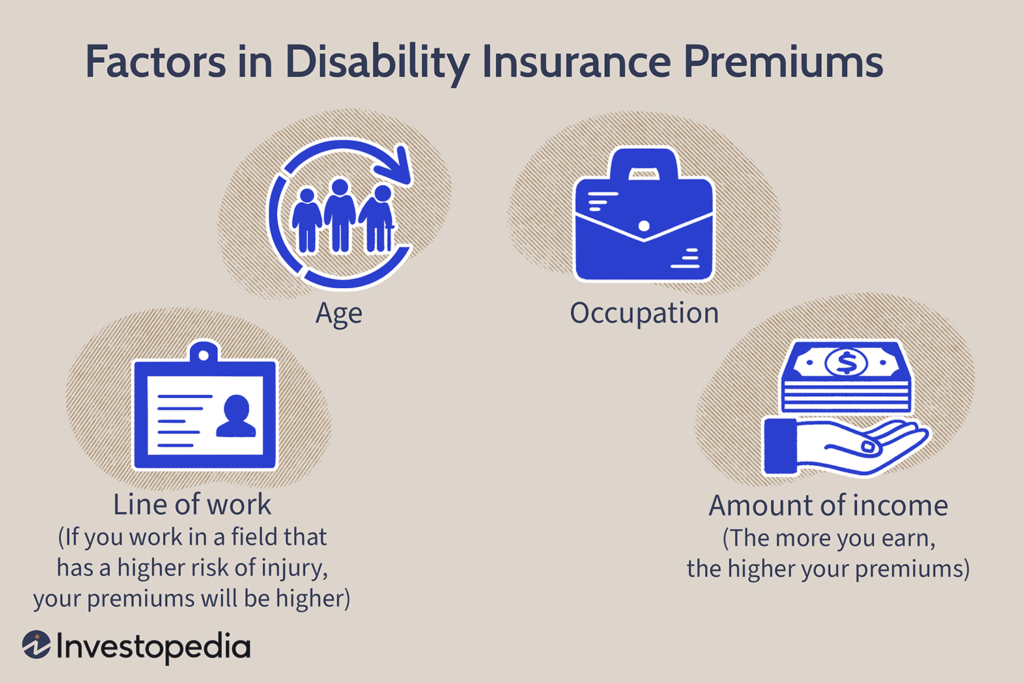

- The cost of disability insurance premiums can vary based on factors such as age, health status, occupation, benefit amount, and selected features.

- Compare quotes from multiple insurance providers to find a policy that offers the best value for your budget.

Conclusion:

Disability insurance is an essential component of financial planning that provides protection and peace of mind in the event of a disability. By replacing lost income, disability insurance helps individuals and their families maintain financial stability and achieve their long-term goals. When choosing a disability insurance policy, it’s essential to consider factors such as benefit amount, benefit period, waiting period, definition of disability, and cost of coverage to ensure adequate protection. By investing in disability insurance, individuals can safeguard their income and protect their financial future against the uncertainties of life.