In today’s complex healthcare landscape, choosing the right health insurance plan can feel like navigating a labyrinth. With numerous options, varying coverage levels, and ever-changing regulations, individuals and businesses alike often find themselves overwhelmed by the sheer magnitude of choices. This is where health insurance brokers step in, offering invaluable assistance in finding and comparing plans tailored to specific needs and budgets.

In this comprehensive guide, we’ll delve into the role of health insurance brokers, explore the benefits they provide, and provide practical tips for making informed decisions when selecting a health insurance plan.

Understanding the Role of Health Insurance Brokers

Health insurance brokers serve as intermediaries between insurance companies and consumers. They possess in-depth knowledge of the healthcare industry, including the intricacies of different insurance plans, coverage options, and pricing structures. Brokers work closely with individuals, families, and businesses to assess their unique needs and preferences, and then leverage their expertise to recommend suitable insurance solutions.

Unlike insurance agents who work directly for specific insurance companies, brokers are independent professionals who represent multiple insurers. This independence allows them to offer unbiased advice and access a broader range of plans, ensuring clients receive personalized recommendations tailored to their circumstances.

The Benefits of Working with a Health Insurance Broker

- Expert Guidance: Health insurance brokers are well-versed in the complexities of insurance terminology, regulations, and coverage options. They can demystify the jargon and provide clear explanations, helping clients make informed decisions.

- Personalized Recommendations: By conducting a thorough assessment of clients’ needs, brokers can identify insurance plans that align with their healthcare requirements and budgetary constraints. This personalized approach ensures that clients receive coverage that meets their specific needs.

- Access to a Wide Range of Plans: Brokers have access to an extensive network of insurance providers, allowing them to compare multiple plans from different companies. This enables clients to explore a variety of options and choose the plan that offers the best value for their money.

- Assistance with Enrollment and Claims: Brokers assist clients throughout the entire insurance process, from initial enrollment to filing claims. They can address any questions or concerns that arise along the way, providing ongoing support and advocacy.

- Cost Savings: Contrary to popular belief, working with a broker typically does not incur additional costs for clients. Brokers are compensated by insurance companies through commissions, meaning their services are often free to consumers. Moreover, brokers can help clients identify cost-saving opportunities, such as subsidies or discounts, further maximizing value.

Tips for Choosing a Health Insurance Broker

- Verify Credentials: Before selecting a broker, ensure they are licensed to sell insurance in your state. Check for any disciplinary actions or complaints against the broker to gauge their credibility and reliability.

- Evaluate Experience and Specialization: Look for brokers with extensive experience in the healthcare industry, particularly in areas relevant to your needs. For example, if you’re a small business owner, seek out brokers who specialize in group health insurance plans.

- Seek Referrals and Recommendations: Ask friends, family members, or colleagues for recommendations based on their experiences with health insurance brokers. Online reviews and testimonials can also provide insights into the quality of a broker’s services.

- Interview Multiple Brokers: Don’t hesitate to interview multiple brokers to compare their expertise, approach, and proposed insurance solutions. This allows you to assess compatibility and ensure you find a broker who understands your needs and priorities.

- Transparent Communication: Choose a broker who prioritizes transparent communication and takes the time to address your questions and concerns. Avoid brokers who pressure you into purchasing a specific plan or withhold essential information.

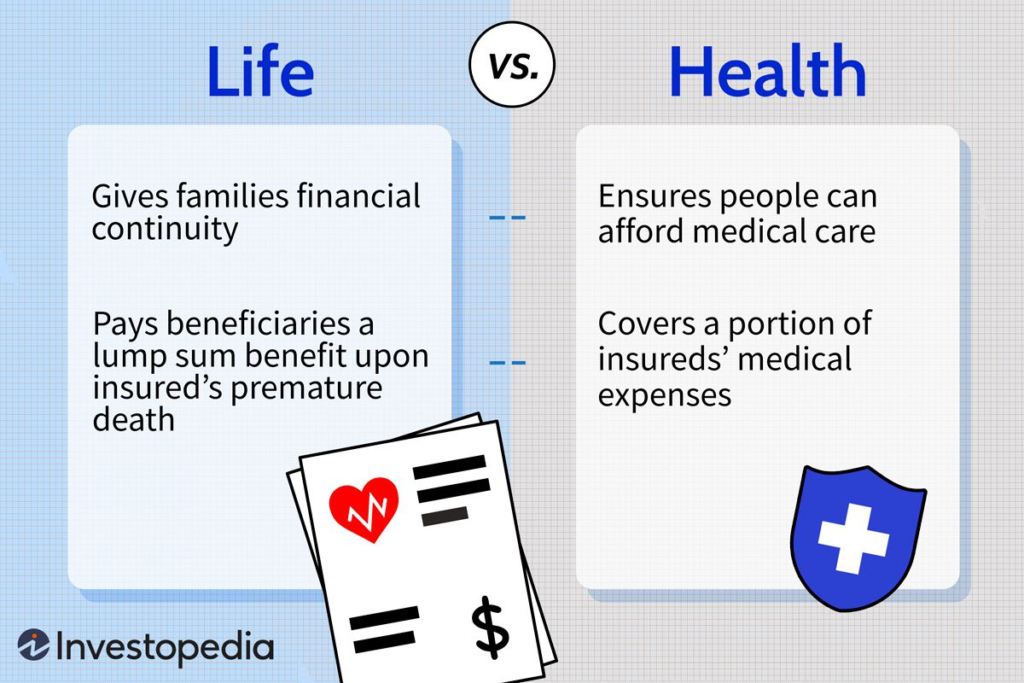

Understanding Different Types of Health Insurance Plans

Before diving into the process of finding and comparing insurance plans, it’s essential to understand the various types of health insurance available. Here are some common options:

- Health Maintenance Organization (HMO): HMO plans require members to select a primary care physician (PCP) who coordinates all their healthcare needs. Referrals from the PCP are typically necessary to see specialists, and out-of-network care is not covered except in emergencies.

- Preferred Provider Organization (PPO): PPO plans offer more flexibility in choosing healthcare providers, allowing members to see both in-network and out-of-network providers without a referral. While out-of-network care is covered, it often comes with higher out-of-pocket costs.

Exclusive Provider Organization (EPO):EPO plans combine elements of HMOs and PPOs, offering a network of preferred providers but without the need for referrals. However, coverage is typically limited to in-network providers, except in emergencies.- Point of Service (POS): POS plans blend features of HMOs and PPOs, requiring members to select a primary care physician and obtain referrals for specialist care. However, members have the option to see out-of-network providers at a higher cost.

- High-Deductible Health Plan (HDHP): HDHPs come with lower premiums but higher deductibles, making them suitable for individuals who are relatively healthy and don’t anticipate frequent medical expenses. These plans are often paired with Health Savings Accounts (HSAs) to help cover out-of-pocket costs.

Comparing Health Insurance Plans

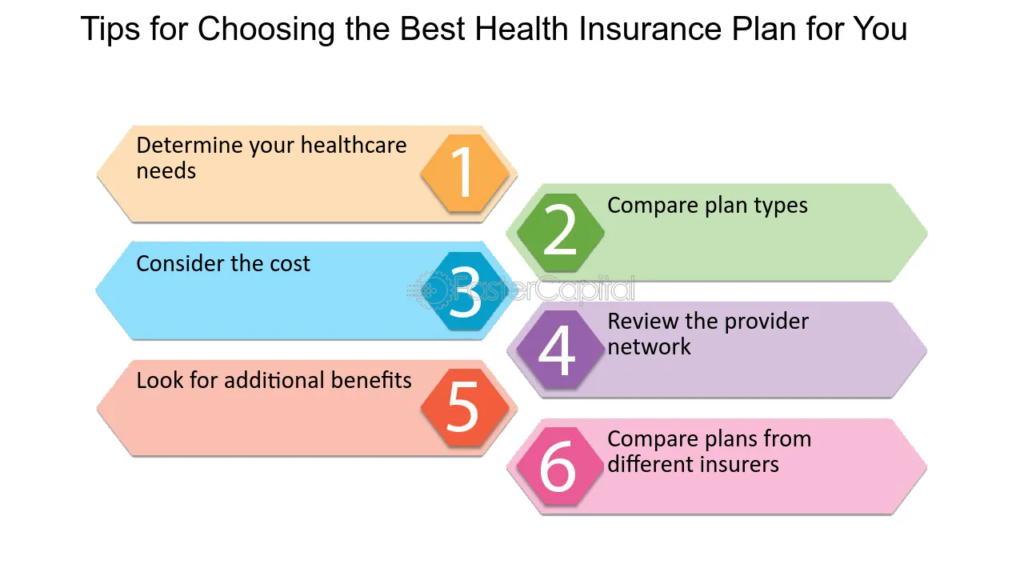

Once you’ve identified your insurance needs and preferences, it’s time to compare available plans. Here are some key factors to consider:

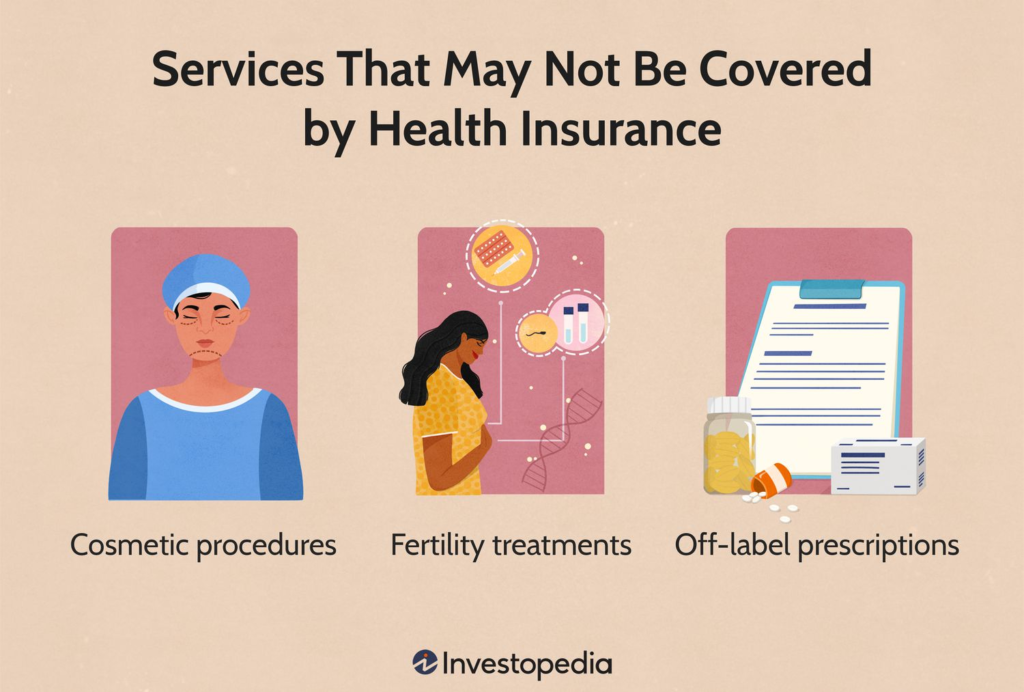

- Coverage Benefits: Evaluate the scope of coverage provided by each plan, including medical services, prescription drugs, preventive care, and specialty services. Pay attention to coverage limits, exclusions, and any additional benefits offered, such as telemedicine or wellness programs.

- Costs and Premiums: Consider the total cost of the plan, including premiums, deductibles, copayments, and coinsurance. While a plan with lower premiums may seem attractive, ensure that the deductible and out-of-pocket costs are manageable based on your healthcare usage.

- Provider Network: Review the list of participating healthcare providers and facilities within each plan’s network. Determine whether your preferred doctors, specialists, and hospitals are included in the network, as using out-of-network providers may result in higher costs.

- Prescription Drug Coverage: If you take prescription medications regularly, examine each plan’s formulary to ensure that your medications are covered. Pay attention to copayment or coinsurance requirements for prescriptions, as well as any restrictions on brand-name versus generic drugs.

- Out-of-Pocket Maximum: The out-of-pocket maximum represents the most you’ll have to pay for covered services in a given year, excluding premiums. Choose a plan with a reasonable out-of-pocket maximum that provides financial protection in the event of unexpected medical expenses.

- Quality Ratings and Reviews: Research the quality ratings and customer reviews for each insurance plan, including factors such as customer satisfaction, provider network quality, and claims processing efficiency. High ratings and positive reviews can indicate a reliable and reputable insurer.

Leveraging Technology in the Selection Process

In today’s digital age, technology plays a crucial role in streamlining the process of finding and comparing health insurance plans. Here are some tools and resources to consider:

- Online Broker Platforms: Many health insurance brokers offer online platforms or portals that allow clients to compare plans, request quotes, and enroll in coverage digitally. These platforms provide convenient access to information and enable seamless communication with brokers.

- Insurance Aggregator Websites: Websites like HealthCare.gov, eHealth, and Policygenius aggregate information from multiple insurers, allowing users to compare plans side by side. These platforms often include tools for estimating costs, checking provider networks, and exploring subsidy eligibility.

- Mobile Apps: Insurance companies and brokerages may offer mobile apps that enable users to access their insurance information, track claims, find in-network providers, and receive notifications about coverage updates. Mobile apps provide on-the-go convenience and accessibility.

- Telemedicine Services: Some insurance plans include telemedicine services that allow members to consult with healthcare providers remotely for non-emergency medical issues. Telemedicine can be a convenient and cost-effective alternative to traditional office visits, particularly for minor ailments.

- Educational Resources: Look for insurers and brokerages that provide educational resources, such as articles, guides, and videos, to help consumers navigate the complexities of health insurance. These resources can enhance understanding and empower individuals to make informed decisions.

Conclusion

Navigating the healthcare landscape and selecting the right health insurance plan can be a daunting task, but it doesn’t have to be a solo journey. Health insurance brokers play a vital role in guiding individuals, families, and businesses through the process, offering expertise, personalized recommendations, and access to a wide range of insurance options.

By understanding the role of health insurance brokers, evaluating different types of health insurance plans, and leveraging technology to compare options, consumers can make confident and informed decisions that align with their healthcare needs and financial goals. Whether you’re a first-time insurance buyer or exploring options for renewal, partnering with a knowledgeable broker can simplify the process and provide peace of mind knowing that you’re adequately protected.