Introduction to Health Insurance Enrollment Periods

Health insurance is a critical aspect of healthcare access, providing individuals and families with financial protection against the high costs of medical care. To ensure widespread coverage and facilitate efficient administration, health insurance plans typically operate within specific enrollment periods. These enrollment periods dictate when individuals can sign up for or make changes to their health insurance coverage.

Understanding the various enrollment periods, their significance, and the rules governing them is essential for individuals seeking health insurance coverage. In this comprehensive guide, we’ll explore the different types of enrollment periods, their purposes, associated deadlines, and key considerations for obtaining and maintaining health insurance coverage.

Types of Health Insurance Enrollment Periods

1. Open Enrollment Period (OEP)

The Open Enrollment Period is a designated time frame during which individuals can enroll in or make changes to their health insurance coverage without needing a qualifying life event. Here are some key points regarding the Open Enrollment Period:

- Annual Occurrence: The Open Enrollment Period typically occurs once a year and is established by government regulations or insurance providers. It allows individuals to review their current coverage, explore different plan options, and make necessary adjustments.

- Duration: The duration of the Open Enrollment Period may vary depending on the type of health insurance plan and regulatory requirements. In the United States, for example, the Open Enrollment Period for individual and family health insurance plans commonly runs from November 1st to December 15th each year. However, specific dates and duration can differ by state and may be subject to change.

- Flexibility: During the Open Enrollment Period, individuals have the flexibility to apply for new coverage, switch plans, or make adjustments to their existing coverage without experiencing a qualifying life event. This period allows for proactive decision-making regarding healthcare needs and preferences.

2. Special Enrollment Period (SEP)

Special Enrollment Periods are designated time frames outside of the Open Enrollment Period during which individuals can enroll in or make changes to their health insurance coverage due to qualifying life events. Here are some key aspects of Special Enrollment Periods:

- Qualifying Life Events: Special Enrollment Periods are triggered by specific qualifying life events, such as getting married, having a baby, adopting a child, losing other health coverage, or experiencing a change in residence. These events often represent significant life transitions that may impact an individual’s healthcare needs.

- Limited Duration: Individuals typically have a limited window of time, usually around 60 days following a qualifying life event, to enroll in a new health insurance plan or make changes to their existing coverage. It’s crucial to act promptly and provide documentation of the qualifying event when applying for coverage during a Special Enrollment Period.

- Flexibility and Access: Special Enrollment Periods ensure that individuals experiencing significant life changes have access to health insurance coverage outside of the regular enrollment period. This provision helps prevent gaps in coverage and ensures continuity of care during transitional periods.

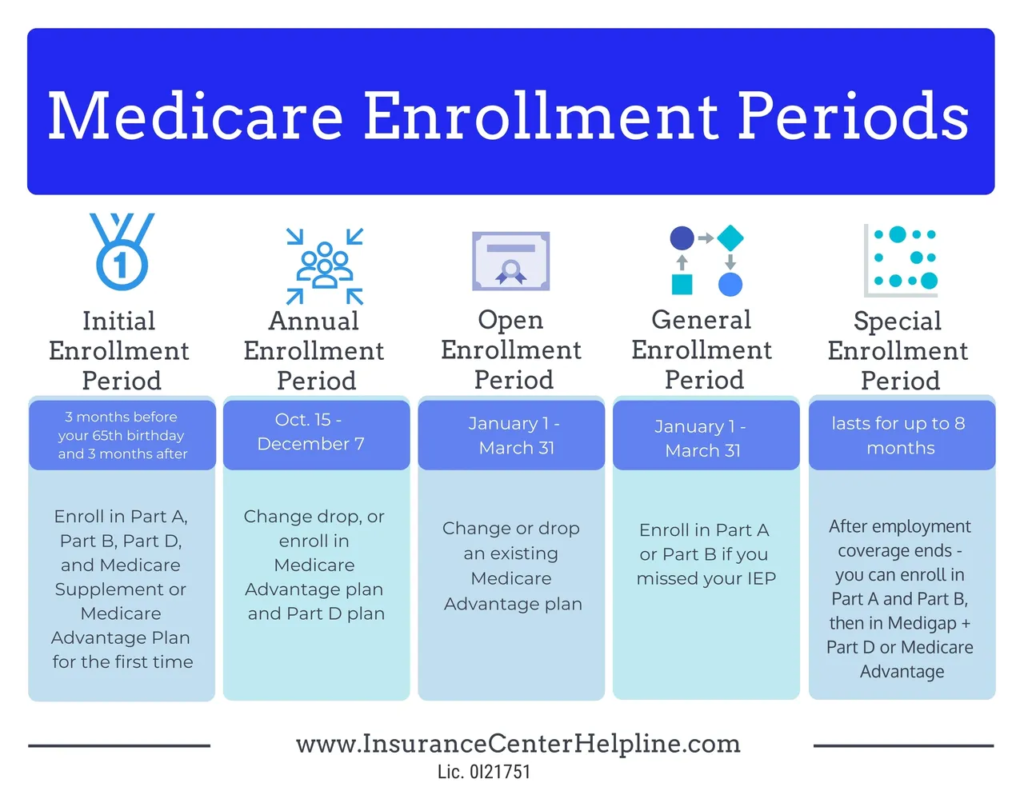

3. Medicare Enrollment Periods

Medicare, the federal health insurance program primarily serving individuals aged 65 and older, has specific enrollment periods for different parts of the program. Understanding these enrollment periods is essential for Medicare beneficiaries:

- Initial Enrollment Period (IEP): The Initial Enrollment Period occurs when an individual first becomes eligible for Medicare, typically around their 65th birthday. It provides an opportunity to sign up for Medicare Part A (hospital insurance) and/or Part B (medical insurance) without incurring late enrollment penalties.

- General Enrollment Period (GEP): The General Enrollment Period allows individuals who missed their Initial Enrollment Period to sign up for Medicare Part A and/or Part B. It occurs annually from January 1st to March 31st, with coverage starting on July 1st of the same year.

- Annual Enrollment Period (AEP): The Annual Enrollment Period, also known as the Medicare Open Enrollment Period, takes place each year from October 15th to December 7th. During this period, Medicare beneficiaries can make changes to their coverage, such as switching between Original Medicare and Medicare Advantage plans or adjusting prescription drug coverage.

- Special Enrollment Periods (SEP) for Medicare: Similar to Special Enrollment Periods for other health insurance plans, Medicare offers SEPs for specific qualifying events, such as moving to a new area with different Medicare plan options, losing employer-sponsored coverage, or qualifying for additional assistance programs.

4. Employer-Sponsored Insurance Enrollment

Many individuals receive health insurance coverage through their employers, and understanding the enrollment periods for employer-sponsored plans is crucial:

- Annual Enrollment: Employer-sponsored health insurance plans typically have an annual enrollment period during which employees can sign up for coverage, make changes to their existing coverage, or add dependents. Employers usually communicate the dates and details of the enrollment period well in advance.

- New Hire Enrollment: Employees who are newly hired or become eligible for employer-sponsored coverage may have a specific enrollment period to sign up for health insurance. This enrollment period often occurs shortly after starting a new job or meeting eligibility requirements.

- Mid-Year Enrollment Changes: In some cases, employers may offer a mid-year enrollment period if there are significant changes to the health insurance plan or if employees experience qualifying life events, such as marriage, childbirth, or loss of coverage through a spouse’s plan.

Importance of Health Insurance Enrollment Periods

Understanding and adhering to health insurance enrollment periods are essential for several reasons:

- Access to Coverage: Enrollment periods ensure that individuals have access to health insurance coverage when they need it, preventing gaps in coverage that could leave them vulnerable to high medical expenses.

- Regulatory Compliance: Compliance with enrollment periods helps individuals and insurance providers adhere to regulatory requirements set by government agencies. Failure to enroll within the designated periods may result in penalties or limitations on coverage options.

- Continuity of Care: By enrolling or making changes to their coverage during the appropriate periods, individuals can maintain continuity of care with their healthcare providers and access necessary medical services without interruptions.

- Cost Savings: Enrolling in health insurance during the Open Enrollment Period or a Special Enrollment Period can potentially result in cost savings through access to subsidies, discounts, or employer contributions toward premiums.

- Risk Management: Health insurance enrollment periods allow individuals to assess their healthcare needs, evaluate available plan options, and make informed decisions to mitigate financial risks associated with medical emergencies or unexpected health issues.

Considerations for Health Insurance Enrollment

When navigating health insurance enrollment periods, individuals should consider several factors to make informed decisions about their coverage:

1. Coverage Needs and Preferences

Before enrolling in a health insurance plan, individuals should assess their healthcare needs, including anticipated medical expenses, prescription drug requirements, and preferred healthcare providers. Evaluating plan options based on coverage benefits, network providers, and cost-sharing arrangements can help individuals select a plan that aligns with their preferences and budget.

2. Affordability and Financial Assistance

Understanding the costs associated with health insurance coverage, including premiums, deductibles, copayments, and coinsurance, is crucial for budget planning. Individuals may qualify for financial assistance programs, such as premium tax credits, cost-sharing reductions, or Medicaid, based on their income and household size. Exploring eligibility for these programs can help individuals lower their out-of-pocket expenses and make coverage more affordable.

3. Network Providers and Access to Care

Health insurance plans often have provider networks consisting of hospitals, physicians, specialists, and other healthcare professionals. Individuals should verify that their preferred healthcare providers participate in the plan’s network to ensure continuity of care and avoid unexpected out-of-network charges. Additionally, considering factors such as travel distance to network providers and access to specialty services can help individuals assess the adequacy of a plan’s provider network.

4. Prescription Drug Coverage

For individuals requiring prescription medications, evaluating a health insurance plan’s prescription drug formulary is essential. Understanding the coverage tiers, copayment or coinsurance amounts, and any restrictions on certain medications can help individuals choose a plan that provides adequate coverage for their prescription drug needs. It’s also advisable to confirm that preferred pharmacies are included in the plan’s network to access prescription medications conveniently.

5. Qualifying Life Events and Special Enrollment Periods

Life changes such as marriage, childbirth, adoption, loss of other health coverage, or relocation may trigger eligibility for a Special Enrollment Period outside of the standard enrollment periods. Individuals experiencing qualifying life events should promptly notify their insurance provider and explore available coverage options to avoid gaps in coverage and maintain access to healthcare services. Providing documentation of the qualifying event may be necessary when applying for coverage during a Special Enrollment Period.

6. Coordination with Other Coverage Options

Some individuals may have access to multiple sources of health insurance coverage, such as employer-sponsored plans, Medicare, Medicaid, or coverage through a spouse’s plan. Coordinating coverage options and understanding how different plans complement each other can optimize benefits and minimize out-of-pocket expenses. However, individuals should be mindful of potential coordination of benefits rules to avoid duplicate coverage or overpayment of claims.

Conclusion

Health insurance enrollment periods play a crucial role in facilitating access to healthcare coverage and ensuring regulatory compliance for individuals and insurance providers. By understanding the different types of enrollment periods, their purposes, associated deadlines, and key considerations, individuals can make informed decisions about their health insurance coverage and maintain financial protection against medical expenses.

Whether enrolling during the Open Enrollment Period, taking advantage of a Special Enrollment Period due to a qualifying life event, or navigating Medicare enrollment periods, individuals should carefully evaluate their coverage needs, explore available options, and consider factors such as affordability, provider networks, prescription drug coverage, and coordination with other coverage sources. By proactively managing their health insurance enrollment, individuals can secure appropriate coverage that meets their healthcare needs and safeguards their financial well-being.

In summary, health insurance enrollment periods are not just administrative requirements but essential opportunities for individuals to safeguard their health and financial security. By staying informed, evaluating options, and taking timely action, individuals can navigate enrollment periods effectively and access the healthcare coverage they need when they need it.

You really make it appear really easy with your presentation however I to find this topic to be actually something which I believe I might by no means understand. It kind of feels too complex and very huge for me. I am taking a look ahead to your subsequent put up, I抣l attempt to get the hold of it!

F*ckin?tremendous things here. I抦 very satisfied to see your article. Thanks a lot and i’m taking a look ahead to touch you. Will you kindly drop me a mail?

Thanks for your post. One other thing is when you are selling your property on your own, one of the difficulties you need to be aware about upfront is just how to deal with household inspection reports. As a FSBO seller, the key concerning successfully transferring your property and saving money on real estate agent commission rates is expertise. The more you are aware of, the better your sales effort will be. One area in which this is particularly vital is reports.

Hi, i think that i saw you visited my blog thus i came to 搑eturn the favor?I’m trying to find things to enhance my site!I suppose its ok to use a few of your ideas!!

Woah! I’m really enjoying the template/theme of this site. It’s simple, yet effective. A lot of times it’s very hard to get that “perfect balance” between superb usability and visual appeal. I must say you have done a excellent job with this. Additionally, the blog loads very quick for me on Opera. Outstanding Blog!

Today, taking into consideration the fast way of life that everyone leads, credit cards have a big demand in the economy. Persons from every area of life are using the credit card and people who aren’t using the credit cards have made up their minds to apply for even one. Thanks for revealing your ideas in credit cards.

You can certainly see your skills in the paintings you write. The world hopes for more passionate writers like you who aren’t afraid to say how they believe. At all times go after your heart.

Woah! I’m really digging the template/theme of this site. It’s simple, yet effective. A lot of times it’s challenging to get that “perfect balance” between usability and visual appearance. I must say that you’ve done a awesome job with this. In addition, the blog loads very fast for me on Safari. Excellent Blog!

Whoa! This blog looks exactly like my old one! It’s on a entirely different topic but it has pretty much the same layout and design. Excellent choice of colors!

It抯 really a nice and helpful piece of info. I抦 glad that you shared this helpful info with us. Please keep us informed like this. Thanks for sharing.

Hello there, You have done an incredible job. I抣l certainly digg it and in my opinion suggest to my friends. I am sure they will be benefited from this web site.

Today, with all the fast life-style that everyone leads, credit cards have a huge demand throughout the economy. Persons coming from every arena are using credit card and people who aren’t using the credit card have arranged to apply for one in particular. Thanks for discussing your ideas about credit cards.