Introduction:

Homeownership is a cornerstone of the American Dream, representing stability, security, and an investment in the future. However, with the joys of homeownership also come responsibilities, including protecting one’s property against unforeseen risks. Homeowner insurance, commonly known as home insurance, serves as a safety net for homeowners, offering financial protection in the event of property damage, theft, or liability claims. In this essay, we will delve into the intricacies of homeowner insurance in the United States, exploring its significance, types, coverage options, factors influencing premiums, the claims process, and emerging trends in the industry.

- Significance of Homeowner Insurance:

- Homeowner insurance is a crucial financial tool that provides peace of mind to homeowners by safeguarding their most valuable asset – their home.

- It offers protection against various perils, including fire, theft, vandalism, natural disasters, and liability lawsuits.

- For many homeowners, a mortgage lender may require proof of homeowner insurance as a condition for loan approval, further underscoring its importance.

- Types of Homeowner Insurance Policies:

- a. HO-1: Basic Form Policy – Provides coverage for specific perils listed in the policy, such as fire, theft, vandalism, and certain natural disasters.

- b. HO-2: Broad Form Policy – Offers broader coverage than HO-1, including additional perils such as falling objects, weight of snow, ice, and freezing of household systems.

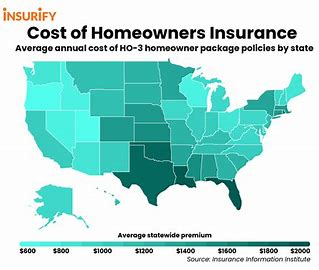

- c. HO-3: Special Form Policy – The most common type of homeowner insurance, offering coverage for the dwelling and personal property against all perils except those specifically excluded in the policy.

- d. HO-4: Renter’s Insurance – Designed for tenants renting a home or apartment, covering personal belongings and liability but not the structure itself.

- e. HO-5: Comprehensive Form Policy – Provides extensive coverage for both the dwelling and personal property, typically with fewer exclusions and higher coverage limits.

- f. HO-6: Condo Insurance – Tailored for condominium unit owners, covering personal property, liability, and improvements to the interior structure.

- g. HO-7: Mobile Home Insurance – Specifically designed for mobile or manufactured homes, offering similar coverage to traditional homeowner insurance policies.

- h. HO-8: Older Home Insurance – Geared towards older homes with unique construction or historical significance, providing specialized coverage options.

Coverage Options in Homeowner Insurance:

a. Dwelling Coverage

Protects the physical structure of the home, including walls, roof, floors, and attached structures like garages or decks.

b. Personal Property Coverage

Reimburses the policyholder for the loss or damage of personal belongings, such as furniture, electronics, clothing, and appliances.

c. Liability Coverage

Provides financial protection against lawsuits for bodily injury or property damage caused by the policyholder or their family members.

d. Additional Living Expenses (ALE) Coverage

Covers the cost of temporary accommodation, meals, and other living expenses if the insured property becomes uninhabitable due to a covered peril.

e. Other Structures Coverage

Extends coverage to structures on the property that are not attached to the main dwelling, such as detached garages, fences, or sheds.

f. Medical Payments Coverage

Pays for medical expenses if someone is injured on the insured property, regardless of fault.

Factors Influencing Homeowner Insurance Premiums:

a. Location

Proximity to coastlines, flood zones, earthquake-prone areas, or regions with high crime rates can significantly impact premiums.

b. Replacement Cost of the Home

The cost to rebuild or repair the home in case of damage or destruction, including materials, labor, and local construction costs.

c. Age and Condition of the Home

Older homes or properties with outdated systems (e.g., plumbing, electrical) may pose higher risks and thus result in higher premiums.

d. Home Security Features

Installation of security systems, smoke detectors, fire alarms, deadbolts, and other protective measures can lead to premium discounts.

e. Credit Score

Insurers may consider credit history as a factor in determining premiums, as individuals with higher credit scores are perceived as less risky.

f. Claims History

A history of previous claims or losses may lead to higher premiums or difficulty in obtaining coverage from certain insurers.

g. Coverage Limits and Deductibles

Higher coverage limits and lower deductibles typically result in higher premiums, while opting for higher deductibles may lower premiums but increase out-of-pocket expenses in the event of a claim.

The Claims Process in Homeowner Insurance:

a. Filing a Claim

Policyholders must promptly notify their insurance company of any damages, losses, or incidents that may give rise to a claim.

b. Claim Investigation

Upon receiving a claim, the insurance company assigns an adjuster to assess the extent of the damages, verify coverage, and determine the value of the claim.

c. Damage Assessment

The adjuster may inspect the property, gather evidence (e.g., photographs, repair estimates), and consult with experts if necessary to evaluate the scope of the loss.

d. Settlement

Once the claim is approved, the insurance company offers a settlement to the policyholder, which may include payment for repairs, replacement of damaged items, or compensation for loss of use.

e. Appeals Process

Policyholders have the right to appeal if they disagree with the insurer’s decision, the valuation of the claim, or the settlement amount, following the procedures outlined in their policy or state regulations.

Emerging Trends and Challenges in Homeowner Insurance:

a. Climate Change and Natural Disasters

Increasing frequency and severity of weather-related events, such as hurricanes, wildfires, and floods, pose challenges for insurers in assessing risks, pricing policies, and managing claims.

b. Technological Advancements

Insurtech companies are leveraging technologies such as artificial intelligence, data analytics, drones, and satellite imagery to streamline underwriting processes, enhance risk assessment accuracy, and improve customer experience.

c. Cybersecurity Risks

With the proliferation of smart home devices and digital platforms, homeowners face new risks related to cybersecurity threats, data breaches, and identity theft, prompting the need for specialized coverage options.

d. Regulatory Changes

Evolving regulations at the federal and state levels, including changes in insurance laws, consumer protection measures, and disaster mitigation strategies, shape the landscape of homeowner insurance and influence industry practices.

Conclusion:

Homeowner insurance is a fundamental aspect of responsible homeownership, offering financial protection and peace of mind to individuals and families across the United States. Understanding the different types of policies, coverage options, factors influencing premiums, and the claims process is essential for homeowners to make informed decisions and ensure adequate protection for their homes and belongings. As the homeowner insurance industry continues to evolve in response to emerging trends, technological advancements, and regulatory changes, stakeholders must adapt and innovate to meet the evolving needs of policyholders and effectively manage risks in an increasingly complex environment. By staying informed, proactive, and engaged, homeowners can navigate the intricacies of homeowner insurance with confidence and safeguard their most valuable asset against unforeseen perils.

Thank you for this enlightening blog. It’s been packed with information , and provided valuable knowledge. Should you be keen on the world of viral real estate SEO, be sure to visit https://www.elevenviral.com for more information.

I’m truly impressed by your profound understanding and excellent writing style. The knowledge you share is evident in every piece you write. It’s evident that you put a lot of effort into delving into your topics, and this effort is well-appreciated. We appreciate your efforts in sharing such detailed information. Continue the excellent job! https://www.elevenviral.com