Introduction

Life insurance is a crucial financial tool that provides financial security to loved ones in the event of the policyholder’s death. While individual life insurance policies are commonly known, joint life insurance policies offer coverage for couples, providing unique benefits and considerations. This comprehensive guide will delve into the intricacies of joint life insurance policies, exploring their features, benefits, considerations, and how they can be a valuable asset for couples in securing their financial future.

Understanding Joint Life Insurance Policies

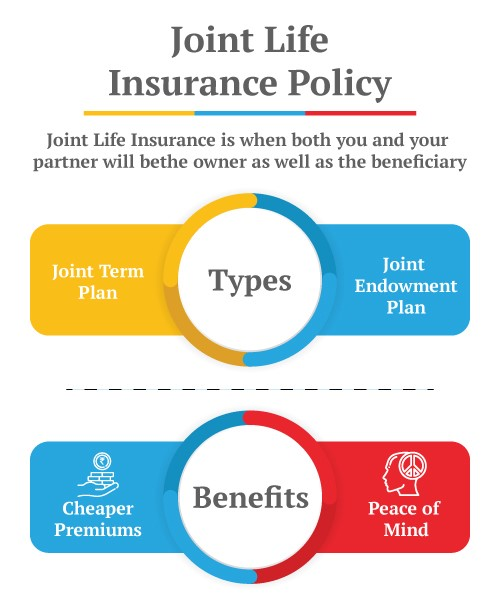

Joint life insurance policies, also known as first-to-die or second-to-die policies, are designed to cover two individuals under a single insurance policy. These policies differ from individual life insurance policies in that they insure multiple lives simultaneously. There are two primary types of joint life insurance policies:

- First-to-Die Policies: These policies provide a death benefit upon the first death among the insured individuals. The benefit is typically paid out to the surviving spouse or beneficiaries, offering financial protection during a time of loss.

- Second-to-Die Policies: Also known as survivorship life insurance, these policies pay out the death benefit upon the death of the second insured individual. This type of policy is often used for estate planning purposes, providing liquidity to cover estate taxes and other expenses after both individuals have passed away.

Features and Benefits of Joint Life Insurance Policies:

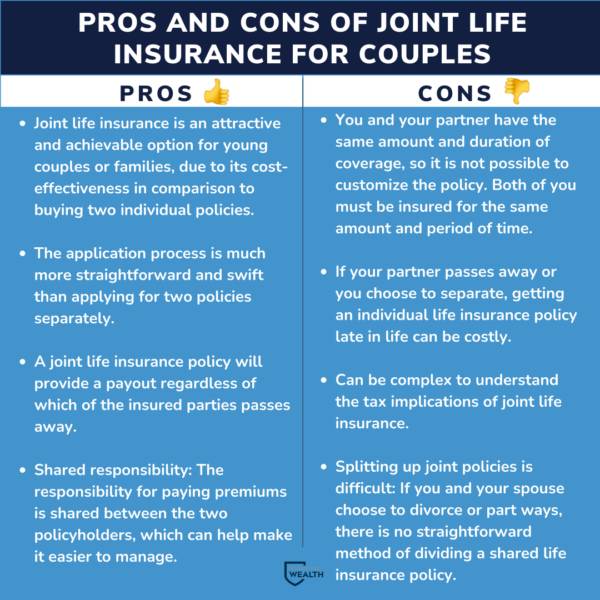

Joint life insurance policies offer several unique features and benefits that make them an attractive option for couples:

- Cost Savings: Joint policies often come with lower premiums compared to purchasing separate individual policies for each person. This can result in significant cost savings for couples, making life insurance more affordable while still providing adequate coverage.

- Convenience: Managing a single joint policy is more convenient than managing multiple individual policies. With a joint policy, couples only need to make one premium payment and keep track of one policy, simplifying the administrative process.

- Shared Coverage: Joint policies provide coverage for both individuals under a single policy, ensuring that both spouses are protected financially in the event of one partner’s death. This shared coverage can provide peace of mind knowing that both individuals are financially secure.

- Estate Planning: Second-to-die policies are commonly used for estate planning purposes. These policies can help cover estate taxes and other expenses that may arise after both individuals have passed away, ensuring that assets are preserved for heirs and beneficiaries.

- Survivorship Benefits: Second-to-die policies can provide survivorship benefits to the surviving spouse or beneficiaries, offering financial support after the death of both insured individuals. This can help maintain the surviving spouse’s standard of living and cover ongoing expenses.

- Flexible Options: Joint life insurance policies often come with flexible options for coverage amounts, premium payments, and policy terms. Couples can tailor the policy to meet their specific needs and budgetary constraints, ensuring that they have the right amount of coverage for their situation.

- Tax Advantages: Depending on the jurisdiction and the specific circumstances, joint life insurance policies may offer tax advantages, particularly for estate planning purposes. It’s essential to consult with a financial advisor or tax professional to understand the tax implications of a joint policy fully.

Considerations for Couples

While joint life insurance policies offer many benefits, there are also some considerations that couples should take into account before purchasing a policy:

- Shared Coverage: While shared coverage can be advantageous, it’s essential to consider whether both individuals require the same level of coverage. In some cases, one partner may need more coverage than the other due to differences in income, debt levels, or financial responsibilities.

- Dependency: Couples should assess each partner’s level of dependency on the other for financial support. If one partner is the primary breadwinner or provides significant financial support to the other, it may be necessary to ensure that both individuals are adequately covered under the policy.

- Health Considerations: Joint policies require both individuals to meet the insurer’s underwriting requirements. If one partner has pre-existing health conditions or is considered a higher risk, it could affect the cost of premiums or the insurability of the policy.

- Divorce or Separation: Couples should consider what would happen to the joint policy in the event of divorce or separation. While some policies may allow for the policy to be divided or converted into individual policies, it’s essential to review the terms and conditions of the policy carefully.

- Flexibility: While joint policies offer flexibility in terms of coverage amounts and policy terms, it’s essential to ensure that the policy can be adjusted as needed in the future. Life circumstances can change, and having the ability to modify the policy can help ensure that it remains suitable over time.

- Financial Goals: Couples should consider their long-term financial goals when selecting a joint life insurance policy. Whether the goal is to provide financial security for dependents, cover estate taxes, or protect assets, the policy should align with these objectives.

How to Purchase a Joint Life Insurance Policy

Purchasing a joint life insurance policy involves several steps:

- Assess Your Needs: Determine how much coverage you need and what type of policy best suits your situation. Consider factors such as income, debt, lifestyle, and financial goals when assessing your needs.

- Research Insurers: Research different insurance companies and compare policies to find the best coverage options and premiums. Look for insurers with a strong financial rating and a reputation for excellent customer service.

- Get Quotes: Obtain quotes from multiple insurers to compare prices and coverage options. Be sure to provide accurate information about both individuals’ ages, health status, and other relevant factors to get an accurate quote.

- Review Policy Options: Review the policy options available, including coverage amounts, premium payments, and policy terms. Consider any additional riders or features that may be beneficial, such as accelerated death benefits or waiver of premium riders.

- Apply for Coverage: Complete the application process for the joint life insurance policy. Both individuals will need to undergo underwriting, which may involve a medical exam and providing medical history information.

- Review Policy Documents: Once approved, carefully review the policy documents to ensure that you understand the terms and conditions of the policy. Pay attention to any exclusions, limitations, or restrictions that may apply.

- Make Premium Payments: Make premium payments according to the schedule outlined in the policy. Be sure to keep up with premium payments to keep the policy in force and maintain coverage.

- Periodic Review: Periodically review your joint life insurance policy to ensure that it continues to meet your needs. Consider any life changes or significant events that may necessitate adjustments to your coverage.

Conclusion

Joint life insurance policies offer couples a convenient and cost-effective way to ensure financial security for themselves and their loved ones. With shared coverage, flexible options, and potential tax advantages, these policies can be a valuable asset in protecting against life’s uncertainties. However, couples should carefully consider their needs, health status, and long-term financial goals before purchasing a joint policy. By understanding the features, benefits, and considerations associated with joint life insurance policies, couples can make informed decisions to safeguard their financial future.