Introduction

Asset protection refers to the legal strategies and mechanisms individuals employ to safeguard their assets from potential creditors’ claims. It’s a crucial aspect of financial planning aimed at preserving wealth, managing risks, and ensuring long-term financial security.

A. Definition and Importance of Asset Protection

Asset protection involves structuring one’s financial affairs in a way that shields assets from various risks, including lawsuits, bankruptcy, divorce, and creditor claims. It’s vital for individuals and businesses alike to protect their hard-earned assets from unforeseen circumstances that could jeopardize their financial stability.

B. Common Methods of Asset Protection

- Trusts: Trusts are legal entities that hold assets for the benefit of beneficiaries. They can offer significant asset protection benefits by separating legal ownership from beneficial ownership.

- Business Structures: Choosing the right business structure, such as forming a corporation or limited liability company (LLC), can provide a degree of asset protection by limiting personal liability for business debts.

- Retirement Accounts: Retirement accounts, such as 401(k)s and IRAs, often enjoy protection from creditors under federal and state laws. Maxing out contributions to these accounts can shield assets from potential creditors.

- Insurance Policies: Various insurance policies, including liability insurance, malpractice insurance, and umbrella insurance, can provide protection against lawsuits and other liabilities.

- Homestead Exemptions: Some states offer homestead exemptions, which protect a certain amount of equity in a primary residence from creditors’ claims.

C. Challenges and Risks Involved

While asset protection strategies offer numerous benefits, they also come with challenges and risks. These may include:

- Legal Complexity: Asset protection involves navigating complex legal frameworks and regulations, requiring professional advice to ensure compliance.

- Potential Fraudulent Transfer Claims: Transferring assets with the intent to hinder, delay, or defraud creditors can lead to fraudulent transfer claims, undermining asset protection efforts.

- Tax Implications: Certain asset protection strategies may have tax consequences that individuals need to consider carefully.

- Ethical Considerations: There may be ethical implications associated with asset protection strategies, particularly if they involve hiding assets or defrauding legitimate creditors.

II. Introduction to Life Insurance

Life insurance is a financial product designed to provide a lump sum payment, known as the death benefit, to beneficiaries upon the insured’s death. While traditionally used for income replacement and estate planning, life insurance can also serve as a powerful tool for asset protection.

A. Overview of Life Insurance

Life insurance policies come in various forms, including term life, whole life, universal life, and variable life insurance. Each type offers unique features and benefits, catering to different financial needs and objectives.

- Term Life Insurance: Provides coverage for a specific period (e.g., 10, 20, or 30 years) and pays out a death benefit if the insured dies during the term.

- Whole Life Insurance: Offers coverage for the insured’s entire life and includes a cash value component that accumulates over time.

- Universal Life Insurance: Combines a death benefit with a savings component that earns interest based on market rates.

- Variable Life Insurance: Allows policyholders to allocate premiums to investment sub-accounts, offering potential for higher returns but also greater investment risk.

B. Role of Life Insurance in Financial Planning

Life insurance plays a crucial role in comprehensive financial planning by providing protection against financial risks and uncertainties. Key aspects of life insurance in financial planning include:

- Income Replacement: Life insurance can replace lost income in the event of the insured’s death, ensuring financial stability for dependents.

- Estate Planning: Life insurance proceeds can be used to pay estate taxes, debts, and final expenses, preserving the value of the estate for heirs.

- Debt Repayment: Life insurance can be used to repay outstanding debts, such as mortgages, loans, and other liabilities, preventing financial burden on surviving family members.

- Business Continuity: Life insurance can fund buy-sell agreements and key person insurance, ensuring business continuity in the event of an owner or key employee’s death.

III. Life Insurance as an Asset Protection Tool

While life insurance is primarily associated with providing financial security for beneficiaries, it can also serve as an effective asset protection tool under certain circumstances.

A. Legal Framework: Exemptions and Protections

In many jurisdictions, life insurance policies enjoy favorable treatment under state and federal laws, offering significant asset protection benefits. Common exemptions and protections include:

- Creditor Protection: Life insurance death benefits are often exempt from creditors’ claims, providing a shield against potential lawsuits and financial liabilities.

- Bankruptcy Protection: Life insurance cash values and death benefits are typically protected from creditors in bankruptcy proceedings, preserving the policy’s value for the insured’s beneficiaries.

- Spousal and Dependent Protection: Life insurance proceeds may be protected for the benefit of surviving spouses, children, and other dependents, ensuring their financial security.

B. Cash Value Life Insurance: Shielding Assets

Cash value life insurance policies, such as whole life and universal life insurance, accumulate a cash value component over time. This cash value is shielded from creditors’ claims in many jurisdictions, offering a safe haven for asset protection.

- Cash Value Growth: Cash value life insurance policies provide a tax-advantaged way to accumulate savings over time, with the cash value growing on a tax-deferred basis.

- Creditor Protection: The cash value of life insurance policies is often protected from creditors’ claims under state law, providing a valuable asset protection benefit.

- Access to Funds: Policyholders can access the cash value of their life insurance policies through policy loans or withdrawals, providing liquidity for financial needs while preserving asset protection benefits.

C. Irrevocable Life Insurance Trusts (ILITs)

Irrevocable life insurance trusts (ILITs) are estate planning tools used to hold life insurance policies outside of the insured’s estate. By transferring ownership of the policy to an ILIT, individuals can shield the policy’s proceeds from creditors and estate taxes.

- Estate Tax Mitigation: ILITs can help minimize estate taxes by removing life insurance proceeds from the insured’s taxable estate, ensuring more significant wealth transfer to beneficiaries.

- Creditor Protection: Life insurance held within an ILIT is typically shielded from creditors’ claims, providing enhanced asset protection benefits.

- Control and Flexibility: ILITs offer control and flexibility over the distribution of life insurance proceeds, allowing grantors to specify how and when beneficiaries receive the funds.

D. Annuities and Asset Protection

Annuities are financial products that provide a stream of income payments over a specified period or for the rest of the annuitant’s life. Certain types of annuities may offer asset protection benefits, particularly in states with favorable annuity exemption laws.

- Creditor Protection: Annuities may enjoy protection from creditors’ claims under state law, preserving the annuitant’s retirement savings and income stream.

- Payout Options: Annuities offer various payout options, including lifetime income streams, fixed-period payments, and lump-sum distributions, providing flexibility in managing retirement assets.

- Tax-Deferred Growth: Annuities provide tax-deferred growth on investment gains, allowing annuitants to accumulate savings more efficiently for retirement.

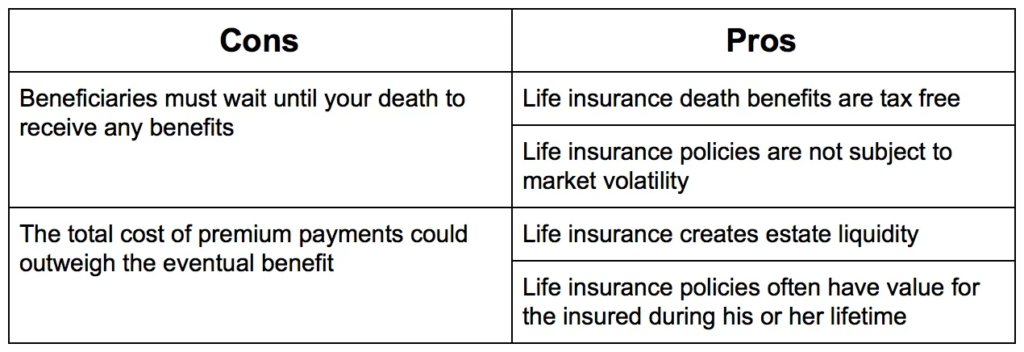

IV. Benefits and Drawbacks

A. Benefits of Using Life Insurance for Asset Protection

Life insurance offers several advantages as an asset protection tool, including:

- Creditor Protection: Life insurance policies and proceeds are often shielded from creditors’ claims under state and federal laws, providing a safe haven for asset protection.

- Tax Advantages: Cash value life insurance policies offer tax-deferred growth on the cash value component, allowing policyholders to accumulate savings more efficiently.

- Estate Planning Benefits: Life insurance can play a crucial role in estate planning by providing liquidity to pay estate taxes, debts, and final expenses, preserving the value of the estate for heirs.

B. Limitations and Risks

Despite its benefits, using life insurance for asset protection comes with certain limitations and risks, including:

- Cost: Life insurance premiums can be costly, particularly for cash value policies, which may limit their affordability for some individuals.

- Underwriting Requirements: Life insurance policies require medical underwriting, which may result in higher premiums or denial of coverage for individuals with health issues.

- Investment Risk: Variable life insurance policies expose policyholders to investment risk, as the cash value component is invested in sub-accounts subject to market fluctuations.

- Potential Changes in Laws: Legislative changes or court rulings could affect the asset protection benefits of life insurance policies, requiring individuals to adapt their planning strategies accordingly.

C. Considerations for Different Life Stages and Financial Situations

Asset protection needs vary depending on individuals’ life stages, financial situations, and risk profiles. Tailoring asset protection strategies to specific circumstances is essential for maximizing their effectiveness. Considerations may include:

- Family Situation: Individuals with dependents may prioritize asset protection to ensure their loved ones’ financial security in the event of unforeseen circumstances.

- Career Stage: Professionals in high-liability occupations, such as doctors, lawyers, and business owners, may have greater asset protection needs due to their exposure to lawsuits and other liabilities.

- Retirement Planning: Pre-retirees and retirees may focus on asset protection strategies to safeguard their retirement savings and income streams from creditors’ claims and market volatility.

V. Case Studies and Examples

Examining real-life scenarios can illustrate how life insurance can be effectively used as an asset protection tool. Case studies may include:

- Protecting Family Assets: A high-net-worth individual establishes an ILIT to shield life insurance proceeds from potential creditors and estate taxes, ensuring a smooth transfer of wealth to future generations.

- Business Succession Planning: A business owner funds a buy-sell agreement with life insurance to ensure continuity in the event of an owner’s death, protecting the business and its assets from disruption.

VI. Legal and Ethical Considerations

When utilizing life insurance for asset protection, individuals must adhere to legal requirements and ethical principles. Key considerations include:

- Compliance with Laws: Asset protection strategies must comply with state and federal laws governing insurance, trusts, and estate planning to ensure their validity and effectiveness.

- Transparency and Disclosure: Individuals should disclose all relevant financial information and assets when implementing asset protection strategies to avoid potential legal and ethical issues.

- Ethical Responsibilities: Asset protection should be pursued ethically and responsibly, avoiding fraudulent or deceptive practices that could harm legitimate creditors or undermine the integrity of the financial system.

VII. Practical Implementation and Strategies

Implementing asset protection strategies requires careful planning and consideration of various factors. Practical steps and strategies may include:

- Consulting with Professionals: Individuals should seek advice from experienced professionals, such as attorneys, financial planners, and insurance agents, to develop customized asset protection plans.

- Reviewing Existing Policies: Reviewing existing life insurance policies and estate planning documents can help identify gaps and opportunities for enhancing asset protection.

- Regular Updates and Monitoring: Asset protection strategies should be reviewed and updated regularly to reflect changes in laws, financial circumstances, and life events.

- Integration with Financial Planning: Asset protection should be integrated into comprehensive financial planning, aligning with individuals’ goals, risk tolerance, and long-term objectives.

VIII. Future Trends and Emerging Strategies

The landscape of asset protection and life insurance continues to evolve, driven by changes in laws, regulations, and market dynamics. Future trends and emerging strategies may include:

- Technological Innovations: Advances in technology, such as blockchain and smart contracts, could revolutionize asset protection strategies, providing greater transparency, security, and efficiency.

- Impact of Regulatory Changes: Legislative and regulatory changes, such as updates to bankruptcy laws or tax codes, may affect the asset protection benefits of life insurance policies, necessitating adjustments to planning strategies.

- Globalization and Cross-Border Planning: As individuals and businesses operate in an increasingly globalized economy, cross-border asset protection planning becomes more complex, requiring coordination across multiple jurisdictions.

Conclusion

Life insurance offers a powerful means of protecting assets from creditors’ claims, complementing traditional asset protection strategies. By understanding the legal framework, benefits, and limitations of using life insurance for asset protection, individuals can develop robust planning strategies to safeguard their wealth and ensure long-term financial security. However, effective asset protection requires careful planning, professional guidance, and ongoing review to adapt to changing circumstances and regulatory environments. With proper implementation and diligence, life insurance can serve as a valuable tool for shielding assets and preserving financial legacies for future generations.