Introduction:

In the world of business, debt is often a necessary component for growth and expansion. However, it also introduces risks, particularly in the event of unexpected circumstances such as the death of a key stakeholder or business partner. In such cases, the burden of debt can fall upon the remaining partners or the deceased individual’s estate, potentially jeopardizing the continuity and stability of the business. To mitigate these risks, businesses often turn to life insurance as a means of protecting against the impact of business debt. In this article, we will explore the role of life insurance in safeguarding businesses against liabilities, the types of coverage available, and the considerations businesses should keep in mind when implementing life insurance strategies.

Understanding Business Debt:

Before delving into the role of life insurance, it’s essential to understand the nature of business debt and its implications. Business debt can arise from various sources, including loans, lines of credit, mortgages, and other financial obligations. While debt can be a tool for financing growth and investment, it also represents a liability that must be repaid, typically with interest.

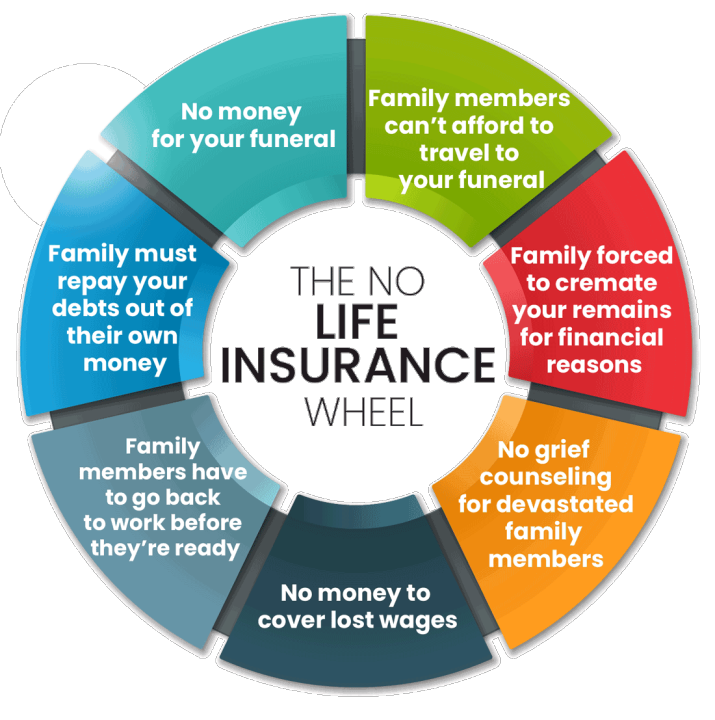

One of the primary concerns associated with business debt is what happens in the event of the death of a key stakeholder or partner. For example, in a partnership or closely held corporation, the death of a partner or shareholder can trigger the need to repay outstanding debts or buy out the deceased individual’s interest in the business. Without adequate planning, this can place a significant financial strain on the surviving partners or the business itself.

Role of Life Insurance:

Life insurance serves as a financial safety net for businesses by providing funds to cover outstanding debts, buy out the interests of deceased partners or shareholders, and ensure the continuity of operations. The proceeds from a life insurance policy can be used to settle outstanding debts, thereby protecting the business’s assets and ensuring its ongoing viability.

There are several ways in which life insurance can be utilized to protect against business debt:

- Key Person Insurance: Key person insurance, also known as key man insurance, is a type of life insurance policy taken out by a business on the life of a key employee or executive whose death would have a significant impact on the company’s operations and finances. The proceeds from the policy can be used to cover the costs of hiring and training a replacement, offsetting lost revenue, or paying off outstanding debts.

For example, if a business relies heavily on the expertise and leadership of its founder or CEO, their sudden death could disrupt operations and jeopardize the company’s ability to meet its financial obligations. Key person insurance provides a financial cushion to help the business weather the impact of such a loss.

- Buy-Sell Agreements: Buy-sell agreements are legal contracts that govern what happens to a partner or shareholder’s ownership interest in the event of their death, disability, retirement, or other triggering events. These agreements typically include provisions for the purchase and sale of the deceased individual’s interest in the business, with the proceeds from a life insurance policy often used to fund the buyout.

In a buy-sell agreement funded by life insurance, each partner or shareholder purchases a life insurance policy on the lives of the other partners or shareholders. In the event of a partner’s death, the proceeds from the policy are used to buy out their ownership interest at a predetermined price, providing liquidity to the deceased individual’s estate and ensuring a smooth transition of ownership.

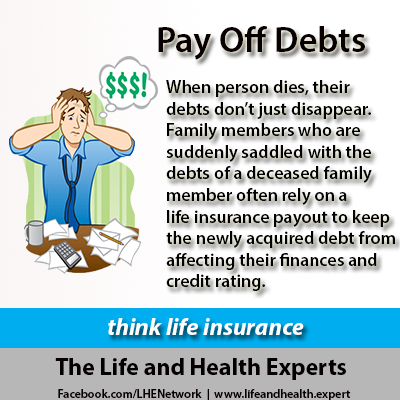

- Debt Repayment: Life insurance can also be used to protect against the risk of business debt by providing funds to repay outstanding loans, mortgages, or other financial obligations in the event of a key individual’s death. By naming the business as the beneficiary of the policy, the proceeds can be used to settle debts and preserve the company’s financial stability.

For example, if a business has taken out a loan to finance the purchase of equipment or real estate, the death of a key stakeholder responsible for repaying the loan could leave the business unable to meet its obligations. Life insurance can provide the necessary funds to repay the debt, preventing default and safeguarding the business’s assets.

Types of Life Insurance Coverage:

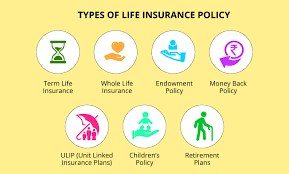

When it comes to protecting against business debt, businesses have several options for life insurance coverage, each with its own benefits and considerations:

- Term Life Insurance: Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. It offers a straightforward and cost-effective solution for businesses seeking temporary protection against the risk of debt. Term policies are often used to cover specific liabilities or obligations, such as outstanding loans or buy-sell agreements, during the term of the policy.

One of the primary advantages of term life insurance is its affordability, as premiums tend to be lower compared to permanent life insurance policies. However, term policies do not build cash value and expire at the end of the term, meaning that businesses may need to reassess their insurance needs periodically and potentially pay higher premiums as they age or if health conditions develop.

- Whole Life Insurance: Whole life insurance provides lifelong coverage with a guaranteed death benefit and a cash value component that accumulates over time. Unlike term insurance, which only pays out if the insured individual dies during the term of the policy, whole life insurance offers permanent protection and can be used as a long-term asset accumulation vehicle.

For businesses seeking permanent protection against the risk of debt, whole life insurance offers stability and certainty. The cash value component of the policy can be accessed through policy loans or withdrawals to supplement retirement income, fund business expenses, or cover unexpected financial needs. However, whole life insurance tends to have higher premiums compared to term insurance, making it a more significant financial commitment.

- Universal Life Insurance: Universal life insurance is a flexible form of permanent life insurance that allows policyholders to adjust their premiums and death benefits over time. It offers the same lifelong coverage as whole life insurance but provides greater flexibility in terms of premium payments and investment options.

With universal life insurance, businesses can tailor their coverage to meet their evolving needs and financial goals. Policyholders have the flexibility to increase or decrease their premiums, subject to certain limitations, and can also allocate cash value towards investment accounts to potentially earn a higher return. However, universal life insurance policies are more complex than term or whole life insurance and require careful management to ensure the policy remains adequately funded.

Considerations for Businesses:

When implementing a life insurance strategy to protect against business debt, there are several key considerations that businesses should keep in mind:

- Assessing Insurance Needs: Before purchasing life insurance, businesses should conduct a thorough assessment of their liabilities, obligations, and financial objectives. This includes evaluating outstanding debts, projecting future cash flow needs, and identifying key individuals whose death could have a significant impact on the business. By understanding their insurance needs, businesses can select the appropriate type and amount of coverage to adequately protect against the risk of debt.

- Choosing the Right Policy: With various types of life insurance available, businesses must choose the policy that best aligns with their goals and preferences. Term life insurance may be suitable for businesses seeking temporary protection against specific liabilities, while whole life insurance offers permanent coverage and cash value accumulation. Universal life insurance provides flexibility and customization options but requires ongoing management to ensure the policy remains viable.

- Funding Mechanisms: When funding life insurance policies to protect against business debt, businesses have several options to consider. They can pay premiums directly from company funds, allocate profits towards insurance premiums, or establish sinking funds to set aside money for future premiums. In the case of buy-sell agreements, businesses may also explore options such as cross-purchase agreements, where each partner purchases a policy on the life of the other partners, or entity-purchase agreements, where the business itself owns the policies.

- Review and Update: Once implemented, it’s essential for businesses to regularly review and update their life insurance strategies to ensure they remain effective and aligned with changing circumstances. This includes revisiting coverage amounts, reassessing insurance needs, and adjusting policies as necessary to reflect changes in the business’s financial position or ownership structure.

Conclusion:

Business debt represents a significant risk for companies of all sizes, particularly in the event of unforeseen circumstances such as the death of a key stakeholder or partner. Life insurance serves as a valuable tool for protecting against these risks by providing funds to cover outstanding debts, buy out deceased individuals’ interests, and ensure the continuity of operations. By understanding their insurance needs, selecting the right type of coverage, and implementing sound funding mechanisms, businesses can effectively mitigate the impact of debt and safeguard their financial future. Regular review and updates to life insurance strategies are essential to ensure they remain aligned with the business’s evolving needs and objectives. Through thoughtful planning and prudent risk management, businesses can navigate the complexities of debt and secure a solid foundation for long-term success.