Introduction:

In the world of business, ensuring continuity in ownership is crucial for the long-term sustainability and success of enterprises. Business succession planning, especially for family-owned businesses and small to medium-sized enterprises (SMBs), is essential for managing the transition of ownership and management when key individuals retire, become incapacitated, or pass away. Among the various tools and strategies available for effective succession planning, life insurance emerges as a powerful instrument. This essay explores the intricate relationship between life insurance and business succession, elucidating how life insurance can be utilized to facilitate smooth transitions in ownership, protect against financial risks, and preserve the legacy of the business.

Understanding Business Succession Planning:

Before delving into the role of life insurance, it’s imperative to grasp the essence of business succession planning. Business succession planning encompasses the strategic process of determining how ownership and management of a business will transition from one generation to the next or from one set of owners to another. It involves identifying and preparing successors, establishing mechanisms for transferring ownership, and addressing potential tax and legal implications. For family-owned businesses, succession planning often entails complex emotional and relational dynamics, as it necessitates balancing familial relationships with business interests. Effective planning requires clear communication, transparency, and the involvement of all relevant stakeholders.

Challenges in Business Succession:

Several challenges pose obstacles to the succession process for businesses:

- Lack of Planning: Many businesses fail to adequately plan for succession, leading to uncertainty and potential disruption when key individuals depart.

- Financial Considerations: Transferring ownership of a business can incur significant financial costs, including taxes, valuation expenses, and potential buyout agreements.

- Family Dynamics: Family-owned businesses must navigate interpersonal relationships and potential conflicts of interest when determining succession plans.

- Management Transition: Ensuring a smooth transition of management and leadership is essential for maintaining operational continuity and sustaining growth.

Role of Life Insurance in Business Succession:

Life insurance emerges as a valuable tool in addressing several key challenges associated with business succession planning:

- Financial Protection: Life insurance policies can provide a source of liquidity to fund buy-sell agreements, pay estate taxes, or cover other expenses associated with the transfer of ownership.

- Equalizing Inheritances: In cases where some family members are involved in the business while others are not, life insurance can be used to provide equitable inheritances to non-business heirs.

- Risk Mitigation: Life insurance helps mitigate financial risks associated with the unexpected death or disability of key individuals involved in the business.

- Funding Executive Compensation: Businesses can use life insurance to fund executive compensation or retirement plans, attracting and retaining key talent critical to the company’s success.

Types of Life Insurance for Business Succession:

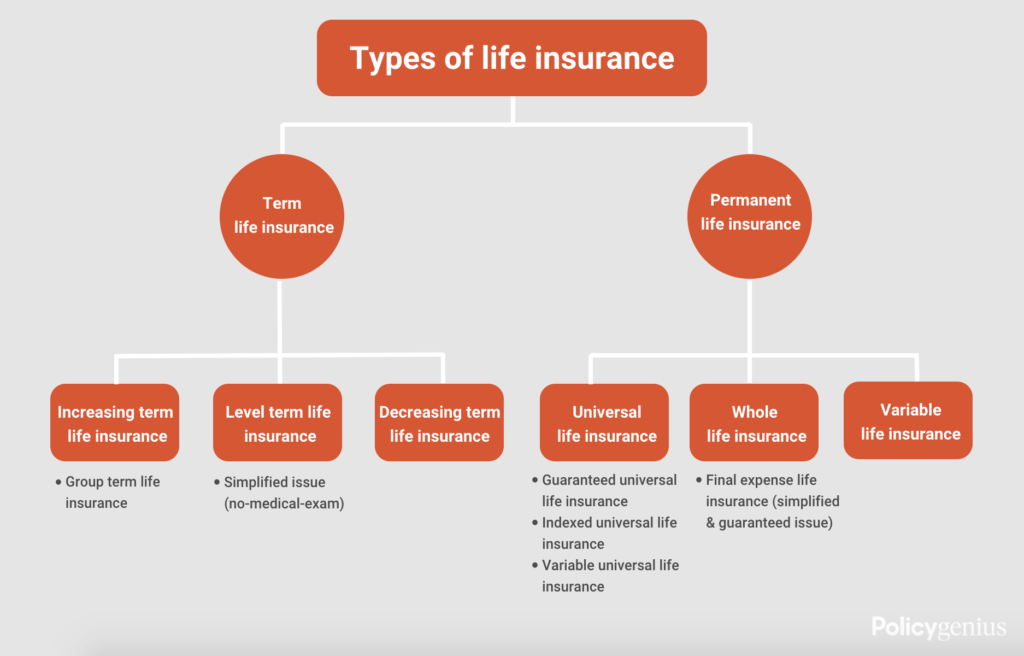

Several types of life insurance policies can be utilized in business succession planning:

- Term Life Insurance: Provides coverage for a specified period, typically at a lower cost than permanent life insurance. Term policies are often used to cover short-term financial needs or debt obligations.

- Whole Life Insurance: Offers permanent coverage with a guaranteed death benefit and cash value accumulation. Whole life policies can be used for long-term financial planning and as a funding mechanism for buy-sell agreements.

- Universal Life Insurance: Combines a death benefit with a cash value component and offers flexibility in premium payments and death benefit options. Universal life policies can be tailored to meet the evolving needs of the business.

- Key Person Insurance: Specifically insures key individuals whose contributions are essential to the business’s success. Key person insurance can provide financial protection to the business in the event of the insured’s death or disability.

Case Study: Smith Family Business

Let’s illustrate the role of life insurance in business succession planning through a hypothetical case study:

The Smith family owns a successful manufacturing company that has been passed down through generations. As the current owners approach retirement age, they are concerned about the future of the business and how to ensure a smooth transition to the next generation. The Smiths decide to implement a comprehensive succession plan that incorporates life insurance as a key component.

- Buy-Sell Agreement: The Smiths establish a buy-sell agreement funded by life insurance policies on each family member involved in the business. In the event of death or disability, the policies provide the necessary funds to facilitate the buyout of the deceased or disabled member’s share of the business.

- Estate Planning: To address potential estate tax liabilities, the Smiths use life insurance to provide liquidity to the estate, ensuring that sufficient funds are available to pay any taxes owed without liquidating assets or disrupting the business’s operations.

- Equal Inheritance: The Smiths have children who are actively involved in the business as well as those who have pursued other career paths. To ensure equitable treatment of all heirs, the Smiths purchase life insurance policies that will provide a cash inheritance to non-business heirs, while the business itself passes to those actively involved.

Conclusion:

Effective business succession planning is essential for ensuring the continuity and long-term viability of a business. Life insurance serves as a versatile tool in this process, providing financial security, mitigating risks, and facilitating smooth transitions in ownership. By incorporating life insurance into their succession plans, businesses can protect their interests, preserve their legacies, and pave the way for future success.

In conclusion, the strategic use of life insurance can play a crucial role in navigating the complexities of business succession, ensuring that businesses remain resilient and prosperous across generations. By addressing financial challenges, equalizing inheritances, and mitigating risks, life insurance empowers businesses to transition smoothly and sustainably, preserving their legacies for years to come.