Introduction:

Planning for a child’s education is one of the most critical financial responsibilities parents face. With the rising costs of higher education, many families are exploring various avenues to secure funding for their children’s college expenses. One often overlooked but potentially powerful tool in this endeavor is life insurance. While traditionally seen as a means of providing financial protection in the event of death, life insurance can also play a vital role in funding education expenses. In this comprehensive guide, we will explore the intersection of life insurance and college planning, examining the different types of life insurance policies, their features, and how they can be utilized to ensure a secure financial future for your child’s education.

I. Understanding the Cost of College Education:

Before delving into the role of life insurance in funding education expenses, it’s crucial to understand the landscape of college costs. Over the past few decades, the cost of higher education has skyrocketed, outpacing inflation and wage growth by a significant margin. According to data from the College Board, the average annual cost of tuition and fees at a public four-year institution in the United States exceeded $10,000, while private nonprofit colleges averaged over $35,000 per year.

These figures only account for tuition and fees; additional expenses such as room and board, textbooks, and personal expenses can substantially increase the overall cost of attendance. For families with multiple children or those planning for advanced degrees, the financial burden can be staggering. Consequently, many parents are seeking proactive strategies to ensure they can afford their children’s education without sacrificing their financial stability or retirement savings.

II. Types of Life Insurance:

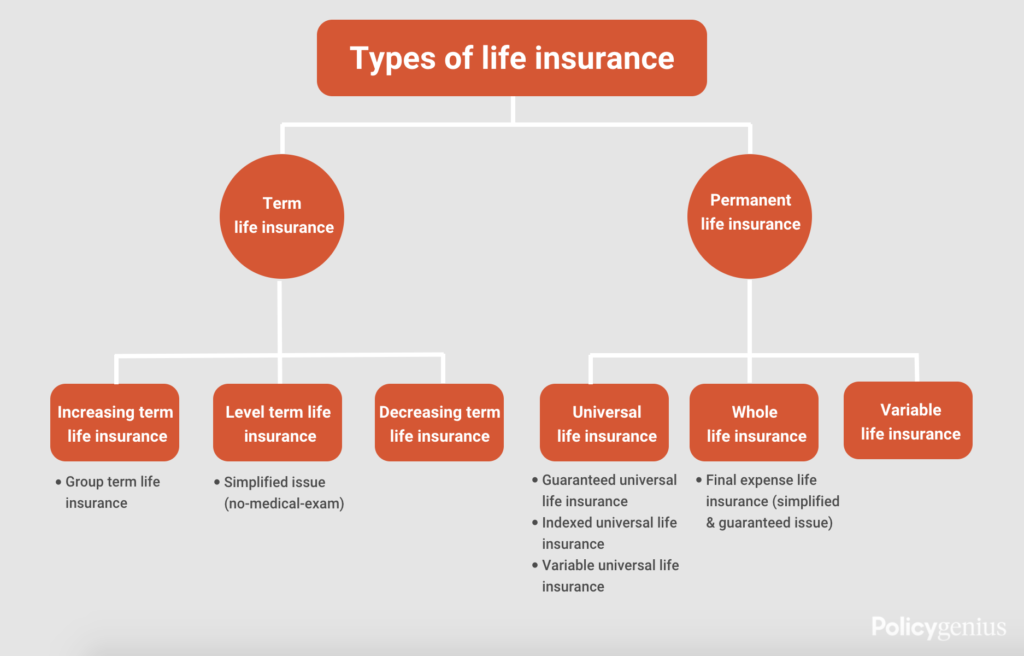

Life insurance comes in various forms, each with its own set of features, benefits, and suitability for different financial goals. The two primary types of life insurance are:

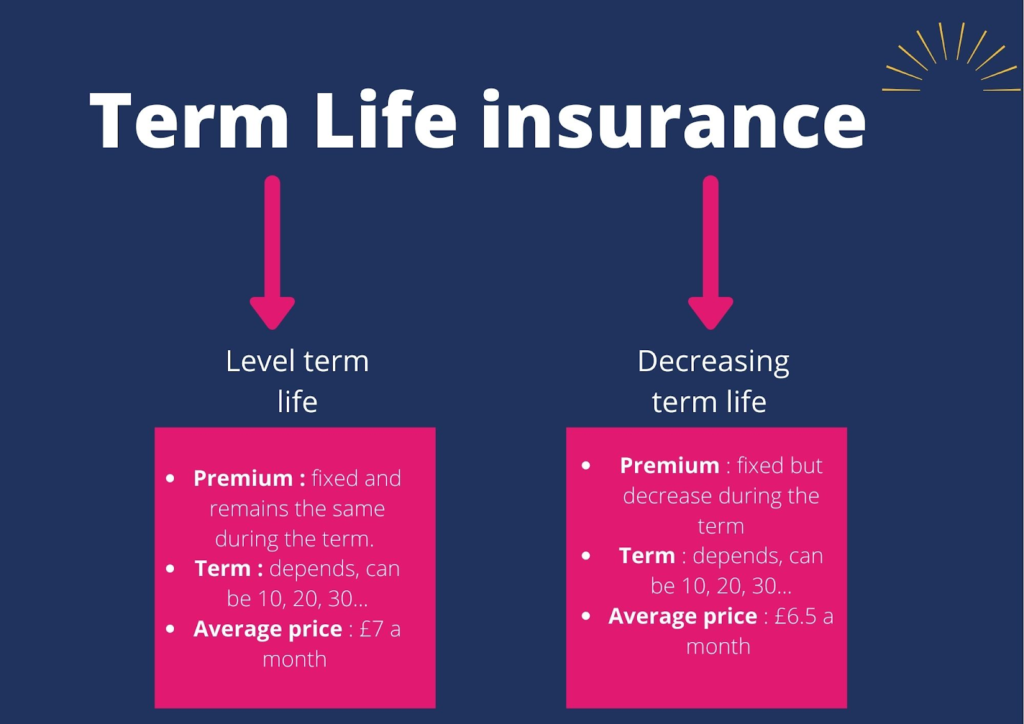

- Term Life Insurance:

- Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years.

- It offers a death benefit to beneficiaries if the insured individual passes away during the policy term.

- Term policies are usually more affordable than permanent life insurance options, making them attractive for families seeking cost-effective protection.

- However, term life insurance does not accumulate cash value and expires at the end of the term, leaving policyholders without coverage unless they renew or purchase a new policy, which may be more expensive due to age and health changes.

- Permanent Life Insurance:

- Permanent life insurance, as the name suggests, provides coverage for the insured’s entire life, as long as premiums are paid.

- Unlike term insurance, permanent policies often include a cash value component that accumulates over time, providing a savings element in addition to the death benefit.

- There are several types of permanent life insurance, including whole life, universal life, and variable life, each with its own variations and features.

- Whole life insurance offers fixed premiums, guaranteed death benefits, and guaranteed cash value growth, providing stability and predictability but typically with higher premiums compared to term insurance.

- Universal life insurance offers more flexibility in premium payments and death benefit amounts, allowing policyholders to adjust their coverage as their needs change.

- Variable life insurance allows policyholders to allocate cash value into investment options such as stocks, bonds, or mutual funds, offering the potential for higher returns but also greater investment risk.

III. Utilizing Life Insurance for College Planning:

While life insurance is primarily associated with providing financial security in the event of death, its features and benefits can be leveraged to address various financial needs, including funding education expenses. Here are several ways life insurance can be utilized in college planning:

- Income Replacement:

- In the unfortunate event of the primary breadwinner’s death, life insurance can provide a tax-free death benefit to replace lost income, ensuring that the family’s financial obligations, including children’s education expenses, are met.

- By calculating the future cost of college education and estimating the amount of income needed to cover those expenses, parents can determine the appropriate level of life insurance coverage to safeguard their children’s educational goals.

- Cash Value Accumulation:

- Permanent life insurance policies, such as whole life or universal life, accumulate cash value over time, which can be accessed through policy loans or withdrawals.

- Policyholders can use the cash value to supplement college funding needs, whether to cover tuition payments, room and board expenses, or other educational costs.

- Unlike loans, policy withdrawals typically do not have to be repaid, providing a tax-efficient source of funding for college expenses.

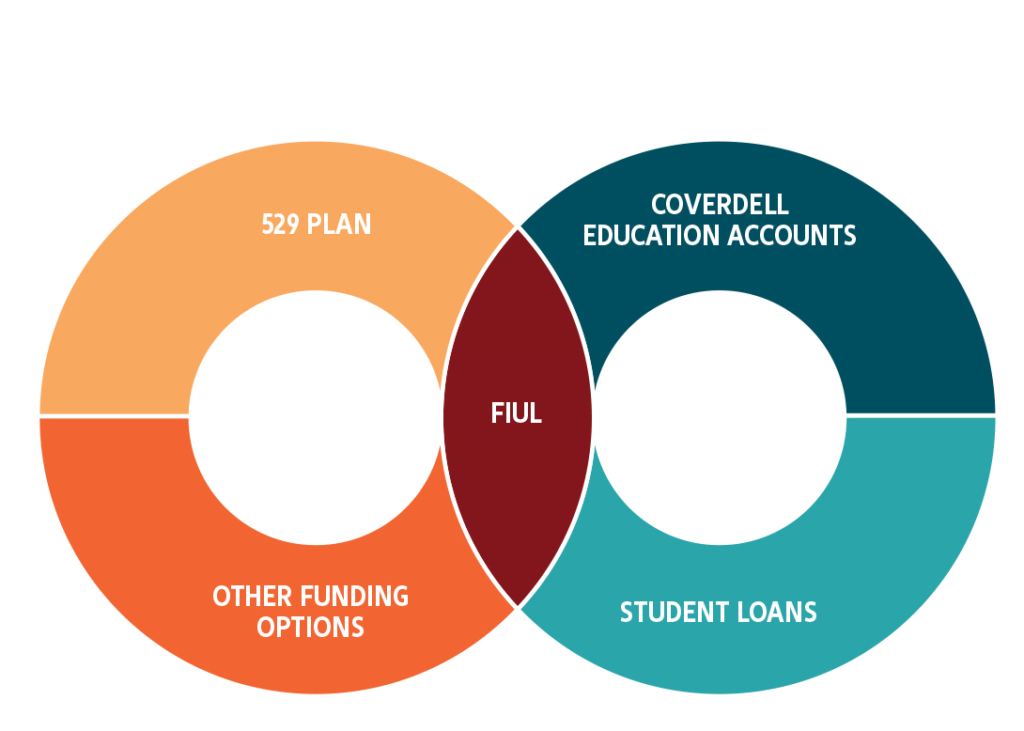

- College Savings Alternative:

- For parents who have maxed out contributions to traditional college savings vehicles such as 529 plans or Coverdell Education Savings Accounts (ESAs), life insurance can serve as an additional tax-advantaged savings vehicle.

- Cash value growth within permanent life insurance policies is tax-deferred, meaning policyholders do not pay taxes on the earnings until they are withdrawn.

- Policyholders can access the cash value without penalties or restrictions, providing flexibility in funding college expenses compared to other savings options.

- Estate Planning Benefits:

- Life insurance can play a vital role in estate planning by providing liquidity to cover estate taxes, debts, and other expenses without the need to sell assets or disrupt the family’s financial stability.

- By naming a trust or the college itself as the beneficiary of a life insurance policy, parents can ensure that funds are earmarked specifically for education expenses and are not subject to probate or estate distribution delays.

IV. Case Studies: Real-World Applications of Life Insurance in College Planning:

To illustrate the practical application of life insurance in funding education expenses, let’s consider two hypothetical case studies:

Case Study 1: The Smith Family

- John and Sarah Smith have two children, Emily and Michael, aged 10 and 8, respectively.

- They anticipate that both children will attend a four-year college and are concerned about how they will afford the rising costs of higher education.

- After assessing their financial situation, John and Sarah decide to purchase a whole life insurance policy with a death benefit sufficient to cover their children’s college expenses.

- They choose a policy with guaranteed cash value accumulation and plan to use the cash value to supplement their savings for tuition, room and board, and other educational costs.

- By leveraging the cash value growth of the life insurance policy, the Smiths can ensure that they have a tax-efficient source of funding for their children’s education, even if their other investments underperform or unexpected expenses arise.

Case Study 2: The Patel Family

- Raj and Priya Patel have a daughter, Aisha, who is a high school senior preparing to attend college next year.

- Despite diligent saving in a 529 plan, they realize that they may not have enough funds to cover the full cost of Aisha’s education, especially if she chooses to attend a private or out-of-state university.

- Concerned about the potential impact of market volatility on their college savings, Raj and Priya decide to purchase a variable universal life insurance policy with flexible premium payments and investment options.

- They allocate a portion of the policy’s cash value to conservative investments to provide stability for college funding while earmarking the remainder for more aggressive growth opportunities.

- With the ability to access the cash value tax-efficiently and without penalties, the Patels have peace of mind knowing that they have a supplemental source of funding to bridge any gaps in their college savings and cover Aisha’s educational expenses.

These case studies illustrate how families can tailor their life insurance strategies to their unique financial goals and circumstances, whether it’s supplementing existing college savings, providing income replacement in the event of death, or ensuring liquidity for estate planning purposes.

V. Considerations and Caveats:

While life insurance can be a valuable tool in funding education expenses, there are several considerations and caveats to keep in mind:

- Cost vs. Benefit Analysis:

- Families should carefully weigh the cost of life insurance premiums against the potential benefits, including death benefits, cash value accumulation, and tax advantages.

- Depending on factors such as age, health, coverage amount, and policy type, the cost of life insurance can vary significantly, so it’s essential to conduct a thorough analysis to determine the most cost-effective solution.

- Policy Features and Flexibility:

- Not all life insurance policies are created equal, so it’s crucial to understand the features, benefits, and limitations of each policy type before making a decision.

- Families should consider factors such as premium payments, death benefit guarantees, cash value growth potential, policy loans and withdrawals, and flexibility in adjusting coverage amounts or investment allocations.

- Impact on Financial Aid Eligibility:

- Cash value within permanent life insurance policies is considered an asset for financial aid purposes and may affect eligibility for need-based aid.

- Families should consult with a financial advisor or college financial aid expert to understand how life insurance may impact their child’s eligibility for grants, scholarships, and student loans.

- Long-Term Commitment:

- Life insurance is a long-term financial commitment that requires regular premium payments to maintain coverage and cash value growth.

- Families should assess their ability to afford premiums over the life of the policy, taking into account potential changes in income, expenses, and financial goals.

- Professional Guidance:

- Given the complexity of life insurance and its interaction with other financial planning strategies, families should seek guidance from a qualified financial advisor or insurance professional.

- An advisor can help assess individual needs, recommend suitable policy options, and ensure that life insurance aligns with broader financial goals and objectives.

Conclusion:

Funding education expenses is a significant financial undertaking for many families, requiring careful planning and consideration of various savings and investment strategies. While life insurance may not be the first option that comes to mind for college planning, its unique features and benefits can make it a valuable tool in ensuring a secure financial future for your child’s education.

By understanding the different types of life insurance policies, their features, and how they can be leveraged to address college funding needs, families can develop a comprehensive financial plan that balances protection, savings, and investment objectives. Whether it’s providing income replacement in the event of death, accumulating cash value to supplement college savings, or enhancing estate planning flexibility, life insurance can play a vital role in achieving your educational goals.

As with any financial decision, it’s essential to conduct thorough research, seek professional guidance, and carefully evaluate the costs and benefits of life insurance in the context of your overall financial situation. By taking a proactive approach to college planning and leveraging the tools and resources available, you can help ensure that your child receives the education they deserve without sacrificing your family’s financial security and stability.

I have been exploring for a bit for any high quality articles or blog posts on this kind of space . Exploring in Yahoo I eventually stumbled upon this site. Studying this information So i抦 glad to show that I have a very just right uncanny feeling I found out exactly what I needed. I most definitely will make sure to don抰 overlook this website and give it a glance regularly.

Thanks for your publiction. Another issue is that just being a photographer involves not only issues in catching award-winning photographs and also hardships in acquiring the best digicam suited to your needs and most especially struggles in maintaining the quality of your camera. That is very true and visible for those professional photographers that are into capturing this nature’s fascinating scenes – the mountains, the forests, the actual wild or the seas. Going to these daring places definitely requires a dslr camera that can surpass the wild’s harsh natural environment.

That is really attention-grabbing, You are a very skilled blogger. I have joined your rss feed and stay up for searching for more of your wonderful post. Additionally, I’ve shared your site in my social networks!

It’s best to participate in a contest for among the finest blogs on the web. I’ll recommend this website!

Howdy would you mind letting me know which web host you’re working with? I’ve loaded your blog in 3 different internet browsers and I must say this blog loads a lot faster then most. Can you suggest a good web hosting provider at a fair price? Kudos, I appreciate it!

Wow, amazing weblog structure! How long have you ever been blogging for? you make running a blog look easy. The total glance of your website is magnificent, let alone the content!

Hey there, You have done a fantastic job. I抣l definitely digg it and personally suggest to my friends. I’m sure they’ll be benefited from this website.

In accordance with my study, after a foreclosed home is offered at a sale, it is common to the borrower to be able to still have the remaining unpaid debt on the mortgage loan. There are many loan merchants who try to have all charges and liens paid by the upcoming buyer. Nonetheless, depending on particular programs, laws, and state guidelines there may be several loans that aren’t easily settled through the transfer of financial loans. Therefore, the duty still rests on the debtor that has had his or her property in foreclosure process. Many thanks sharing your opinions on this website.

I’m really impressed together with your writing abilities as well as with the layout in your blog. Is that this a paid theme or did you modify it your self? Anyway stay up the excellent quality writing, it is rare to peer a great blog like this one these days..