Introduction:

Life insurance is a critical financial tool that offers peace of mind and financial security to individuals and their families. However, for smokers, obtaining life insurance can be more complex due to the associated health risks. In this comprehensive guide, we’ll delve into the intricacies of life insurance for smokers, exploring the impact of smoking on premiums, the types of coverage available, and strategies to secure the best policy.

I. Smoking and Life Insurance: Understanding the Impact

A. Health Risks Associated with Smoking:

Smoking is linked to various health issues such as lung cancer, heart disease, and respiratory problems. Understanding these risks is essential for both insurers and policyholders. Statistics reveal higher mortality rates among smokers compared to non-smokers, highlighting the increased risk associated with smoking. Studies show that smoking can significantly reduce life expectancy, emphasizing the importance of addressing smoking habits in life insurance policies.

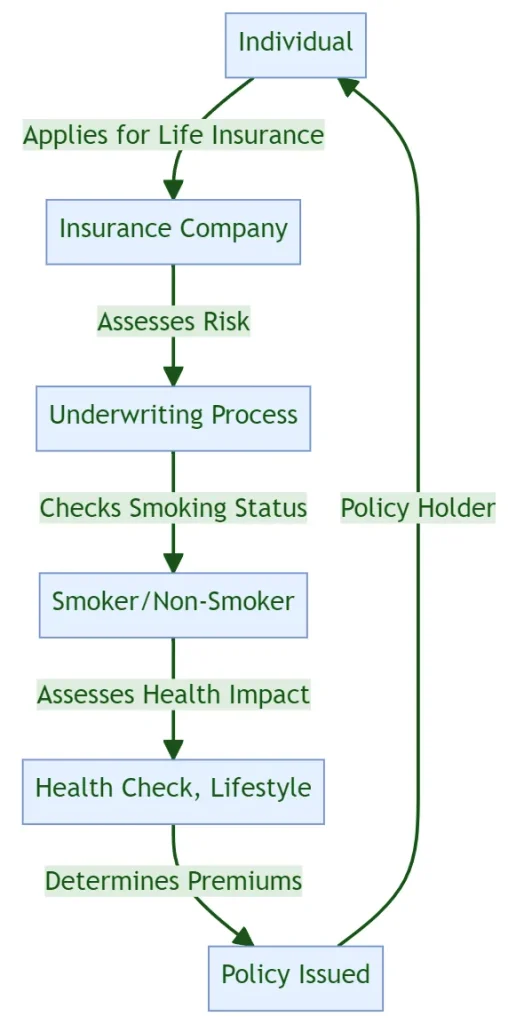

B. Underwriting Process for Smokers:

Insurers evaluate smoking status during the underwriting process to assess risk accurately. Health assessments and medical exams are commonly required for smokers to determine their overall health and insurability. Accurate disclosure of smoking habits is crucial to avoid complications during the underwriting process and ensure transparency with insurers.

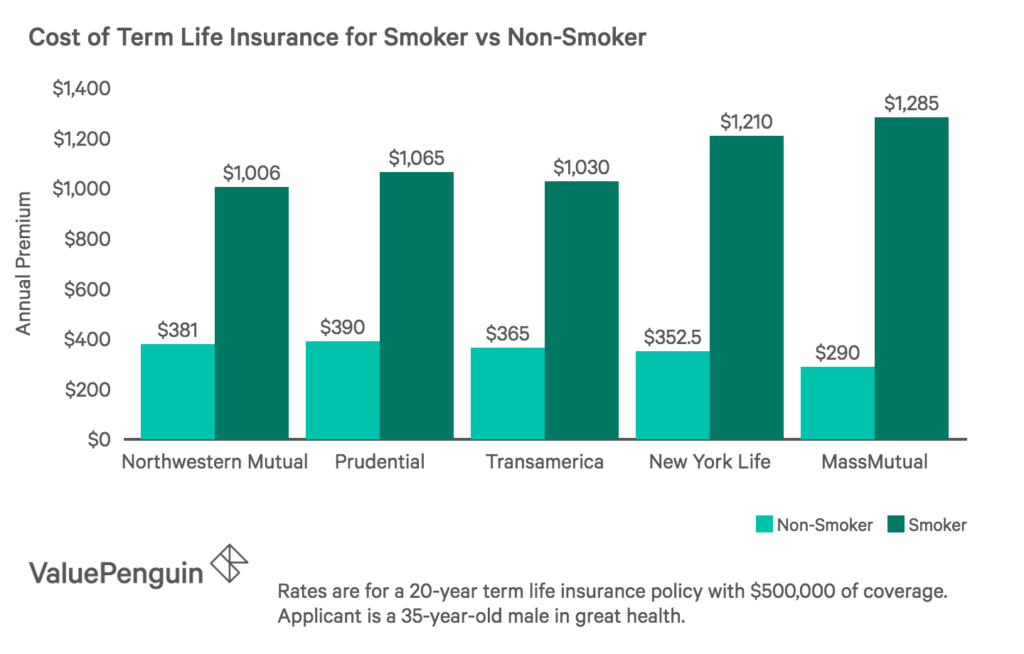

C. Impact on Premiums:

Several factors influence the cost of premiums for smokers, including age, smoking frequency, and duration of smoking. Smokers typically face higher premium rates compared to non-smokers due to their increased mortality risk. Cost comparison between smoker and non-smoker policies highlights the financial implications of smoking on life insurance premiums.

II. Types of Life Insurance Coverage for Smokers

A. Term Life Insurance:

Term life insurance provides coverage for a specified period, offering a death benefit to beneficiaries if the insured passes away during the term. While term policies are available for smokers, they may come with higher premiums compared to non-smokers. Pros and cons of term life insurance for smokers include flexibility in coverage duration but may lack cash value accumulation.

B. Whole Life Insurance:

Whole life insurance offers lifelong coverage with a guaranteed death benefit and cash value accumulation. Whole life policies are accessible to smokers, but premiums may be higher due to the extended coverage period and investment component. Benefits of whole life insurance for smokers include lifelong coverage and potential cash value growth, but premiums may be prohibitive for some individuals.

C. Universal Life Insurance:

Universal life insurance provides flexibility in premium payments and death benefits, with a cash value component that can be used for various purposes. Universal life policies are suitable for smokers seeking flexible coverage options, but premiums may vary based on smoking habits and health status. Understanding the investment components and flexibility of universal life insurance can help smokers make informed decisions about coverage.

D. Critical Illness and Disability Insurance:

Supplemental coverage such as critical illness and disability insurance provides additional protection against unforeseen health issues. Critical illness and disability policies are available for smokers but may come with higher premiums due to increased health risks. Considerations when selecting additional coverage options include assessing individual needs and budget constraints.

III. Strategies for Smokers to Obtain Affordable Coverage

A. Quitting Smoking:

Quitting smoking before applying for life insurance can lead to lower premiums and improved health outcomes. Incentives for quitting smoking may include premium discounts and access to preferred rates from insurers. Support resources such as smoking cessation programs and counseling can aid smokers in their journey to quit tobacco use.

B. Shopping Around for Quotes:

Comparing quotes from multiple insurers allows smokers to find competitive rates and suitable coverage options. Online tools and insurance brokers can help smokers navigate the insurance market and obtain personalized quotes. Negotiating with insurers for competitive rates based on individual health and lifestyle factors can lead to cost savings.

C. Choosing the Right Policy:

Assessing individual insurance needs and goals is essential when selecting a life insurance policy. Understanding policy terms, conditions, and exclusions helps smokers make informed decisions about coverage. Seeking professional advice from financial advisors or insurance agents can provide valuable insights into available options and suitable policies.

D. Opting for Group Insurance:

Exploring employer-sponsored life insurance options can provide smokers with affordable coverage through group plans. Advantages of group insurance for smokers include potentially lower premiums and simplified underwriting processes. Supplementing group coverage with individual policies may be necessary to ensure adequate protection and flexibility.

IV. Case Studies and Real-Life Examples

A. Case Study 1: Smoker with Pre-existing Health Conditions:

Challenges faced by smokers with pre-existing health issues highlight the importance of comprehensive coverage. Strategies for securing affordable coverage may include leveraging group insurance, quitting smoking, and exploring specialized policies. Success stories of smokers with pre-existing conditions who obtained suitable life insurance coverage provide inspiration and guidance.

B. Case Study 2: Young Smoker with Dependents:

Financial implications for young smokers with dependents underscore the importance of adequate life insurance protection. Tailored insurance solutions such as term life policies with sufficient coverage can provide financial security for young families. Testimonials from individuals who have navigated similar situations offer practical insights and encouragement for young smokers seeking life insurance.

V. Regulatory Environment and Industry Trends

A. Legal and Regulatory Framework:

Regulations governing life insurance for smokers aim to ensure fairness, transparency, and consumer protection. Compliance requirements for insurers regarding smoking disclosure help maintain integrity and accuracy in underwriting processes. Potential changes in legislation affecting smoker policies may impact coverage options and premium rates in the future.

B. Industry Trends and Innovations:

Technological advancements in underwriting and risk assessment streamline processes and improve accuracy in evaluating smoker risk. Data analytics play a significant role in pricing and policy customization, allowing insurers to offer personalized solutions to smokers. Emerging trends in smoker-specific insurance products and services reflect evolving consumer needs and preferences in the insurance market.

VI. Conclusion and Future Outlook

A. Summary of Key Points:

Understanding the impact of smoking on life insurance premiums and coverage is essential for smokers seeking adequate protection. Strategies such as quitting smoking, shopping around for quotes, and choosing the right policy can help smokers obtain affordable coverage. Staying informed about industry trends and regulatory changes enables smokers to make informed decisions about their life insurance needs.

B. Future Outlook:

Predictions for the evolution of smoker-specific insurance offerings include continued innovation in underwriting processes and risk assessment. Advancements in technology and data analytics are expected to further enhance pricing accuracy and policy customization for smokers. Recommendations for individuals seeking life insurance as smokers in the future emphasize the importance of proactive planning and leveraging available resources to secure suitable coverage.

In conclusion, navigating life insurance as a smoker requires a thorough understanding of the impact of smoking on premiums, available coverage options, and strategies to obtain affordable coverage. By implementing proactive measures and staying informed about industry trends, smokers can protect their financial well-being and provide for their loved ones effectively.