Introduction:

Life insurance is a vital component of financial planning that provides peace of mind and security for individuals and their families. While it’s often uncomfortable to think about mortality, the reality is that unexpected events can occur at any time. Life insurance serves as a safety net, ensuring that loved ones are financially protected in the event of the policyholder’s death. In this comprehensive guide, we’ll explore the importance of life insurance, the different types of policies available, factors to consider when purchasing coverage, and how life insurance can effectively secure your family’s financial future.

Understanding the Importance of Life Insurance:

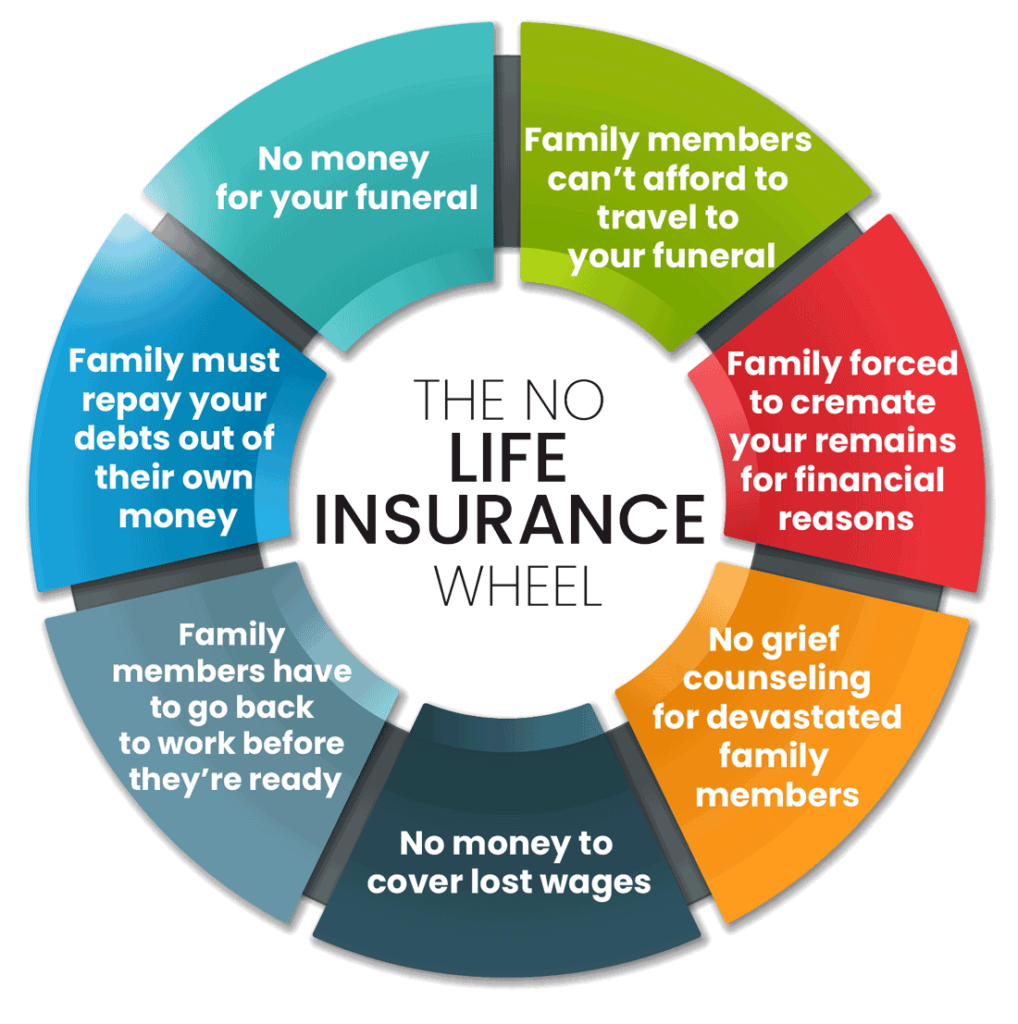

Life insurance plays a crucial role in safeguarding the financial well-being of your family in the event of your untimely demise. Without adequate coverage, your loved ones may face significant financial hardships, including mortgage payments, outstanding debts, living expenses, and educational costs. By securing a life insurance policy, you can provide your family with the financial resources they need to maintain their standard of living and achieve their long-term goals, even after you’re gone.

Types of Life Insurance Policies:

There are several types of life insurance policies available, each offering unique features and benefits to policyholders. The two primary categories of life insurance are term life insurance and permanent life insurance.

- Term Life Insurance: Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It offers straightforward protection at an affordable premium, making it an attractive option for individuals who need temporary coverage to meet their financial obligations. If the insured individual passes away during the term of the policy, the beneficiaries receive a death benefit payout. However, if the policy expires before a claim is made, there is no payout, and the coverage terminates.

- Permanent Life Insurance: Permanent life insurance provides lifelong coverage, as long as premiums are paid on time. Unlike term life insurance, permanent policies accumulate cash value over time, which can be accessed by the policyholder through withdrawals or loans. There are several types of permanent life insurance, including whole life insurance, universal life insurance, and variable life insurance. These policies offer flexibility, investment opportunities, and the ability to customize coverage to meet your specific needs.

Factors to Consider When Purchasing Life Insurance: When purchasing life insurance, it’s essential to carefully evaluate your financial situation, family needs, and long-term goals. Consider the following factors to ensure you select the right policy for your circumstances:

- Coverage Amount: Determine the amount of coverage needed to adequately protect your family’s financial future. Consider factors such as outstanding debts, mortgage payments, living expenses, educational costs, and future financial obligations. A comprehensive needs analysis can help you determine the appropriate coverage amount to meet your family’s needs.

- Policy Term: Decide on the length of coverage that best aligns with your financial goals and obligations. Consider factors such as your age, health status, income level, and the financial needs of your beneficiaries. Choose a policy term that provides sufficient coverage during critical periods, such as mortgage payments, educational expenses, and retirement planning.

- Premium Costs: Evaluate the affordability of the premiums associated with the life insurance policy. Premiums can vary based on factors such as age, health status, coverage amount, policy term, and type of policy. Compare quotes from multiple insurers to find a policy that offers the coverage you need at a price you can afford.

- Riders and Additional Benefits: Explore the various riders and additional benefits available with life insurance policies. Riders can enhance coverage by providing additional protection, such as accelerated death benefits, waiver of premium, accidental death benefit, and guaranteed insurability. Consider adding riders that align with your specific needs and preferences.

- Insurer Reputation and Financial Stability: Research the reputation and financial stability of the insurance company before purchasing a policy. Choose a reputable insurer with a strong financial rating and a proven track record of claims payment. Review customer reviews, ratings, and industry rankings to assess the insurer’s reliability and customer service quality.

- Underwriting Process: Understand the underwriting process involved in obtaining life insurance coverage. Insurers evaluate factors such as age, health status, medical history, lifestyle habits, occupation, and hobbies to assess the applicant’s risk profile. Be prepared to undergo a medical exam, provide medical records, and answer health-related questions during the underwriting process.

- Conversion Options: Consider the conversion options available with term life insurance policies. Some policies offer the flexibility to convert to permanent coverage without undergoing additional medical underwriting. Conversion options provide the opportunity to extend coverage beyond the initial term without having to requalify based on health status.

Securing Your Family’s Financial Future with Life Insurance:

Life insurance serves as a critical tool for securing your family’s financial future and providing them with the financial resources they need to thrive. Here’s how life insurance can effectively protect your loved ones:

- Income Replacement: Life insurance provides a tax-free death benefit payout to beneficiaries upon the policyholder’s death. This lump sum payment can replace lost income and support your family’s financial needs, includin

- g daily living expenses, mortgage payments, utility bills, and childcare costs. By ensuring a steady stream of income for your loved ones, life insurance helps maintain their standard of living and financial stability.

- Debt Repayment: Many families carry various forms of debt, such as mortgages, car loans, credit card debt, and student loans. In the event of your death, life insurance can be used to repay outstanding debts and liabilities, relieving your family of financial burdens. By eliminating debt obligations, your loved ones can avoid financial strain and focus on rebuilding their lives.

- Educational Expenses: Life insurance can fund educational expenses for your children or grandchildren, ensuring they have access to quality education and opportunities for personal and professional growth. The death benefit payout can be used to cover tuition fees, school supplies, extracurricular activities, and other educational costs. By investing in your family’s education, you can empower them to achieve their academic goals and pursue rewarding careers.

- Estate Planning: Life insurance plays a crucial role in estate planning by providing liquidity to cover estate taxes, probate fees, and other settlement costs. The death benefit payout can be used to preserve family assets, protect inheritances, and facilitate the transfer of wealth to future generations. By integrating life insurance into your estate plan, you can ensure a smooth and efficient distribution of assets to your heirs and beneficiaries.

- Business Continuity: For business owners, life insurance can safeguard the continuity of the business and protect the interests of co-owners, employees, and stakeholders. Key person insurance provides financial protection in the event of the death of a key employee or business partner, allowing the business to continue operating without disruption. Buy-sell agreements funded by life insurance ensure a smooth transition of ownership and provide liquidity to buy out the deceased owner’s share of the business.

Conclusion:

Life insurance is a powerful financial tool that provides essential protection and security for your family’s future. By securing a life insurance policy, you can ensure that your loved ones are financially protected in the event of your untimely demise. Whether you’re a young family starting out or a seasoned professional planning for retirement, life insurance offers peace of mind and financial stability for the road ahead. Take the time to assess your insurance needs, explore your options, and invest in the coverage that best meets your family’s needs and goals. With life insurance, you can rest assured knowing that your family’s financial future is secure, no matter what the future may hold.