When it comes to planning for the future, few financial products are as essential as life insurance. Whether you’re just starting your career, raising a family, or approaching retirement, having adequate life insurance coverage can provide peace of mind and financial security for your loved ones. However, navigating the world of life insurance can be daunting, especially with the plethora of options available. Two primary types of life insurance policies that often come up in discussions are term life insurance and whole life insurance. Let’s delve deeper into each to help you make an informed decision about which one aligns best with your needs and goals.

Understanding Term Life Insurance:

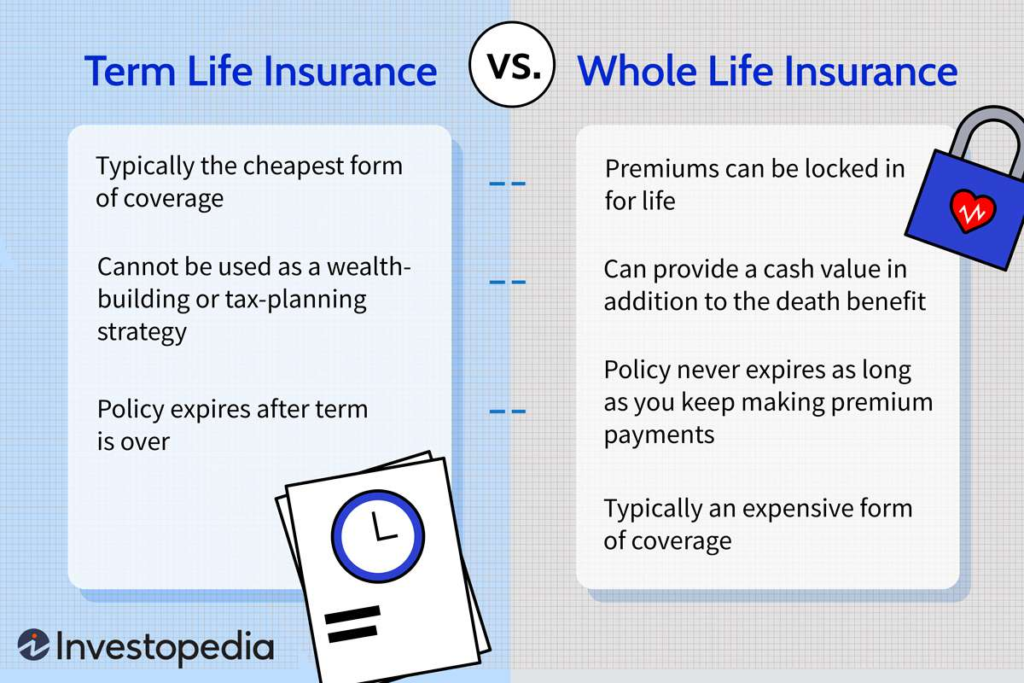

Term life insurance is often likened to renting a house—you pay for coverage for a specified period, and if nothing happens during that time, you don’t get anything back. Here are the key features of term life insurance:

- Coverage Period: Term life insurance provides coverage for a predetermined period, typically ranging from 10 to 30 years. This makes it an excellent option for covering specific financial obligations with a temporary need for protection, such as paying off a mortgage or ensuring your children’s education expenses are covered until they become financially independent.

- Affordability: One of the primary advantages of term life insurance is its affordability. Since it offers coverage for a limited time and does not accumulate cash value, premiums are generally lower compared to whole life insurance policies.

- Death Benefit: In the event of the insured’s death during the term of the policy, the beneficiary receives the death benefit—a lump-sum payment intended to provide financial support to cover expenses or replace lost income.

- No Cash Value: Unlike whole life insurance, term life insurance policies typically do not build cash value over time. Once the term ends, coverage ceases, and there’s no return on premiums paid.

- Renewability: Some term life insurance policies offer the option to renew at the end of the term, often at a higher premium. However, it’s essential to note that renewal may not be guaranteed and could come with age restrictions or increased costs.

Deciphering Whole Life Insurance:

Whole life insurance, on the other hand, is often compared to owning a house—you build equity over time, and it provides lifelong protection. Here’s what you need to know about whole life insurance:

- Lifetime Coverage: Whole life insurance offers coverage for the insured’s entire life, as long as premiums are paid. This permanence makes it a popular choice for individuals seeking to leave a legacy or ensure their loved ones are provided for regardless of when they pass away.

- Premiums and Cash Value: While whole life insurance premiums are typically higher than those for term life insurance, they remain level throughout the life of the policy. Additionally, a portion of the premium payments goes towards building cash value, which accumulates over time on a tax-deferred basis. This cash value can be accessed through policy loans or withdrawals, providing a source of emergency funds or supplementing retirement income.

- Death Benefit and Investment Component: Similar to term life insurance, whole life insurance pays out a death benefit to the beneficiary upon the insured’s death. However, whole life policies also include an investment component, where a portion of the premiums is invested by the insurance company. Depending on the type of whole life policy, this investment component may earn dividends or interest, further enhancing the policy’s cash value growth.

- Guarantees and Stability: Whole life insurance offers guaranteed death benefits and guaranteed cash value growth, providing stability and predictability in an uncertain world. This can be particularly appealing for individuals looking for a long-term financial planning tool with guaranteed returns.

Choosing the Right Policy for You:

When it comes to deciding between term and whole life insurance, there is no one-size-fits-all answer. The choice depends on various factors, including your financial goals, budget, age, health, and family situation. Here are some considerations to help guide your decision-making process:

- Assess Your Needs: Consider your current financial obligations, such as mortgage payments, outstanding debts, and dependents’ needs. Determine how long you’ll need coverage and what you want to achieve with your life insurance policy.

- Evaluate Your Budget: Review your budget to understand how much you can afford to allocate towards life insurance premiums. While term life insurance may be more affordable initially, whole life insurance offers lifelong coverage and a savings component that may align better with your long-term financial goals.

- Consult with a Financial Advisor: Life insurance can be a complex financial product, and it’s essential to seek guidance from a qualified financial advisor who can help you navigate the options available and tailor a policy to your specific needs and circumstances.

In conclusion, both term and whole life insurance serve valuable purposes in providing financial protection and security for you and your loved ones. Understanding the differences between the two types of policies and assessing your individual needs and goals will empower you to make an informed decision that aligns with your financial future. Whether you opt for the simplicity and affordability of term life insurance or the lifelong coverage and cash value accumulation of whole life insurance, having the right life insurance policy in place can offer invaluable peace of mind and security for the road ahead.