Introduction:

In the realm of financial planning, individuals often seek instruments that provide both protection and growth for their assets. Whole life insurance is one such financial product that offers both a death benefit and a savings component, commonly known as the cash value. While its primary purpose is to provide financial security to beneficiaries in the event of the insured’s death, whole life insurance also serves as an investment vehicle due to its cash value feature.

This paper aims to delve deeply into the concept of whole life insurance as an investment, focusing specifically on its cash value and growth potential. It will explore the mechanics of whole life insurance, its benefits and drawbacks, and analyze its role in an investor’s portfolio. Furthermore, it will compare whole life insurance with other investment options to provide a comprehensive understanding of its place in financial planning.

Understanding Whole Life Insurance:

A. Definition and Features:

- Whole Life Insurance Definition: Whole life insurance is a type of permanent life insurance that provides coverage for the entirety of the insured’s life as long as premiums are paid. It offers a death benefit to beneficiaries upon the insured’s death and also accumulates a cash value over time.

- Key Features: Whole life insurance is characterized by fixed premiums, meaning the premium amount remains constant throughout the life of the policy. It provides a guaranteed death benefit and a cash value component that grows over time.

- Differences from Term Life Insurance: Unlike term life insurance, which provides coverage for a specified term (e.g., 10, 20, or 30 years), whole life insurance covers the insured’s entire life. Additionally, term life insurance does not accumulate cash value.

B. Mechanics of Whole Life Insurance:

- Premium Payments: Policyholders pay fixed premiums either annually, semi-annually, quarterly, or monthly. These premiums are allocated to cover insurance costs, administrative fees, and to build the cash value.

- Death Benefit Structure: The death benefit is the amount paid to beneficiaries upon the insured’s death. It remains constant throughout the life of the policy and is typically tax-free.

- Cash Value Accumulation: A portion of the premium payments goes into a cash value account, which accumulates over time at a guaranteed interest rate set by the insurance company.

- Surrender Value and Policy Loans: Policyholders can access the cash value through surrendering the policy or taking out loans against it. Surrender value refers to the amount payable to the policyholder upon surrendering the policy, while policy loans allow policyholders to borrow against the cash value with interest.

II. Cash Value: The Investment Component of Whole Life Insurance:

A. What is Cash Value?

- Definition: Cash value is the savings component of a whole life insurance policy. It represents the accumulated funds within the policy that policyholders can access during the insured’s lifetime.

- Accumulation Process: Cash value accumulates gradually over time as premiums are paid and interest is credited to the account by the insurance company. It grows tax-deferred, meaning policyholders do not pay taxes on the growth until they withdraw the funds.

- Factors Influencing Cash Value Growth: Cash value growth is influenced by factors such as the amount and frequency of premium payments, the declared interest rate by the insurer, and the policy’s expenses.

B. Tax Implications of Cash Value:

- Tax-Deferred Growth: Cash value grows tax-deferred, meaning policyholders do not pay taxes on the growth as long as the funds remain within the policy.

- Taxation upon Withdrawal or Surrender: If policyholders withdraw funds from the cash value or surrender the policy, they may be subject to taxation on the accumulated gains, depending on the amount withdrawn and the policy’s structure.

- Tax Advantages: Whole life insurance offers tax advantages compared to other investment vehicles, as the growth within the policy is not subject to annual taxation, allowing for potentially higher compounding returns over time.

III. Growth Potential of Whole Life Insurance:

A. Guaranteed Growth:

- Guaranteed Interest Rate: Whole life insurance policies typically offer a guaranteed minimum interest rate on the cash value, ensuring that the cash value grows steadily over time, regardless of market conditions.

- Minimum Cash Value Growth: Insurance companies guarantee a minimum cash value growth rate, providing policyholders with a level of certainty regarding the growth of their investment component.

B. Dividend Payments:

- Participating vs. Non-Participating Policies: Some whole life insurance policies are participating, meaning policyholders are eligible to receive dividends from the insurance company’s profits. Non-participating policies do not offer dividends.

- Contribution to Cash Value Growth: Dividends are typically used to purchase additional paid-up insurance, increase the cash value, or reduce premiums. This contributes to the overall growth of the cash value component of the policy.

- Factors Affecting Dividend Payments: Dividend payments are influenced by the insurer’s financial performance, prevailing interest rates, and the level of participation by policyholders in the company’s profits.

IV. Advantages and Drawbacks of Whole Life Insurance as an Investment:

A. Advantages:

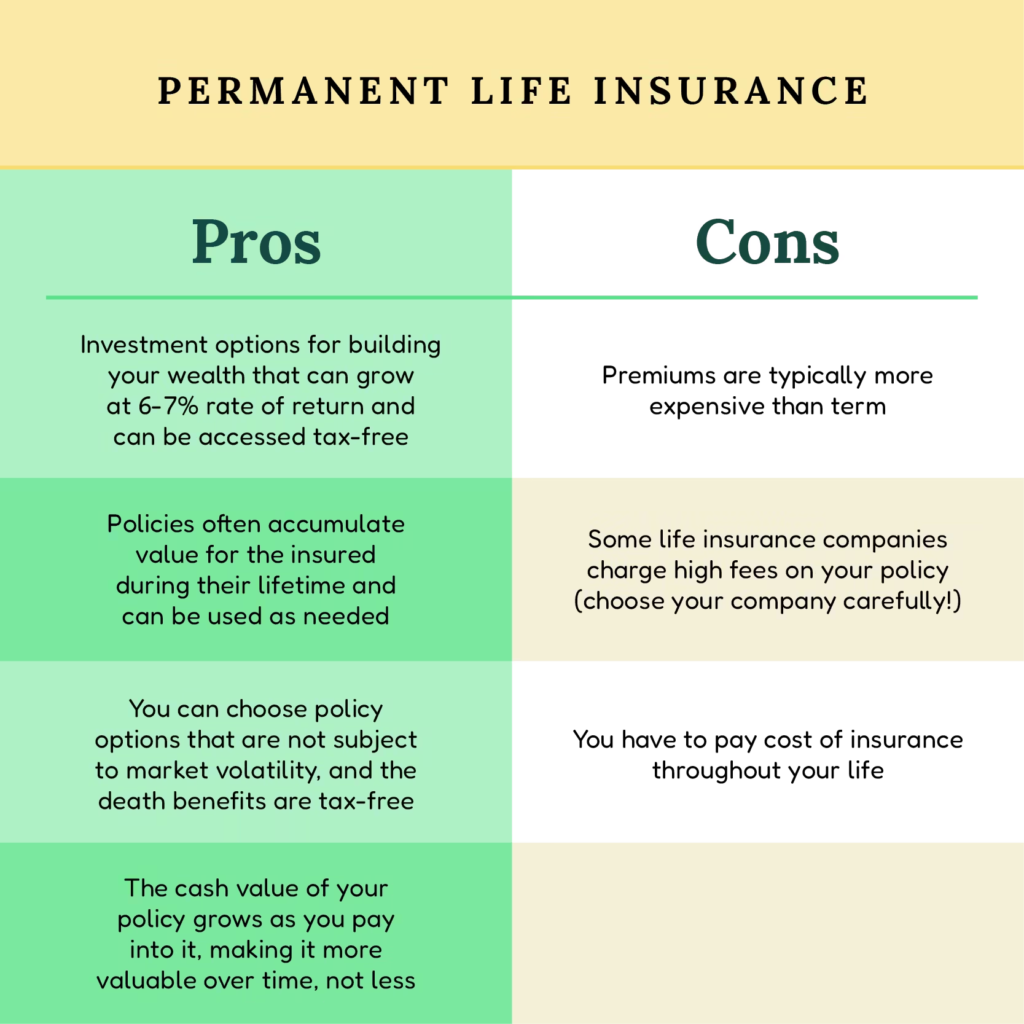

- Death Benefit Protection: Whole life insurance provides a guaranteed death benefit to beneficiaries, ensuring financial security for loved ones.

- Tax Advantages: The tax-deferred growth and potential tax-free death benefit make whole life insurance an attractive option for tax-efficient wealth accumulation.

- Guaranteed Cash Value Growth: Policyholders benefit from the guaranteed growth of the cash value component, providing stability and predictability in investment returns.

- Diversification within Investment Portfolio: Whole life insurance offers diversification within an investment portfolio, particularly for conservative investors seeking stable returns.

B. Drawbacks:

- Higher Premiums: Whole life insurance typically requires higher premiums compared to term life insurance, making it less affordable for some individuals.

- Lower Investment Returns: The investment returns of whole life insurance may be lower compared to other investment options such as stocks or mutual funds, limiting potential wealth accumulation.

- Policy Complexity: Whole life insurance policies can be complex, with various features and options that may be difficult for some individuals to understand.

- Opportunity Cost: Tying up funds in a whole life insurance policy may result in the opportunity cost of not investing in potentially higher-yielding investment opportunities.

V. Comparing Whole Life Insurance with Other Investment Options:

A. Stocks and Bonds:

- Risk-Return Tradeoff: Stocks offer higher potential returns but come with higher risk compared to whole life insurance. Bonds offer lower returns but are less volatile.

- Liquidity: Stocks and bonds offer higher liquidity compared to whole life insurance, allowing investors to access funds more readily.

- Tax Implications: Stocks and bonds may incur taxes on capital gains and dividends, whereas whole life insurance offers tax-deferred growth.

B. Mutual Funds and ETFs:

- Diversification: Mutual funds and ETFs offer diversification across various asset classes, sectors, and geographic regions, potentially reducing investment risk.

- Management Fees: Mutual funds and ETFs may charge management fees, reducing overall investment returns, whereas whole life insurance typically has embedded fees.

- Performance: Mutual funds and ETFs may offer higher returns compared to whole life insurance, but with higher volatility.

C. Real Estate:

- Appreciation Potential: Real estate investments offer potential for property value appreciation over time, potentially yielding higher returns compared to whole life insurance.

- Cash Flow Generation: Rental properties can generate rental income, providing a source of cash flow, whereas whole life insurance primarily offers accumulation of cash value.

- Illiquidity: Real estate investments are relatively illiquid compared to whole life insurance, as selling properties may take time and incur transaction costs.

VI. Case Studies and Examples:

A. Case Study Illustrating Cash Value Growth:

A hypothetical case study can demonstrate the growth of cash value within a whole life insurance policy over time, showcasing the impact of premiums, interest rates, and dividends on the policy’s value.

B. Comparison of Investment Outcomes:

Using hypothetical scenarios, a comparison can be made between the investment outcomes of whole life insurance and other investment options, such as stocks, bonds, mutual funds, ETFs, and real estate, to illustrate the potential advantages and drawbacks of each.

VII. Incorporating Whole Life Insurance into Financial Planning:

A. Determining Suitability:

- Assessing Financial Goals and Risk Tolerance: Understanding one’s financial objectives and risk tolerance is crucial in determining whether whole life insurance aligns with their investment strategy.

- Evaluating Affordability of Premiums: Whole life insurance premiums should be affordable and sustainable over the long term.

- Considering Other Existing Insurance Coverage: Whole life insurance should complement existing insurance coverage and financial planning strategies.

B. Integration with Existing Investment Portfolio:

- Balancing Risk and Return: Whole life insurance can be integrated into an investment portfolio to balance risk and return, particularly for conservative investors seeking stable returns.

- Optimizing Tax Efficiency: Whole life insurance can serve as a tax-efficient investment vehicle, providing tax-deferred growth and potential tax-free death benefits.

- Rebalancing Strategies: Periodic review and adjustment of the investment portfolio, including whole life insurance, can ensure alignment with changing financial goals and market conditions.

VIII. Regulatory Considerations and Consumer Protection:

A. Regulation of Insurance Industry:

The insurance industry is regulated by state insurance departments, which oversee insurance companies’ financial stability, product offerings, and consumer protection.

B. Consumer Rights and Disclosures:

Insurance companies are required to provide policyholders with clear and transparent disclosures regarding policy features, fees, charges, and potential risks.

C. Choosing a Reputable Insurer:

Selecting a reputable and financially stable insurance company is essential to ensure the security and reliability of whole life insurance policies.

IX. Conclusion:

Whole life insurance offers a unique combination of protection and investment opportunities through its cash value component. While it may not be suitable for everyone, understanding the mechanics, growth potential, advantages, and drawbacks of whole life insurance is essential for making informed financial decisions. By comparing whole life insurance with other investment options and integrating it into a comprehensive financial plan, individuals can achieve their long-term financial goals while ensuring financial security for themselves and their loved ones.

This comprehensive exploration of whole life insurance as an investment vehicle highlights its role in financial planning and equips readers with the knowledge needed to evaluate its suitability within their investment portfolios.

There is perceptibly a bunch to know about this. I suppose you made certain good points in features also.

Nice post. I be taught one thing more difficult on different blogs everyday. It’ll always be stimulating to learn content material from different writers and follow a bit of one thing from their store. I抎 favor to make use of some with the content on my blog whether you don抰 mind. Natually I抣l offer you a link in your web blog. Thanks for sharing.

Excellent blog you have here but I was curious about if you knew of any community forums that cover the same topics talked about in this article? I’d really like to be a part of group where I can get feed-back from other knowledgeable individuals that share the same interest. If you have any recommendations, please let me know. Kudos!

I have seen that today, more and more people are increasingly being attracted to digital cameras and the industry of pictures. However, to be a photographer, it’s important to first shell out so much period deciding the model of video camera to buy plus moving store to store just so you could buy the cheapest camera of the trademark you have decided to choose. But it isn’t going to end there. You also have take into consideration whether you should purchase a digital photographic camera extended warranty. Thanks alot : ) for the good suggestions I acquired from your site.

I intended to post you a tiny observation so as to say thanks a lot over again for your personal gorgeous tactics you’ve documented in this case. This has been tremendously open-handed with you to make unreservedly all a few people would’ve marketed as an electronic book to get some cash on their own, principally seeing that you could have tried it if you ever considered necessary. These solutions in addition worked as the great way to be certain that the rest have the same desire the same as mine to grasp a great deal more pertaining to this condition. Certainly there are many more fun periods in the future for people who examine your website.

I enjoy what you guys are usually up too. This type of clever work and reporting! Keep up the great works guys I’ve incorporated you guys to my blogroll.

Thanks for your publication. I also think that laptop computers have become more and more popular nowadays, and now are sometimes the only sort of computer used in a household. This is due to the fact that at the same time potentially they are becoming more and more affordable, their processing power is growing to the point where they can be as robust as desktop computers coming from just a few years back.

I am continuously browsing online for posts that can aid me. Thx!