Introduction:

Climate change is no longer a distant threat; it’s a reality that’s reshaping our world, and the insurance industry is feeling its effects keenly. As extreme weather events become more frequent and severe due to global warming, insurers are facing unprecedented challenges. In this blog post, we’ll explore how climate change is impacting insurance, from rising premiums to changes in risk assessment, and how the industry is adapting to promote climate resilience.

Rising Premiums:

One of the most visible impacts of climate change on insurance is the rise in premiums. With hurricanes, wildfires, floods, and storms causing significant damage to properties and infrastructure, insurers are facing higher financial risks. To stay afloat, insurers often need to adjust premiums to cover potential losses. Unfortunately, this often means higher premiums for policyholders, especially those in high-risk areas.

Additionally, reinsurers, who provide coverage to primary insurers, also face increased costs due to climate-related risks. These costs may trickle down to policyholders through higher premiums, putting further pressure on household budgets.

Changes in Risk Assessment:

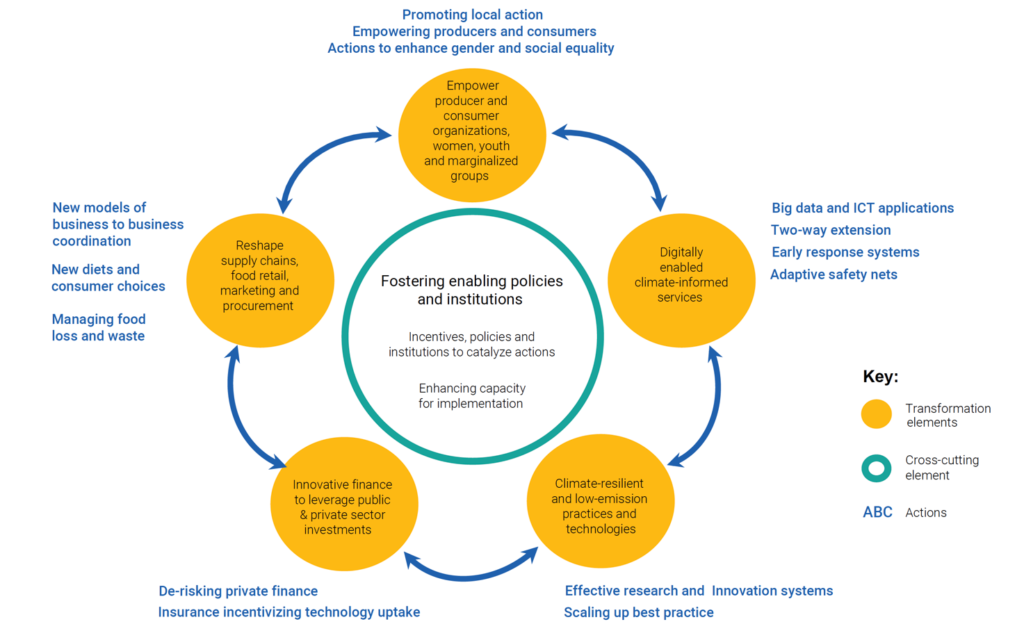

Traditional risk assessment methods used by insurers may no longer suffice in the face of climate change. With new variables and uncertainties introduced, insurers are turning to advanced technologies like climate modeling and remote sensing to better understand and quantify climate-related risks. By incorporating climate data into their risk models, insurers can more accurately assess the likelihood and severity of climate-related losses, allowing for more precise pricing and risk management strategies.

Role of Insurance in Climate Adaptation and Resilience:

Despite the challenges posed by climate change, insurance also plays a crucial role in promoting climate adaptation and resilience. By providing financial protection against climate-related losses, insurance incentivizes individuals and businesses to invest in risk-reducing measures such as resilient building practices and climate-smart infrastructure.

Insurers are also developing specialized products and services to support climate adaptation efforts. For example, parametric insurance products offer rapid payouts based on predefined triggers, enabling quicker access to funds for post-disaster recovery.

Moreover, insurers are actively advocating for policies and regulations that promote climate resilience and mitigation. By collaborating with governments and other stakeholders, insurers can influence the development of climate-conscious policies such as building codes and infrastructure investments, further enhancing community resilience.

Conclusion:

Climate change presents significant challenges to the insurance industry, but it also presents opportunities for innovation and collaboration. By embracing new technologies, refining risk assessment methods, and promoting climate adaptation and resilience, insurers can help communities and economies better withstand the impacts of climate change. As we navigate the uncertainties of a changing climate, the insurance industry has a crucial role to play in building a more resilient future for all.