INTRODUCTION

Insurtech Dynamic Pricing and its transformative impact on the insurance industry. In today’s rapidly evolving landscape, insurers are seeking ways to enhance pricing accuracy, improve risk assessment, and personalize offerings to meet the diverse needs of customers. Insurtech Dynamic Pricing offers a solution by leveraging advanced analytics, real-time data, and machine learning algorithms to adjust premiums dynamically based on individual risk profiles and market conditions. In this post, we’ll explore the concept of Insurtech Dynamic Pricing, examine its key features and benefits, and discuss how it’s reshaping the future of insurance pricing.

Understanding Insurtech Dynamic Pricing

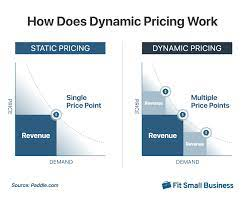

Insurtech Dynamic Pricing is a data-driven approach to insurance pricing that uses real-time data, advanced analytics, and machine learning algorithms to adjust premiums dynamically based on individual risk factors and market dynamics. Unlike traditional pricing models, which rely on static rating factors and historical data, Insurtech Dynamic Pricing adapts to changing circumstances, allowing insurers to optimize pricing strategies, improve risk selection, and enhance profitability.

At its core, Insurtech Dynamic Pricing involves the following key components:

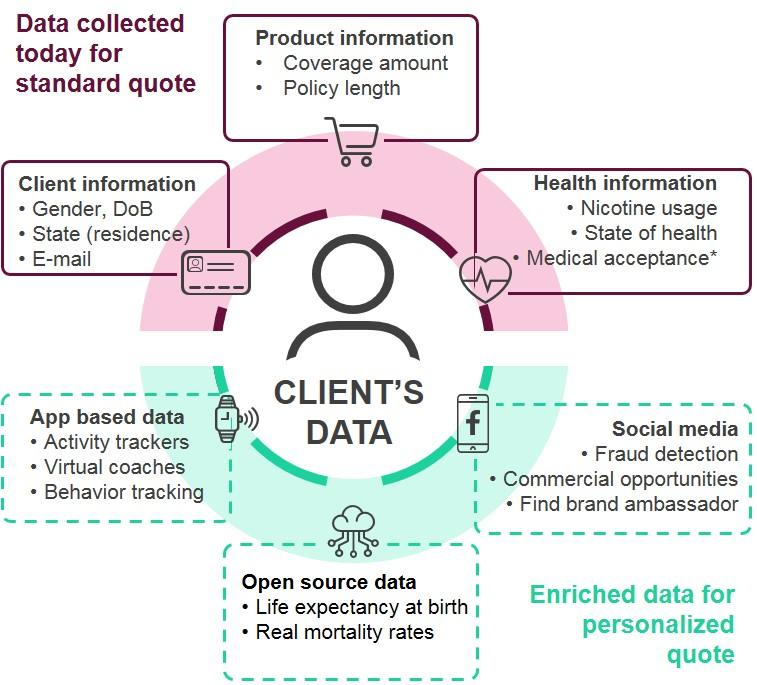

- Real-time Data Integration: Insurtech Dynamic Pricing relies on the integration of real-time data sources, including telematics, IoT devices, wearables, and external data feeds, to capture up-to-date information about individual risk factors and market conditions. By leveraging real-time data, insurers can gain deeper insights into customer behavior, environmental factors, and emerging risks, enabling more accurate pricing decisions.

- Advanced Analytics and Machine Learning: Insurtech Dynamic Pricing uses advanced analytics techniques, such as predictive modeling, machine learning, and artificial intelligence, to analyze vast amounts of data and identify patterns, trends, and correlations. By leveraging machine learning algorithms, insurers can develop predictive models that assess individual risk profiles, predict claim likelihood, and estimate potential losses more accurately, leading to more precise pricing adjustments.

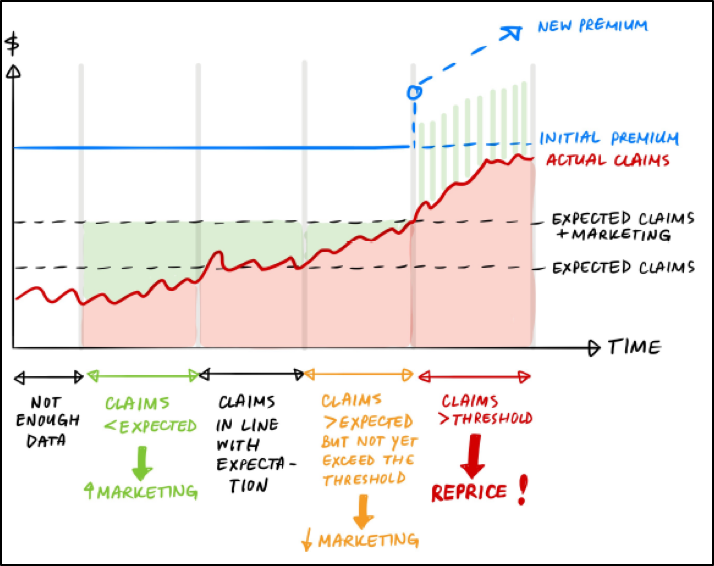

- Dynamic Pricing Algorithms: Insurtech Dynamic Pricing algorithms continuously analyze real-time data and adjust premiums dynamically based on individual risk profiles and market conditions. These algorithms take into account various factors, such as driving behavior, credit history, demographic information, and environmental factors, to calculate personalized premiums that reflect the actual risk exposure of each policyholder.

- Personalization and Customization: Insurtech Dynamic Pricing enables insurers to personalize pricing based on individual risk profiles, preferences, and behaviors. By tailoring premiums to match the specific needs and characteristics of each policyholder, insurers can improve customer satisfaction, increase retention, and attract new customers who value personalized offerings.

- Transparency and Fairness: Insurtech Dynamic Pricing promotes transparency and fairness by providing policyholders with insights into the factors influencing their premiums and the rationale behind pricing decisions. By enhancing transparency and communication, insurers can build trust with customers, mitigate concerns about pricing fairness, and foster long-term relationships based on mutual understanding and transparency.

Benefits of Insurtech Dynamic Pricing

Insurtech Dynamic Pricing offers a range of benefits for insurers and policyholders alike, including:

- Improved Pricing Accuracy: Insurtech Dynamic Pricing enables insurers to assess risk more accurately by leveraging real-time data and advanced analytics to develop predictive models that reflect individual risk profiles and market conditions. By adjusting premiums dynamically based on up-to-date information, insurers can price policies more accurately and mitigate adverse selection, leading to improved profitability and risk management.

- Enhanced Risk Selection: Insurtech Dynamic Pricing allows insurers to identify and select risks more effectively by analyzing individual risk factors and behaviors in real-time. By leveraging machine learning algorithms, insurers can develop predictive models that differentiate between high-risk and low-risk policyholders, enabling more precise risk selection and pricing adjustments that reflect the actual risk exposure of each customer.

- Personalized Customer Experience: Insurtech Dynamic Pricing enables insurers to tailor premiums and offerings to match the specific needs and preferences of individual policyholders. By personalizing pricing based on factors such as driving behavior, lifestyle, and coverage preferences, insurers can enhance the customer experience, increase satisfaction, and foster loyalty among policyholders who value personalized offerings.

- Optimized Underwriting and Profitability: Insurtech Dynamic Pricing helps insurers optimize underwriting and pricing strategies to maximize profitability and minimize risk. By leveraging real-time data and predictive analytics, insurers can identify profitable market segments, adjust premiums dynamically to reflect changing risk profiles, and optimize pricing strategies to achieve the desired balance between risk and reward.

- Greater Competitiveness and Differentiation: Insurtech Dynamic Pricing allows insurers to differentiate themselves in the market by offering innovative pricing models and personalized offerings that meet the unique needs of customers. By leveraging advanced analytics and machine learning algorithms, insurers can differentiate themselves from competitors, attract new customers, and gain a competitive edge in a crowded marketplace.

Use Cases and Applications

Insurtech Dynamic Pricing can be applied across various lines of business and use cases within the insurance industry, including:

- Usage-based Insurance (UBI): Insurtech Dynamic Pricing enables insurers to offer usage-based insurance products, such as pay-as-you-drive (PAYD) or pay-how-you-drive (PHYD) auto insurance. By leveraging telematics and IoT devices to monitor driving behavior in real-time, insurers can adjust premiums dynamically based on factors such as mileage, speed, acceleration, and braking patterns, leading to more accurate pricing and risk assessment.

- Behavior-based Insurance: Insurtech Dynamic Pricing enables insurers to offer behavior-based insurance products that reward policyholders for adopting safer behaviors and lifestyles. By analyzing behavioral data from wearable devices, smart home sensors, and mobile apps, insurers can incentivize policyholders to engage in healthy behaviors, reduce risks, and lower their premiums through discounts, rewards, or personalized incentives.

- On-demand Insurance: Insurtech Dynamic Pricing facilitates the development of on-demand insurance products that provide coverage on a flexible, pay-as-you-go basis. By leveraging real-time data and mobile technology, insurers can offer on-demand insurance for specific events, activities, or durations, enabling policyholders to purchase coverage when needed and pay premiums based on actual usage, leading to greater flexibility and affordability.

- Dynamic Pricing for Commercial Insurance: Insurtech Dynamic Pricing supports dynamic pricing models for commercial insurance products, such as property, liability, and workers’ compensation coverage. By analyzing real-time data from sensors, IoT devices, and business systems, insurers can adjust premiums dynamically based on factors such as business activities, industry trends, and environmental conditions, enabling more accurate risk assessment and pricing for commercial clients.

- Health and Life Insurance: Insurtech Dynamic Pricing enables insurers to offer personalized health and life insurance products that reflect individual risk factors, lifestyle choices, and health behaviors. By leveraging data from wearable devices, electronic health records (EHR), and genetic testing, insurers can adjust premiums dynamically based on factors such as fitness levels, genetic predispositions, and lifestyle habits, leading to more accurate pricing and risk assessment for health and life insurance coverage.

Challenges and Considerations

While Insurtech Dynamic Pricing offers significant opportunities for insurers, it also presents challenges and considerations that must be addressed:

- Data Privacy and Security: Insurtech Dynamic Pricing relies on access to vast amounts of personal and sensitive data, raising concerns about data privacy and security. Insurers must ensure compliance with data protection regulations, such as GDPR and CCPA, and implement robust security measures to protect customer data from unauthorized access, breaches, or misuse.

- Model Interpretability and Transparency: Insurtech Dynamic Pricing algorithms can be complex and opaque, making it challenging to interpret their decisions and understand the factors driving pricing adjustments. Insurers must prioritize model interpretability and transparency to ensure that pricing decisions are explainable, understandable, and fair, particularly in regulated or high-stakes applications such as health and life insurance.

- Regulatory Compliance: Insurers must navigate regulatory requirements and compliance obligations when deploying Insurtech Dynamic Pricing models, particularly in areas such as data privacy, fairness, and transparency. Compliance with regulations such as GDPR, HIPAA, and anti-discrimination laws is essential to protect consumer rights and maintain trust in the insurance system.

- Ethical and Social Implications: Insurtech Dynamic Pricing algorithms can perpetuate biases and inequalities present in the underlying data, leading to unfair or discriminatory outcomes. Insurers must address ethical and social implications associated with algorithmic decision-making, such as bias mitigation, fairness assessment, and algorithmic accountability, to ensure that pricing models are ethical and responsible.

- Customer Perception and Acceptance: Insurtech Dynamic Pricing may raise concerns among customers about privacy, fairness, and transparency, particularly if pricing adjustments are perceived as intrusive or discriminatory. Insurers must communicate transparently with customers about the factors influencing their premiums and the rationale behind pricing decisions to build trust and address concerns about fairness and discrimination.

Conclusion

In conclusion, Insurtech Dynamic Pricing represents a paradigm shift in insurance pricing, offering insurers a data-driven approach to pricing that adapts to individual risk profiles and market dynamics in real-time. By leveraging advanced analytics, machine learning algorithms, and real-time data, insurers can optimize pricing strategies, improve risk assessment, and enhance the overall customer experience.

As insurers continue to embrace Insurtech Dynamic Pricing and incorporate it into their pricing models, they must address key challenges and considerations related to data privacy, model interpretability, regulatory compliance, ethical implications, and customer perception. By prioritizing transparency, fairness, and accountability in their pricing practices, insurers can harness the full potential of Insurtech Dynamic Pricing to create value for their customers, stakeholders, and society as a whole, ultimately driving greater efficiency, innovation, and competitiveness in the insurance industry.