Introduction:

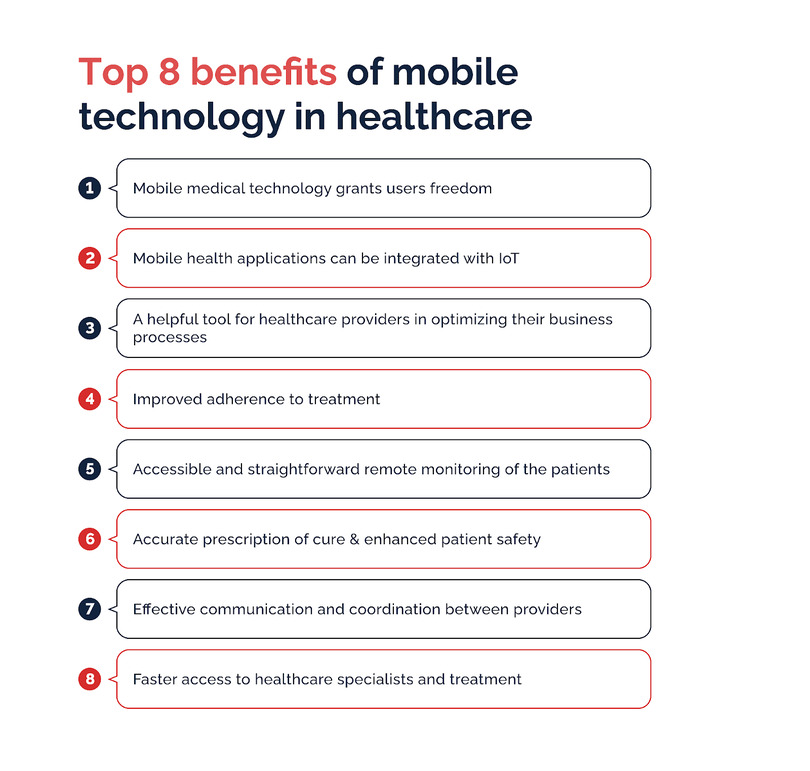

In the modern era, technology has permeated nearly every aspect of human life, reshaping how we communicate, work, and even manage our health. The advent of smartphones and wearable devices has led to the proliferation of lifestyle apps, which offer users tools to monitor and improve various aspects of their well-being. These apps track everything from physical activity and sleep patterns to nutrition and stress levels, providing users with personalized insights and actionable recommendations.

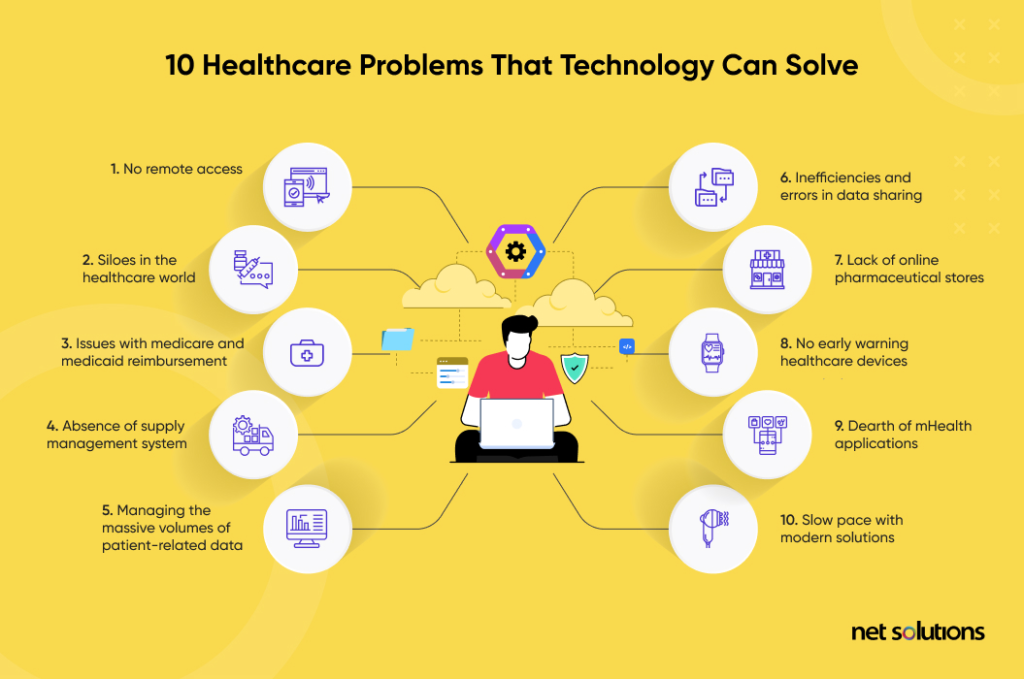

As technology continues to evolve, insurers are increasingly exploring ways to leverage lifestyle apps to incentivize healthy behaviors and mitigate risk factors associated with chronic diseases. By encouraging policyholders to adopt and maintain healthier lifestyles, insurers aim to reduce healthcare costs, improve health outcomes, and enhance overall population health. However, the integration of lifestyle apps into insurance programs raises questions about privacy, data security, and the fairness of using behavioral data to determine premiums.

In this blog, we will explore the intersection of health and technology, assessing the impact of lifestyle apps on insurance premiums. We will examine the potential benefits of incorporating digital health tools into insurance programs, discuss real-world examples of insurers leveraging lifestyle apps, and address the challenges and considerations associated with this emerging trend.

The Potential Benefits of Lifestyle Apps:

Lifestyle apps offer a range of potential benefits for individuals, insurers, and society as a whole. By empowering users to monitor and improve their health behaviors, these digital tools can lead to better health outcomes, reduced healthcare costs, and enhanced quality of life.

- Health Promotion and Disease Prevention:

Lifestyle apps provide users with personalized insights and recommendations based on their health data, encouraging them to adopt healthier habits and lifestyles. From reminders to drink more water and stand up regularly to personalized workout routines and nutrition plans, these apps can help individuals make informed decisions about their health and well-being. By promoting preventive measures such as regular exercise, balanced nutrition, and stress management, lifestyle apps can reduce the risk of chronic diseases such as obesity, diabetes, and heart disease.

- Behavioral Insights and Risk Assessment:

The data collected by lifestyle apps can offer valuable insights into users’ behaviors, preferences, and risk factors. By analyzing patterns in physical activity, sleep quality, dietary habits, and other health metrics, insurers can assess individuals’ risk profiles and tailor interventions accordingly. For example, individuals with sedentary lifestyles or poor sleep habits may be at higher risk for chronic conditions and could benefit from targeted interventions such as wellness coaching, incentives for physical activity, or access to resources for improving sleep hygiene.

- Engagement and Empowerment:

Lifestyle apps leverage gamification, social networking, and behavioral economics principles to engage users and motivate them to adopt healthy behaviors. Features such as challenges, rewards, progress tracking, and social support networks create a sense of accountability and community, fostering long-term behavior change. By empowering individuals to take an active role in managing their health, lifestyle apps can enhance self-efficacy, resilience, and overall well-being.

- Cost Savings and Risk Mitigation:

From an insurer’s perspective, promoting healthy behaviors through lifestyle apps can lead to cost savings and risk mitigation. By incentivizing policyholders to adopt healthier lifestyles, insurers can reduce the incidence and severity of chronic diseases, decrease healthcare utilization, and lower overall claims costs. Moreover, by proactively addressing risk factors such as obesity, smoking, and sedentary behavior, insurers can mitigate long-term health risks and improve the long-term insurability of their members.

Real-World Examples of Insurers Leveraging Lifestyle Apps:

Several insurers have embraced lifestyle apps as a means of engaging members, promoting healthy behaviors, and enhancing the value of their insurance offerings. These initiatives span various types of insurance, including health, life, and disability, and employ a range of strategies to incentivize and reward users for adopting healthy habits.

- Health Insurance:

Many health insurers offer wellness programs and incentives that incorporate lifestyle apps as a central component. For example, insurers may provide discounts on premiums or rewards for meeting activity goals, logging healthy meals, or completing preventive screenings. Some insurers partner with third-party app developers or integrate their own proprietary apps into their member portals, allowing users to seamlessly track their progress and earn rewards for healthy behaviors.

- Life Insurance:

Life insurers are increasingly leveraging lifestyle data to underwrite policies and assess risk. By analyzing applicants’ health data from wearable devices or lifestyle apps, insurers can gain insights into individuals’ habits, behaviors, and overall health status. Some insurers offer discounts or premium incentives for policyholders who participate in health and wellness programs or demonstrate healthy behaviors over time. Additionally, insurers may offer value-added services such as virtual coaching, telemedicine consultations, or preventive health screenings to support policyholders’ well-being.

- Disability Insurance:

Disability insurers are exploring ways to use lifestyle apps to promote early intervention and support return-to-work efforts. By monitoring employees’ health and wellness metrics, insurers can identify early signs of potential health issues or workplace injuries and intervene proactively to prevent disability claims. Lifestyle apps may offer features such as ergonomic assessments, stress management tools, and resources for improving workplace ergonomics, thereby reducing the risk of occupational injuries and disabilities.

Challenges and Considerations:

While lifestyle apps hold promise for improving health outcomes and reducing insurance risk, their integration into insurance programs raises several challenges and considerations for consumers, insurers, and policymakers.

- Privacy and Data Security:

The collection, storage, and sharing of personal health data raise concerns about privacy and data security. Users may be hesitant to share sensitive health information with insurers or third-party app developers, fearing potential breaches or misuse of their data. Insurers must implement robust data protection measures, transparent privacy policies, and consent mechanisms to safeguard users’ privacy and comply with regulatory requirements such as the Health Insurance Portability and Accountability Act (HIPAA).

- Equity and Accessibility:

Access to technology and digital health tools may not be equitable across all demographic groups, potentially exacerbating health disparities. Individuals without smartphones, internet access, or digital literacy skills may be excluded from participating in lifestyle app-based programs or accessing health-related information and resources. Insurers must ensure that their programs are accessible to all members, regardless of socioeconomic status, geographic location, or technological proficiency, to promote health equity and inclusivity.

- Accuracy and Reliability:

The accuracy and reliability of health data collected by lifestyle apps may vary depending on factors such as device accuracy, user compliance, and data integration capabilities. Inaccurate or incomplete data could lead to misinterpretation of users’ health status, inappropriate risk assessments, and suboptimal outcomes. Insurers must validate the accuracy and reliability of health data collected from lifestyle apps and supplement it with additional sources of information, such as medical records or biometric screenings, to ensure robust risk assessment and decision-making.

- Regulatory and Ethical Considerations:

The use of lifestyle apps in insurance programs raises complex regulatory and ethical considerations related to data protection, informed consent, and fairness. Regulators must balance the potential benefits of leveraging digital health data for risk assessment and underwriting with the need to protect consumers from discrimination, privacy violations, and unfair practices. Insurers must adhere to regulatory requirements and industry guidelines governing the collection, use, and disclosure of personal health information, ensuring transparency, accountability, and ethical conduct throughout the process.

Conclusion:

Lifestyle apps have the potential to revolutionize the insurance industry by promoting healthy behaviors, reducing healthcare costs, and improving risk assessment and underwriting processes. However, their integration into insurance programs raises complex challenges related to privacy, equity, accuracy, and ethics. By addressing these challenges thoughtfully and collaboratively, insurers, policymakers, and technology providers can harness the power of digital health tools to enhance the health and well-being of individuals and communities across the globe.