Introduction:

Car insurance is a vital investment for drivers, offering crucial financial protection in the event of accidents, theft, or damage to their vehicles. However, while most drivers are aware of the upfront cost, known as the premium, there exists a realm of hidden costs within car insurance policies that often go unnoticed. These hidden expenses can substantially impact overall expenses and catch drivers off guard. In this blog post, we’ll embark on a journey to uncover these clandestine expenses, shedding light on the often-overlooked factors that can significantly affect your bottom line when it comes to car insurance. By gaining a deeper understanding of these hidden costs, drivers can make more informed decisions and better prepare themselves financially for any unforeseen circumstances that may arise on the road. Let’s delve into the intricacies of car insurance and unveil the hidden costs lurking beneath the surface.

Chapter 1: Unveiling the True Cost of Deductibles

Deductibles are a key component of car insurance policies, representing the amount you must pay out of pocket before your insurance coverage kicks in. While selecting a higher deductible can lower your premium, it also means you’ll be responsible for more expenses in the event of an accident. Understanding the true cost of deductibles involves:

- The Role of Deductibles: Explaining how deductibles work and their impact on your insurance costs.

- Choosing the Right Deductible: Tips for selecting a deductible amount that aligns with your financial situation and risk tolerance.

- Calculating the Potential Savings: Illustrating how choosing a higher deductible can lead to savings on your premium but also increase your financial liability in the event of a claim.

Chapter 2: Assessing Coverage Limits and Gaps in Protection

Coverage limits dictate the maximum amount your insurance provider will pay for covered losses. While it’s essential to have adequate coverage, insufficient limits can leave you vulnerable to out-of-pocket expenses. This chapter explores:

- Understanding Coverage Limits: Differentiating between bodily injury liability, property damage liability, and other types of coverage.

- Evaluating Adequacy: Assessing whether your coverage limits provide sufficient protection based on your assets, driving habits, and potential liabilities.

- Identifying Gaps in Coverage: Discussing common gaps in coverage, such as uninsured/underinsured motorist coverage and optional add-ons like rental car reimbursement.

Chapter 3: Uncovering Additional Fees and Surcharges

Beyond the premium, car insurance policies often come with hidden fees and surcharges that can inflate your overall costs. These fees may include administrative charges, processing fees, and installment fees. This chapter delves into:

- Administrative Fees: Exploring the various administrative charges imposed by insurance companies and how they contribute to the total cost of coverage.

- Surcharges for Incidents: Discussing how accidents, traffic violations, and claims history can result in surcharges or rate increases.

- The Impact of Credit Scores: Examining the relationship between credit scores, insurance scores, and premium rates, and strategies for maintaining a favorable score.

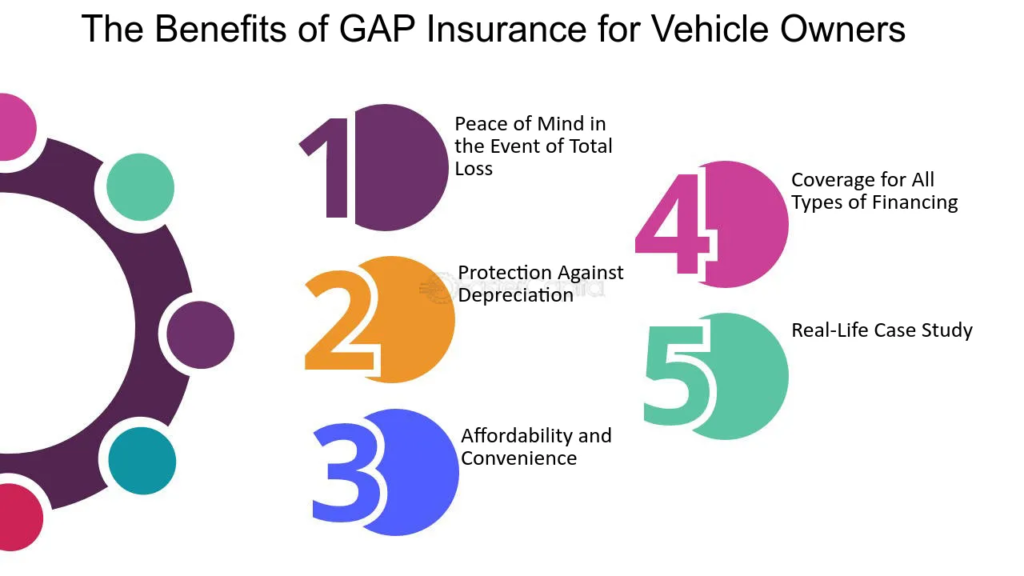

Chapter 4: Beyond the Policy: Considering Maintenance, Repairs, and Depreciation

Car insurance doesn’t just cover accidents—it also factors in maintenance, repairs, and depreciation. While these costs may not be directly related to your premium, they can impact your overall financial burden. This chapter covers:

- Routine Maintenance: Highlighting the importance of regular servicing, tire replacements, and fluid checks in maintaining your vehicle’s performance and safety.

- Repair Expenses: Discussing labor rates, parts prices, and your deductible obligations in the event of vehicle damage.

- Depreciation’s Impact: Explaining how depreciation affects insurance settlements and the difference between actual cash value and replacement cost coverage.

Chapter 5: The Importance of Shopping Around and Comparing Quotes

Shopping around for car insurance is crucial for finding the best coverage at the most affordable price. This chapter explores:

- Benefits of Comparison Shopping: Discussing the advantages of obtaining quotes from multiple insurers and the potential savings it can yield.

- Factors to Consider: Highlighting factors such as coverage options, customer service, and financial stability when comparing insurance providers.

- Utilizing Online Tools: Explaining how online comparison tools and independent agents can streamline the shopping process and help you find the right policy.

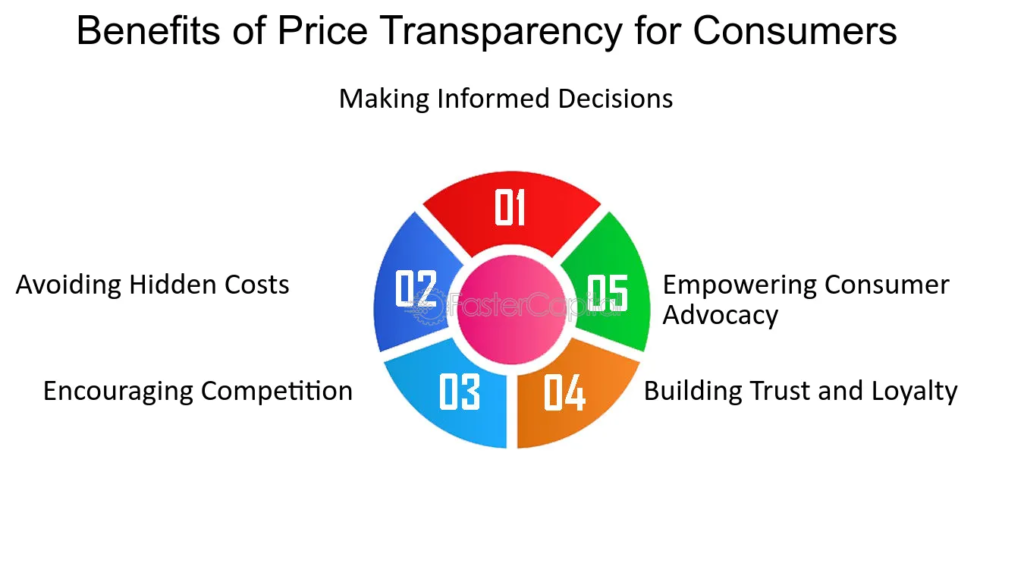

Chapter 6: Advocating for Transparency and Consumer Rights

As consumers, it’s essential to be aware of our rights and advocate for transparency in the insurance industry. This chapter addresses:

- Regulatory Oversight: Discussing the role of state insurance departments and consumer protection laws in safeguarding consumers’ interests.

- Understanding Policy Terms: Empowering consumers to understand their policy terms, including cancellation policies, claims processing procedures, and dispute resolution mechanisms.

- Accessing Resources: Providing information on insurance education materials, complaint databases, and advocacy organizations that can assist consumers in navigating the insurance landscape.

Conclusion:

Navigating the hidden costs of car insurance requires a comprehensive understanding of policy terms, coverage options, and financial implications. By uncovering hidden fees, assessing coverage needs, and shopping around for the best rates, drivers can mitigate the impact of these hidden costs and make informed decisions to protect their assets and financial well-being. Additionally, advocating for transparency and consumer rights ensures that insurance companies uphold fair and equitable practices, fostering trust and accountability within the industry.

In conclusion, navigating the hidden costs of car insurance demands more than just a glance at the premium. It requires a deep understanding of policy terms, coverage options, and the financial implications that come with them. By taking proactive steps to uncover hidden fees, assess coverage needs, and explore various insurers for the best rates, drivers can mitigate the impact of these hidden costs and make informed decisions that safeguard their assets and financial well-being.

Moreover, advocating for transparency and consumer rights is vital in ensuring that insurance companies uphold fair and equitable practices. By holding insurers accountable and demanding clarity in policy terms, consumers can foster trust and accountability within the industry. This not only benefits individual policyholders but also contributes to a more transparent and ethical insurance landscape for all.

Ultimately, by arming themselves with knowledge, actively engaging in comparison shopping, and advocating for their rights, drivers can navigate the complexities of car insurance with confidence, ensuring they are adequately protected without falling victim to hidden costs. With a proactive approach and a commitment to transparency, drivers can secure the coverage they need while minimizing the financial burden of hidden fees and charges.