INTRODUCTION

Insurtech Platform as a Service (PaaS) and its transformative impact on the insurance industry. In today’s fast-paced digital landscape, traditional insurers are facing increasing pressure to innovate, adapt, and deliver seamless, customer-centric experiences. Insurtech PaaS offers a solution by providing insurers with flexible, scalable platforms that enable rapid development, deployment, and management of digital insurance solutions. In this post, we’ll delve into the concept of Insurtech PaaS, examine its key features and benefits, and explore its role in shaping the future of insurance.

Understanding Insurtech Platform as a Service (PaaS)

Insurtech Platform as a Service (PaaS) is a cloud-based platform that provides insurers with a suite of tools, services, and infrastructure to build, launch, and manage digital insurance products and services. Similar to other PaaS offerings in the technology space, Insurtech PaaS enables insurers to leverage pre-built components, APIs, and integrations to accelerate the development process and reduce time-to-market for new insurance offerings.

At its core, Insurtech PaaS is designed to address the unique challenges and opportunities facing insurers in the digital age, including rising customer expectations, evolving regulatory requirements, and increasing competition from agile, tech-savvy startups. By providing a flexible, modular platform that can adapt to changing market dynamics and customer needs, Insurtech PaaS empowers insurers to innovate, differentiate, and thrive in an increasingly competitive landscape.

Key Features of Insurtech PaaS

Insurtech PaaS platforms offer a range of features and capabilities designed to meet the needs of insurers across various lines of business and distribution channels. Some key features of Insurtech PaaS include:

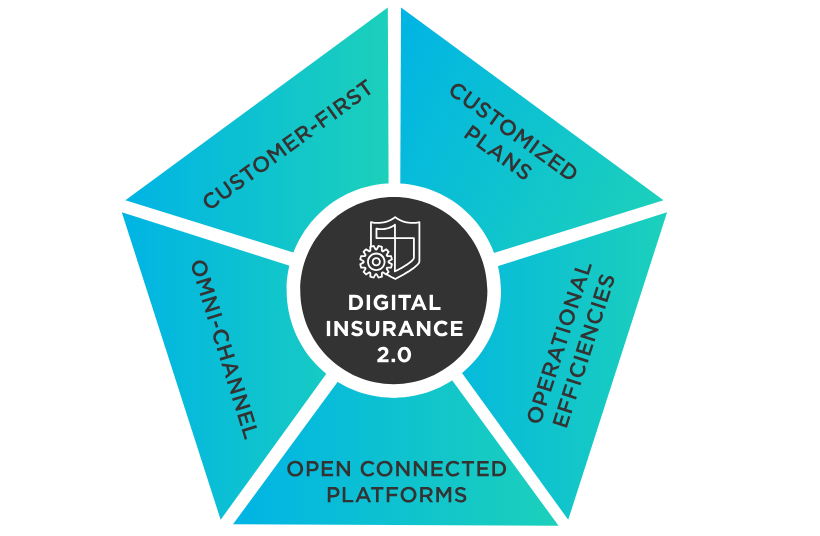

- Modular Architecture: Insurtech PaaS platforms are built on a modular architecture, allowing insurers to select and integrate the specific components and functionalities they need for their business. This modular approach enables insurers to customize their digital insurance solutions to meet the unique requirements of their target markets and customer segments.

- API-Driven Integration: Insurtech PaaS platforms offer robust APIs and integration capabilities that enable seamless connectivity with third-party systems, data sources, and external services. This allows insurers to leverage existing technology investments and integrate with a wide range of external partners, such as data providers, insurtech startups, and distribution channels.

- Scalability and Flexibility: Insurtech PaaS platforms are designed to be highly scalable and flexible, allowing insurers to rapidly scale their digital insurance offerings to meet growing demand or changing market conditions. Whether launching new products, expanding into new markets, or adapting to regulatory changes, insurers can easily adjust and scale their platforms to support their evolving business needs.

- Data Analytics and Insights: Insurtech PaaS platforms offer advanced data analytics and insights capabilities that enable insurers to derive actionable insights from their data. By analyzing customer behavior, market trends, and risk profiles, insurers can make informed decisions, optimize their product offerings, and personalize their customer experiences to drive growth and profitability.

- Digital Distribution Channels: Insurtech PaaS platforms support a variety of digital distribution channels, including web portals, mobile apps, social media, and emerging channels such as chatbots and voice assistants. This enables insurers to reach customers wherever they are and provide a seamless, omnichannel experience across all touchpoints.

Benefits of Insurtech PaaS

Insurtech PaaS offers a range of benefits for insurers looking to embrace digital transformation and drive innovation in their businesses. Some key benefits of Insurtech PaaS include:

- Accelerated Time-to-Market: Insurtech PaaS enables insurers to accelerate the development and deployment of digital insurance solutions, reducing time-to-market for new products and services. By leveraging pre-built components and integrations, insurers can streamline the development process and quickly launch innovative offerings to meet customer demand.

- Cost Efficiency: Insurtech PaaS platforms offer a cost-effective alternative to building and maintaining custom technology infrastructure in-house. By leveraging cloud-based services and shared resources, insurers can reduce capital expenditures, lower operating costs, and achieve greater efficiency and economies of scale.

- Enhanced Agility and Flexibility: Insurtech PaaS platforms provide insurers with the agility and flexibility to adapt to changing market conditions and customer needs. Whether responding to regulatory changes, market disruptions, or emerging trends, insurers can quickly adjust and evolve their digital insurance offerings to stay competitive and meet evolving customer expectations.

- Improved Customer Experience: Insurtech PaaS enables insurers to deliver a seamless, personalized customer experience across all touchpoints, from quote to claim. By leveraging data analytics and digital distribution channels, insurers can engage customers more effectively, anticipate their needs, and deliver tailored solutions that meet their specific requirements.

- Innovation and Differentiation: Insurtech PaaS empowers insurers to innovate and differentiate their offerings in a crowded marketplace. By providing access to cutting-edge technology and tools, insurers can experiment with new business models, product features, and distribution channels, driving innovation and differentiation to stand out from competitors.

Use Cases and Applications

Insurtech PaaS platforms can be applied across various lines of business and use cases, including:

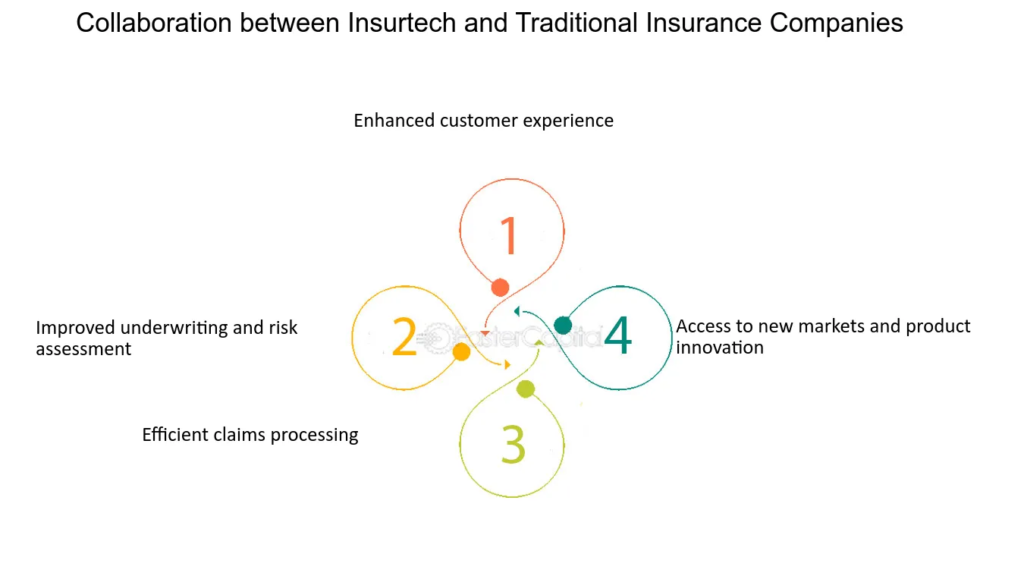

- Digital Underwriting and Policy Administration: Insurers can use Insurtech PaaS platforms to streamline underwriting and policy administration processes, reducing manual effort and improving efficiency. By automating workflows, data capture, and decision-making, insurers can enhance accuracy, speed, and consistency in underwriting and policy issuance.

- Claims Processing and Management: Insurtech PaaS platforms enable insurers to digitize and automate claims processing and management, improving speed, transparency, and customer satisfaction. By leveraging AI and machine learning algorithms, insurers can expedite claims adjudication, detect fraud, and optimize claims settlement processes for faster resolution and reduced costs.

- Customer Engagement and Experience: Insurtech PaaS platforms facilitate personalized customer engagement and experience across all touchpoints, from initial quote to ongoing policy servicing and claims handling. By leveraging data analytics and digital channels, insurers can deliver targeted marketing messages, proactive notifications, and self-service options that enhance customer satisfaction and loyalty.

- Product Innovation and Launch: Insurtech PaaS platforms empower insurers to innovate and launch new products and services more quickly and efficiently. By providing access to modular components, APIs, and development tools, insurers can experiment with new features, pricing models, and distribution channels, bringing innovative offerings to market faster and staying ahead of competitors.

- Risk Management and Analytics: Insurtech PaaS platforms enable insurers to leverage advanced data analytics and insights to improve risk management and decision-making. By analyzing historical data, market trends, and customer behavior, insurers can identify emerging risks, assess portfolio performance, and optimize pricing and underwriting strategies to achieve better outcomes and profitability.

Challenges and Considerations

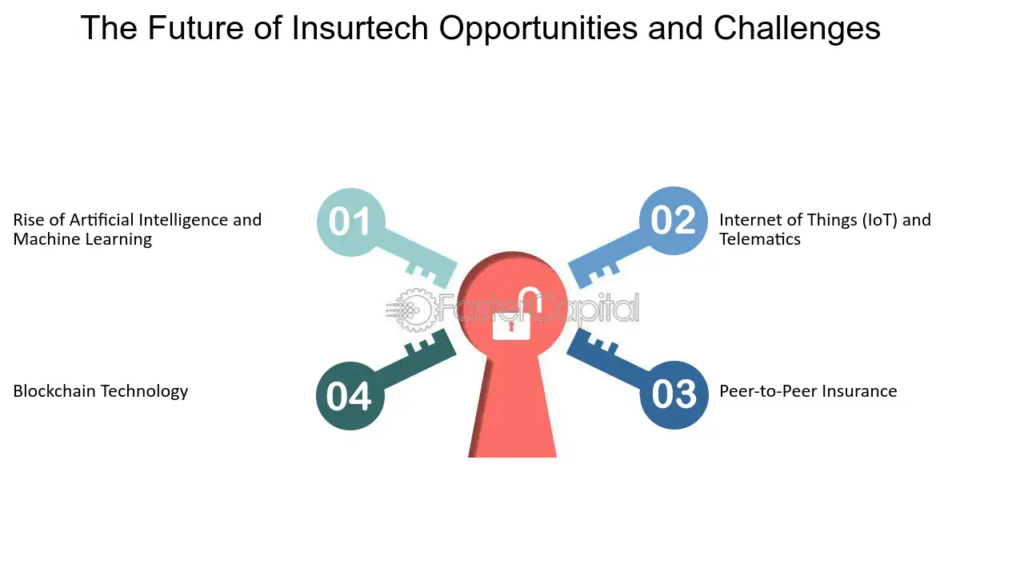

While Insurtech PaaS offers significant opportunities for insurers, it also presents challenges and considerations that must be addressed:

- Data Security and Privacy: Insurers must ensure the security and privacy of customer data when leveraging Insurtech PaaS platforms. Compliance with data protection regulations, such as GDPR and CCPA, is essential to protect sensitive information and maintain customer trust and confidence.

- Integration Complexity: Integrating Insurtech PaaS platforms with existing legacy systems and infrastructure can be complex and challenging. Insurers must carefully plan and execute integration efforts to ensure seamless connectivity, data exchange, and interoperability between systems.

- Regulatory Compliance: Insurers must navigate regulatory requirements and compliance obligations when deploying Insurtech PaaS platforms. This includes ensuring compliance with industry regulations, data protection laws, and licensing requirements, as well as addressing regulatory concerns related to data security, consumer protection, and market conduct.

- Change Management and Adoption: Insurers must manage organizational change and ensure user adoption when implementing Insurtech PaaS platforms. This involves providing training and support to employees, fostering a culture of innovation and collaboration, and addressing resistance to change to maximize the benefits of digital transformation.

- Vendor Selection and Partnership: Insurers must carefully evaluate Insurtech PaaS providers and select the right partners to meet their specific needs and objectives. This includes assessing vendors’ technology capabilities, industry expertise, track record, and financial stability, as well as evaluating factors such as pricing, scalability, and support services.

Conclusion

In conclusion, Insurtech Platform as a Service (PaaS) represents a game-changing opportunity for insurers to embrace digital transformation, drive innovation, and deliver superior customer experiences in today’s rapidly evolving insurance landscape. By providing flexible, scalable platforms that enable rapid development, deployment, and management of digital insurance solutions, Insurtech PaaS empowers insurers to differentiate themselves, stay competitive, and thrive in an increasingly digital world.

As insurers continue to leverage Insurtech PaaS to innovate and evolve their businesses, they must address key challenges and considerations related to data security, integration complexity, regulatory compliance, change management, and vendor partnerships. By overcoming these challenges and harnessing the full potential of Insurtech PaaS, insurers can unlock new opportunities for growth, profitability, and customer satisfaction, positioning themselves for success in the digital age of insurance.

shatasia andere

Ahaa, its good discussion on the topic of this piece

of writing at this place at this webpage, I have read all that, so at this time me also commenting at this place.

karidee manter