INTRODUCTION

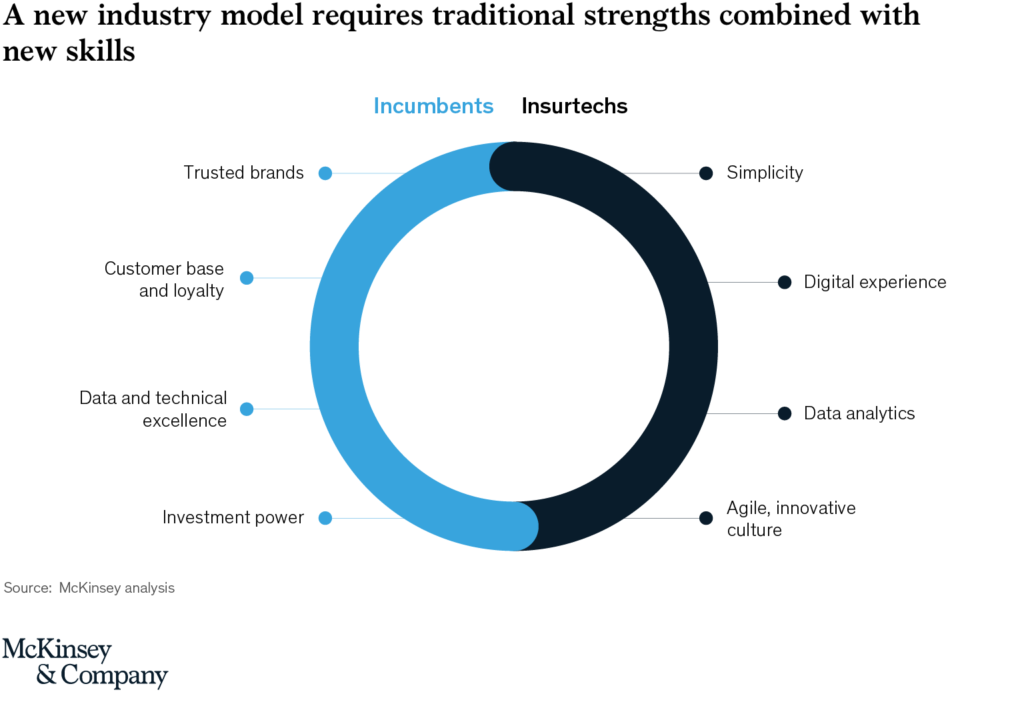

Insurance industry is undergoing a profound transformation driven by technological advancements, changing consumer expectations, and a shifting competitive landscape. Insurtech Innovations are at the forefront of this transformation, revolutionizing traditional insurance processes, products, and business models to meet the evolving needs of consumers and insurers alike. In this post, we’ll explore some of the most groundbreaking Insurtech Innovations shaping the future of insurance and driving industry-wide disruption.

Understanding Insurtech Innovations

Insurtech Innovations encompass a wide range of technological advancements, business models, and product enhancements that leverage cutting-edge technologies such as artificial intelligence (AI), machine learning (ML), blockchain, Internet of Things (IoT), and data analytics to revolutionize the insurance industry. These innovations aim to improve efficiency, enhance customer experience, mitigate risk, and unlock new opportunities for growth and profitability across the insurance value chain.

At their core, Insurtech Innovations introduce new ways of doing business, challenging traditional norms, and pushing the boundaries of what’s possible in the insurance industry. Some of the key areas of innovation include:

- Digital Distribution Channels: Insurtech Innovations are reshaping the way insurance products are distributed and sold, moving away from traditional channels such as agents and brokers towards digital platforms, online marketplaces, and direct-to-consumer models. By leveraging digital distribution channels, insurers can reach a broader audience, reduce distribution costs, and offer more personalized, convenient purchasing experiences for consumers.

- Data-driven Underwriting and Pricing: Insurtech Innovations are revolutionizing underwriting and pricing processes by harnessing big data, advanced analytics, and predictive modeling techniques to assess risk more accurately, personalize premiums, and optimize pricing strategies. By analyzing vast amounts of structured and unstructured data from diverse sources, insurers can develop predictive models that identify emerging risks, detect fraudulent activities, and improve risk selection and pricing decisions.

- Claims Automation and Management: Insurtech Innovations are automating and streamlining claims processes, reducing manual intervention, and accelerating claims settlement times. By leveraging AI, ML, and robotic process automation (RPA), insurers can automate claims intake, assessment, and adjudication, detect fraudulent claims, and provide faster, more responsive service to policyholders, ultimately enhancing customer satisfaction and loyalty.

- Customer Experience Enhancements: Insurtech Innovations are enhancing the overall customer experience by providing seamless, personalized interactions across all touchpoints, from quote to claim. By leveraging chatbots, virtual assistants, and predictive analytics, insurers can deliver proactive, personalized recommendations, anticipate customer needs, and resolve inquiries or issues in real-time, driving greater engagement and loyalty among policyholders.

- Product Innovation and Customization: Insurtech Innovations are driving product innovation and customization, enabling insurers to develop new, innovative insurance products that meet the evolving needs and preferences of consumers. By offering modular, flexible coverage options, usage-based insurance models, and on-demand insurance products, insurers can cater to diverse customer segments, address emerging risks, and differentiate themselves in a competitive market.

Examples of Insurtech Innovations

Let’s explore some real-world examples of Insurtech Innovations that are revolutionizing the insurance industry:

- Telematics-based Auto Insurance: Insurtech startups like Root Insurance and Metromile are disrupting the auto insurance industry by offering telematics-based insurance products that use IoT devices and mobile apps to track driving behavior and adjust premiums based on individual risk factors such as mileage, speed, and braking patterns. By offering usage-based insurance models, these companies provide fairer, more personalized pricing and incentivize safer driving habits among policyholders.

- Parametric Insurance Solutions: Insurtech companies like Jumpstart and Climate Corporation are pioneering parametric insurance solutions that offer fast, transparent payouts based on predefined triggers such as weather events, natural disasters, or crop yields. By using smart contracts and blockchain technology, these companies enable faster claims settlement and provide financial protection against specific risks that may not be covered by traditional insurance policies.

- Peer-to-peer Insurance Platforms: Insurtech startups like Lemonade and Friendsurance are disrupting the insurance industry with peer-to-peer insurance platforms that leverage social networks and collective risk-sharing to lower premiums and increase transparency. By pooling premiums and claims payments among groups of policyholders, these platforms reduce administrative overhead, improve trust, and empower consumers to play a more active role in the insurance process.

- On-demand Insurance Apps: Insurtech companies like Trov and Slice Labs are introducing on-demand insurance apps that allow consumers to purchase coverage for specific items or activities on a temporary or as-needed basis. By offering flexible, pay-as-you-go insurance options, these apps cater to the needs of modern consumers who value convenience, affordability, and customization in their insurance coverage.

- Blockchain-based Smart Contracts: Insurtech companies like Etherisc and InsurePal are leveraging blockchain technology to develop smart contract solutions that automate insurance transactions, enhance transparency, and reduce fraud. By using blockchain-based smart contracts, these companies enable faster, more secure policy issuance, claims processing, and payments, while minimizing the risk of disputes or errors.

Benefits of Insurtech Innovations

Insurtech Innovations offer a wide range of benefits for insurers, consumers, and the industry as a whole, including:

- Improved Efficiency and Cost Savings: Insurtech Innovations streamline insurance processes, reduce manual intervention, and eliminate inefficiencies, leading to lower operating costs and higher productivity for insurers.

- Enhanced Customer Experience: Insurtech Innovations provide seamless, personalized interactions across all touchpoints, enhancing the overall customer experience and driving greater satisfaction and loyalty among policyholders.

- Better Risk Management and Underwriting: Insurtech Innovations leverage data analytics and predictive modeling techniques to assess risk more accurately, improve underwriting decisions, and optimize pricing strategies, leading to more profitable portfolios and reduced exposure to losses.

- Faster Claims Settlement: Insurtech Innovations automate claims processes, accelerate claims settlement times, and provide faster, more responsive service to policyholders, enhancing customer satisfaction and loyalty.

- Innovation and Differentiation: Insurtech Innovations drive product innovation, customization, and differentiation, enabling insurers to develop new, innovative insurance products that meet the evolving needs and preferences of consumers, and differentiate themselves in a competitive market.

Challenges and Considerations

While Insurtech Innovations offer significant opportunities for insurers and consumers, they also present challenges and considerations that must be addressed:

- Regulatory Compliance: Insurtech Innovations must navigate regulatory requirements and compliance obligations when developing and deploying new products and services, particularly in areas such as data privacy, consumer protection, and financial regulations.

- Data Privacy and Security: Insurtech Innovations handle sensitive personal and financial data, raising concerns about data privacy and security. Insurers must implement robust security measures to protect customer data from unauthorized access, breaches, or misuse, and comply with data protection regulations.

- Integration Complexity: Insurtech Innovations must integrate seamlessly with existing systems and infrastructure, such as policy administration systems, claims management platforms, and third-party APIs, to ensure interoperability and data exchange.

- Customer Adoption and Engagement: Insurtech Innovations must promote adoption and engagement among consumers to maximize their value and effectiveness. This involves educating customers about the benefits of new products and services, addressing concerns or misconceptions, and providing support and guidance throughout the adoption process.

- Market Competition and Disruption: Insurtech Innovations face competition from traditional insurers, Insurtech startups, and other players in the industry, which may resist or disrupt existing business models and market dynamics.

Conclusion

In conclusion, Insurtech Innovations are driving unprecedented change and disruption in the insurance industry, revolutionizing traditional processes, products, and business models to meet the evolving needs of consumers and insurers alike. By leveraging cutting-edge technologies, data analytics, and innovative business models, Insurtech Innovations are reshaping the future of insurance and unlocking new opportunities for growth, efficiency, and competitiveness across the industry.

As insurers continue to embrace and invest in Insurtech Innovations, they must address key challenges and considerations related to regulatory compliance, data privacy, integration complexity, customer adoption, and market competition. By prioritizing transparency, security, and customer-centricity, insurers can harness the full potential of Insurtech Innovations to create value for their customers, stakeholders, and society as a whole, ultimately driving greater innovation, resilience, and sustainability in the insurance industry.