INTRODUCTION:

In recent years, the insurance industry in the United States has been undergoing a significant transformation fueled by technological advancements. This evolution, often referred to as Insurtech, is reshaping traditional insurance models and presenting new opportunities and challenges for insurers, regulators, and consumers alike. In this exploration, we delve into the key dynamics shaping the future of insurance in the USA, focusing on the rise of Insurtech, regulatory considerations, data privacy concerns, and the path forward for the industry.

The Rise of Insurtech: Redefining Insurance Operations

Insurtech, a fusion of insurance and technology, encompasses a broad range of innovations aimed at improving various aspects of the insurance value chain. From policy underwriting and claims processing to customer engagement and risk management, Insurtech solutions are driving efficiency, enhancing customer experience, and enabling insurers to better understand and manage risk.

Leveraging Technology for Customer Engagement

Insurtech startups are leveraging emerging technologies such as artificial intelligence (AI), machine learning, and data analytics to transform customer engagement. Through intuitive mobile apps, chatbots, and online platforms, insurers can provide personalized services, streamline communication, and deliver seamless customer experiences.

Example: Lemonade’s Disruptive Approach

Lemonade, a prominent Insurtech startup, has gained recognition for its innovative approach to insurance, particularly in the homeowners and renters insurance sector. By leveraging AI and behavioral economics, Lemonade has simplified the insurance process, allowing customers to obtain coverage quickly and receive claims payouts efficiently.

Enhancing Underwriting and Risk Assessment

Advancements in data analytics and predictive modeling are revolutionizing underwriting and risk assessment processes. Insurers can now harness vast amounts of data from diverse sources, including IoT devices, social media, and external databases, to gain deeper insights into customer behavior, preferences, and risk profiles.

Telematics and Usage-Based Insurance (UBI)

Telematics technology, which involves using IoT devices to monitor driving behavior, has transformed the auto insurance sector. Insurers can offer usage-based insurance (UBI) policies that tailor premiums based on individual driving habits, promoting safer driving and incentivizing low-risk behavior.

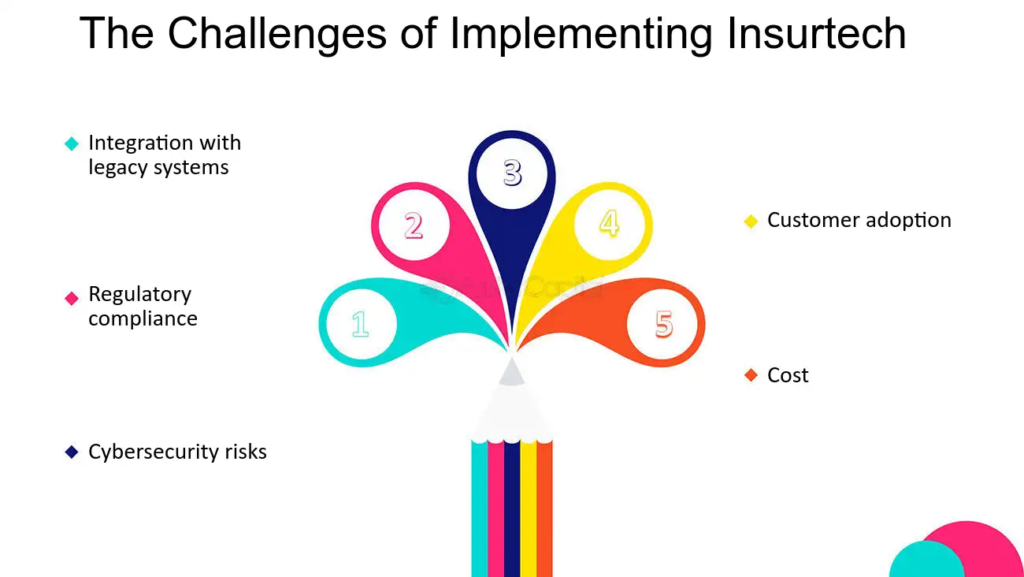

Regulatory Considerations: Navigating the Complex Landscape

While Insurtech presents exciting opportunities for innovation and efficiency, it also poses regulatory challenges that require careful consideration. The insurance industry is subject to a complex regulatory framework governed primarily at the state level, with each state having its own set of rules and requirements.

Regulatory Compliance in a Digital Age

Insurers must navigate a myriad of regulatory requirements related to licensing, solvency, consumer protection, and data privacy. As Insurtech blurs traditional boundaries and introduces new risks and complexities, regulators face the challenge of balancing innovation with consumer protection and market stability.

Regulatory Sandbox Initiatives

To foster innovation and provide a conducive environment for Insurtech experimentation, several states have introduced regulatory sandbox programs. These initiatives allow Insurtech startups to test their products and services in a controlled environment, granting temporary exemptions from certain regulatory requirements.

Data Privacy and Security: Ensuring Consumer Trust

The proliferation of data-driven technologies in the insurance industry has raised significant concerns regarding data privacy, security, and ethics. Insurers must prioritize the protection of customer data and adhere to stringent regulatory requirements to maintain consumer trust and confidence.

Compliance with Data Privacy Regulations

With the implementation of stringent data privacy regulations such as the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR), insurers must implement robust data protection measures and ensure transparency in data collection, processing, and usage.

Ethical Use of Data Analytics

Insurers must also address ethical considerations related to the use of data analytics and AI in insurance operations. It is essential to ensure that data-driven decisions are fair, transparent, and free from bias, and that consumer rights and interests are protected throughout the process.

The Path Forward: Embracing Collaboration and Innovation

As we look ahead, the future of insurance in the USA lies in embracing collaboration, innovation, and regulatory agility. Insurers, regulators, technology providers, and other stakeholders must work together to harness the full potential of Insurtech while addressing the challenges and risks it presents.

Building Collaborative Ecosystems

By fostering partnerships and collaboration between incumbents, startups, regulators, and technology providers, insurers can leverage each other’s strengths and expertise to drive innovation and create value for consumers.

Investing in Talent and Skills Development

As the insurance industry continues to undergo digital transformation, there is a growing demand for skilled professionals with expertise in data science, cybersecurity, AI, and other emerging fields. Insurers must invest in talent development and upskilling initiatives to build a workforce capable of navigating the complexities of the digital landscape.

In conclusion, the future of insurance in the USA is characterized by innovation, collaboration, and regulatory adaptation. Insurtech presents exciting opportunities to improve efficiency, enhance customer experience, and address emerging risks and challenges. By embracing technology, fostering collaboration, and prioritizing consumer protection, insurers can navigate the evolving landscape of insurance and build a resilient industry that meets the needs of tomorrow’s consumers.

Conclusion: Embracing the Future of Insurance

In conclusion, the future of insurance in the USA is characterized by innovation, collaboration, and regulatory adaptation. Insurtech presents exciting opportunities to improve efficiency, enhance customer experience, and address emerging risks and challenges. By embracing technology, fostering collaboration, and prioritizing consumer protection, insurers can navigate the evolving landscape of insurance and build a resilient industry that meets the needs of tomorrow’s consumers.

The fusion of insurance and technology through Insurtech initiatives offers a pathway towards transformative change within the industry. Whether it’s revolutionizing underwriting processes, enhancing customer engagement, or developing innovative risk management strategies, Insurtech holds the potential to redefine traditional insurance operations.

Collaboration among insurers, Insurtech startups, regulators, and other stakeholders is essential for driving innovation forward. By leveraging collective expertise and resources, industry players can co-create solutions that address common challenges and drive the industry’s evolution towards greater efficiency and effectiveness.

Amidst this wave of innovation, it is crucial to prioritize consumer protection. Insurers must uphold rigorous standards of data privacy and security, ensuring that consumer rights are safeguarded throughout the insurance process. Transparency, fairness, and ethical use of data analytics are foundational principles for building trust and fostering long-term relationships with customers.

In navigating the dynamic landscape of insurance, adaptability is key. Insurers must remain agile in responding to regulatory changes, technological advancements, and shifting consumer expectations. Those who embrace change, seize opportunities, and stay ahead of the curve will be best positioned to thrive in the evolving insurance market.

The future of insurance holds immense promise, driven by innovation, collaboration, and a commitment to consumer-centricity. By harnessing the transformative potential of Insurtech, insurers can build a resilient industry that not only meets but exceeds the needs of tomorrow’s consumers, providing them with greater accessibility, affordability, and peace of mind. As we embark on this journey of evolution and adaptation, let us seize the opportunities that lie ahead and shape a future where insurance truly works for everyone.

Thanks for this enlightening blog. It was very enlightening , and offered great insights. Should you be interested in the world of viral real estate SEO, don’t hesitate to explore https://www.elevenviral.com for more information.